Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

$14B Japanese Facility Signals TSMC's Bold AI Strategy

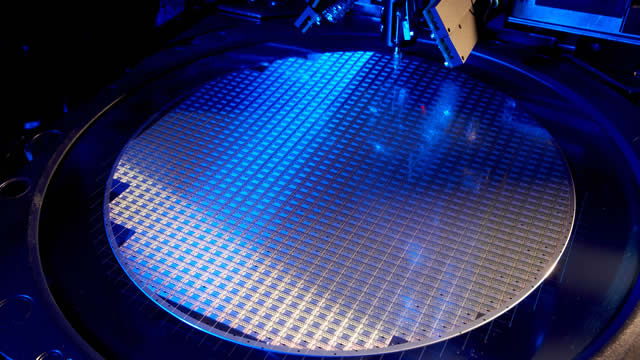

The artificial intelligence (AI) boom has unleashed a historic, seemingly insatiable demand for advanced computing power. At the epicenter of this technological revolution stands one company: Taiwan Semiconductor Manufacturing NYSE: TSM (TSMC), the critical manufacturing partner for nearly every major AI chip designer.

TSMC's 2nm Node: Will It Power the Next Growth Cycle or Pressure Margins?

TSM's bold 2nm expansion may squeeze margins in the short term but could secure long-term gains as AI chip demand accelerates.

Is TSM's Global Fab Push a Wise Expansion Move or a Costly Overreach?

Taiwan Semiconductor's bold global fab expansion fuels soaring AI chip demand and supply-chain resilience, even as margins face short-term pressure.

TSMC: Trimming 50% Of My Position After An Impressive Quarter

Taiwan Semiconductor (TSM) remains a buy after a strong rally, with 50% of my long position closed to lock in gains. TSMC delivered robust Q3 results, with net income up 39.1% YoY and revenue growth driven by high-performance computing and AI demand. Despite premium valuations and potential for multiple compression, TSM's superior margins and capital returns justify its current pricing versus peers.

TSMC: There's No Other Company To Match Its Prowess (Rating Upgrade)

Taiwan Semiconductor delivered strong Q3 results, with 41% revenue growth, robust margins, and continued dominance in advanced chip manufacturing. TSM benefits from surging AI and HPC demand, maintaining a technological edge and deep relationships with key customers like NVDA, AAPL, and AMD. Despite concerns over AI exuberance, potential cyclicality, and geopolitical risks, TSM's financial strength and global presence support long-term resilience.

TSMC: The AI Megatrend And CoWoS Growth Constraints

Taiwan Semiconductor Manufacturing Company Limited delivered strong Q3 2025 results, with revenues up 40.8% year-over-year and margins exceeding guidance. AI-driven demand remains robust, but TSM's high-performance compute sales were flat sequentially due to packaging capacity constraints, not waning demand. TSM raised its base case price target to $407.86, reflecting higher EBITDA projections and continued confidence in the company's long-term growth.

Are You Looking for a Top Momentum Pick? Why TSMC (TSM) is a Great Choice

Does TSMC (TSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

Wall Street Bulls Look Optimistic About TSMC (TSM): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

TSMC Continues To Embody What A Structural Advantage Looks Like

The AI boom represents the biggest secular tech wave since the internet era, and TSMC is structurally positioned to be one of its primary enablers. Its Q3 results showed explosive 45% revenue growth and strong margin expansion, proving its efficiency in capturing AI-driven demand. TSMC's unmatched leadership in advanced nodes and disciplined capacity planning create a compounding structural advantage few can replicate.

Three Serious Problems Owning Taiwan Semiconductor

Taiwan Semiconductor remains a Hold or Sell due to significant risks despite its dominant global chipmaking position and AI megatrend exposure. TSM is less attractive than peers like NVDA and MSFT, given its capital intensity and weaker competitive moat within the AI value chain. TSM trades at a premium valuation more typical of US companies, which is difficult to justify given its emerging market and geopolitical risks.

TSMC: Understanding The Golden Goose Of AI

While competition in other semiconductor value chains is more diversified, TSMC has a dominant share of the semiconductor manufacturing market (71%). Q3 results show strong catalysts, with revenue growing YoY by 40%. The company is in the process of relocating factories that could reduce the risks of a Chinese invasion.

TSMC: The AI Bottleneck

Taiwan Semiconductor Manufacturing Company remains the dominant bleeding-edge chip producer, critical to AI supply chains and industry growth. TSM projects 40%+ CAGR in AI-related revenue, yet current CapEx may still lag exponential compute demand, risking supply bottlenecks. Despite industry risks and geopolitical tensions, TSM's unique market position and robust growth make it attractive at 31x earnings and 16x FCF.