Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Taiwan Semi Earnings Are Coming. Guidance Is Key.

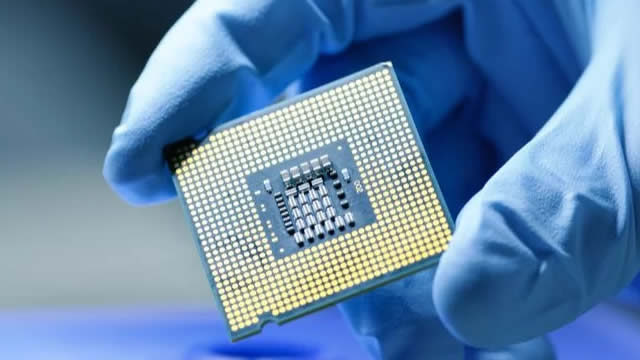

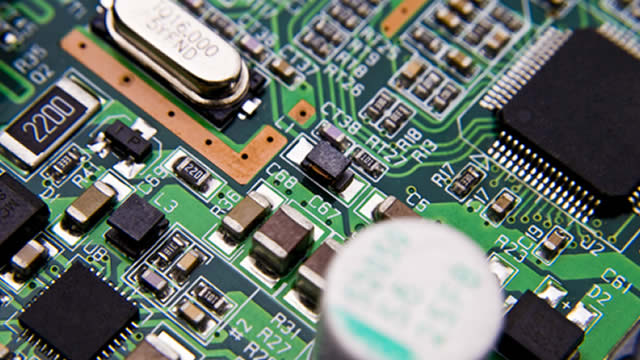

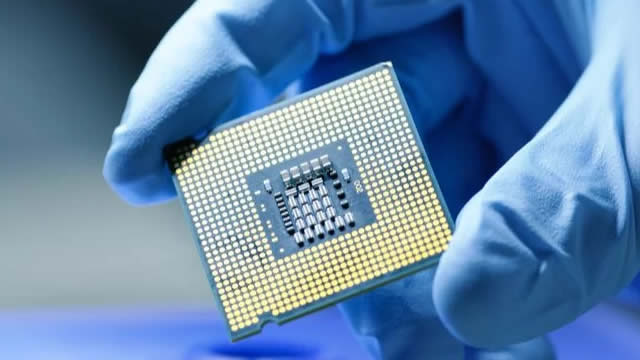

TSMC is a crucial player in the artificial-intelligence chip market, which has been upended by tariff turmoil.

Strong AI Chip Demand to Boost Taiwan Semiconductor's Q1 Earnings

Robust AI chip demand is likely to have driven TSM's Q1 revenue growth, while rising operational costs could have weighed on earnings growth.

TSMC: Tariffs Or Not, Why I'm Betting On The Foundry Leader

Taiwan Semiconductor faces high stakes amid the US-China trade war. TSM needs to localize more American semiconductor manufacturing quickly to assuage President Trump. TSMC's dominant position suggests even if chips tariffs were to hit later, it should strengthen its ability to pass on the costs to its customers.

TSMC Q1 Preview: Beating Trump's Tariffs

Taiwan Semiconductor's shares have dropped 21% YTD, but I'm still bullish due to robust AI chip demand and strong growth prospects. TSMC's U.S. manufacturing strategy, bolstered by the CHIPS Act, reduces geopolitical risks and enhances operational stability, driving future growth. TSMC's Arizona fab outperforms Taiwanese counterparts, attracting major customers like Nvidia and AMD, and potentially increasing the stock's P/E multiple.

Should Investors Buy Taiwan Semiconductor (TSM) Stock as Q1 Earnings Approach?

Responsible for 50% of the world's semiconductor chip components, Wall Street will be paying close attention to Taiwan Semiconductor's (TSM) Q1 results on Thursday, April 17.

Taiwan Semiconductor Set to Report Q1 Earnings: How to Play the Stock?

Strengths in AI-driven technologies are likely to have aided TSM's Q1 top line. However, rising operational costs may have hurt bottom-line growth.

TSMC Q1 Preview: A Moment To Bet Big On The Base Layer Of AI

TSMC's 14% price drop since my last analysis offers deep value amid strong Q1 growth, resilient margins, and AI-led demand. U.S.-led trade realignment favors TSMC as China share declines; geopolitical shifts may further concentrate growth in allied markets. Stock trades at 22.3x non-GAAP P/E vs. a 5-year average of 34; with $9.50 EPS forecast, a 25x multiple implies ~50% 12-month upside.

Taiwan Semiconductor: Tariff War Unlocks Dirt-Cheap Compelling Entry Points, Strong Buy Here

TSM's recent stock price correction offers a rare buying opportunity, with robust long-term growth prospects driven by AI/data center demand and strategic global expansion. Despite market headwinds and the ongoing tariff war, its rich financial performance and promising consensus forward estimates underscore its resilience. While there are near-term risks surrounding the potential moderation in hyperscalers' capex plans, TSM's long-term prospects remain robust as the foundry market leader.

Is It Worth Investing in TSMC (TSM) Based on Wall Street's Bullish Views?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

TSMC first-quarter profit likely soared but Trump policies cloud outlook

TSMC , the main global producer of advanced chips used in artificial intelligence applications, is set to report a 54% leap in first-quarter profit on Thursday, though is also likely to flag risk from trade policies of U.S. President Donald Trump.

Taiwan Semiconductor Earnings Preview: Despite Risks And Headwinds, Valuation Remains Attractive

Taiwan Semiconductor is a very well-managed company with strong fundamentals, technological leadership, and a strong competitive moat, despite geopolitical risks highlighted by Warren Buffett. TSMC's advanced nodes, like 3nm and upcoming 2nm, drive significant revenue growth, especially in the AI/high-performance computing segment. The company maintains a rock-solid balance sheet and impressive profitability, with very low valuation multiples and attractive growth prospects.

TSMC Earnings Preview, AI Strength Faces Tariff Headwinds

TSMC's Q1 2025 earnings report shows revenue slightly ahead of estimates at $25.6 billion, driven by AI servers and smartphone chips. Volatility from tariffs and strong AI growth projections make a short-term strangle on TSM attractive, despite potential tariff impacts on global trade. TSM's CapEx guidance between $38 billion and $42 billion for 2025 will be crucial in assessing future demand and growth expectations.