Telus Corporation (TU)

Why Telus (TU) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Even A No-Growth Scenario Suggests TELUS International Is Highly Undervalued

TELUS International, the tech spinoff from Canada's Telus Corp, has seen its stock plummet more than 90% from its highs amid poor operating results. Amid a swing to net losses, the company's tremendous cash flows appear to be overlooked. There's legitimate potential for a huge rebound in TIXT, but even a conservative scenario-based approach suggests shares can trade 100% higher.

TELUS: Why It Might Be Time To Buy The Stock Soon

TELUS, Canada's largest telco, is undervalued and presents a solid investment opportunity with a potential 16% annualized upside until 2026, despite recent earnings challenges. The company's heavy investments in fiber infrastructure and wireless segments position it for future growth, with a 7% yield and improving free cash flow. TELUS's non-telco investments pose risks, but its core business remains strong, and the dividend is expected to stay on track.

TELUS Q3 Earnings & Revenues Top Estimates, Rise Y/Y, Shares Gain

TU's Q3 2024 performance is driven by higher service revenues from TELUS technology solutions amid soft service revenues in the TELUS digital experience unit.

TELUS Corporation (TU) Q3 2024 Earnings Call Transcript

TELUS Corporation. (NYSE:TU ) Q3 2024 Earnings Conference Call November 8, 2024 12:00 PM ET Company Participants Robert Mitchell - Head, IR Darren Entwistle - President and CEO Doug French - EVP and CFO Zainul Mawji - EVP and President, Consumer Solutions Navin Arora - Executive VP of TELUS Communications Conference Call Participants Drew McReynolds - RBC Vince Valentini - TD Securities Stephanie Price - CIBC Maher Yaghi - Scotiabank Jerome Dubreuil - Desjardin Aravinda Galappatthige - Canaccord Genuity Operator Good day.

Telus (TU) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for Telus (TU) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Telus (TU) Beats Q3 Earnings and Revenue Estimates

Telus (TU) came out with quarterly earnings of $0.21 per share, beating the Zacks Consensus Estimate of $0.17 per share. This compares to earnings of $0.19 per share a year ago.

Here's Why Telus (TU) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

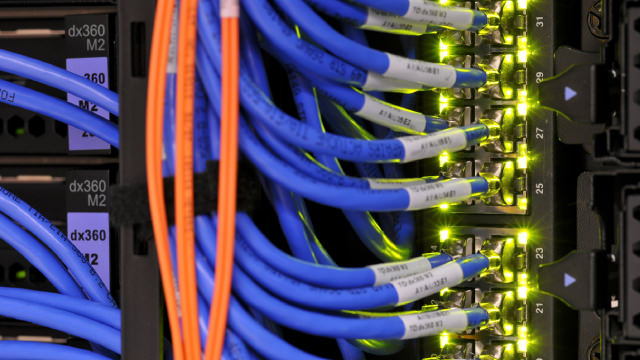

TELUS & Photonic Collaborate to Boost Quantum Communications in Canada

TU's PureFibre infrastructure is utilized by Photonic to drive quantum innovation in Canada.

Analysts Estimate Telus (TU) to Report a Decline in Earnings: What to Look Out for

Telus (TU) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why Telus (TU) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Here's Why Telus (TU) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.