Texas Instruments Inc. (TXN)

Texas Instruments Incorporated (TXN) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Texas Instruments (TXN). This makes it worthwhile to examine what the stock has in store.

Texas Instruments (TXN) Exceeds Market Returns: Some Facts to Consider

In the closing of the recent trading day, Texas Instruments (TXN) stood at $201.40, denoting a +1.61% move from the preceding trading day.

Texas Instruments Plans To Invest $60B in US Amid Trump Push for Domestic Manufacturing

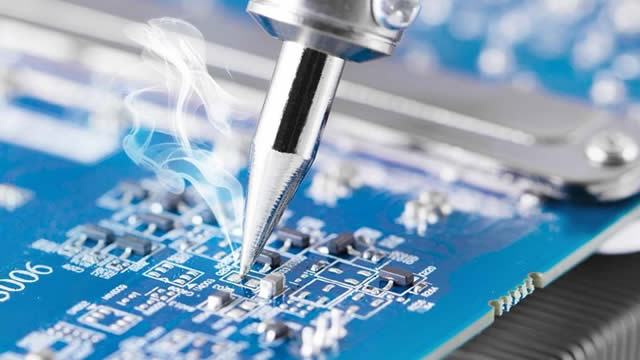

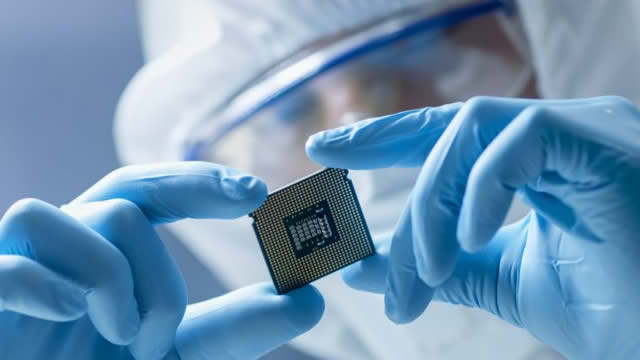

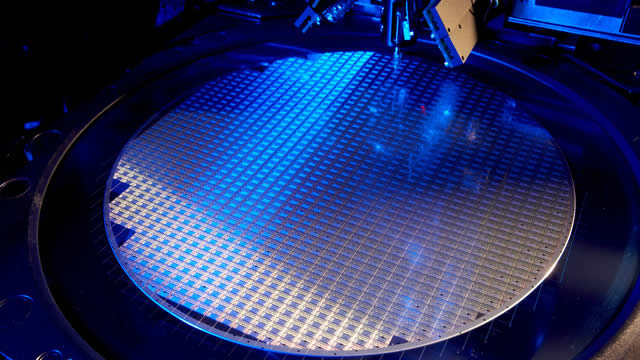

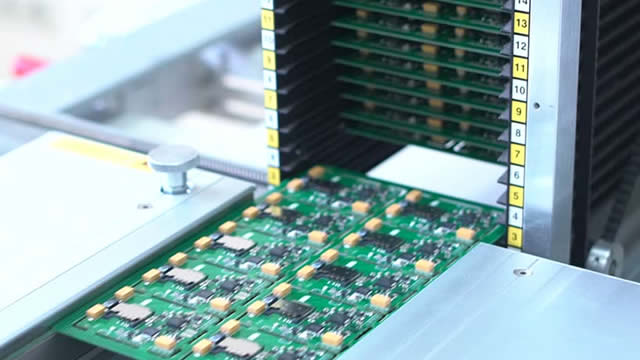

Texas Instruments (TXN) said Wednesday it plans to invest over $60 billion in U.S. chip production, making it the latest chipmaker to announce funds earmarked for U.S. facilities as President Donald Trump urges firms to commit to American manufacturing.

Texas Instruments to spend $60B to boost US chip manufacturing under Trump push

Texas Instruments said the $60 billion investment will create 60,000 jobs and called it the "largest investment in foundational semiconductor manufacturing in US history."

Texas Instruments to invest $60B in domestic semiconductor manufacturing

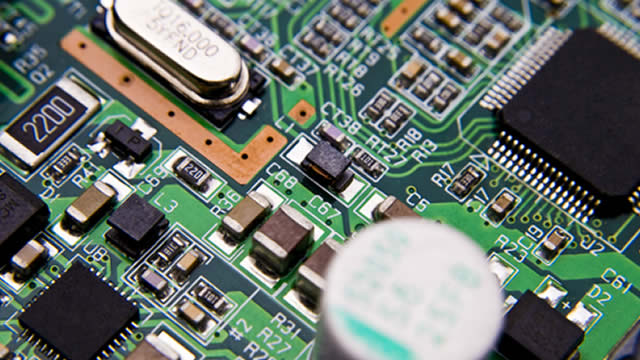

Texas Instruments Inc (NASDAQ:TXN) has announced plans to invest more than $60 billion to expand semiconductor manufacturing in the United States. The investment will fund the construction and expansion of seven semiconductor fabrication plants (fabs) across three major sites in Texas and Utah, including a mega-site in Sherman, Texas, which alone will receive up to $40 billion for four fabs (SM1 to SM4), the company said on Wednesday.

Texas Instruments (TXN) Surpasses Market Returns: Some Facts Worth Knowing

Texas Instruments (TXN) concluded the recent trading session at $199.22, signifying a +2.16% move from its prior day's close.

Texas Instruments Incorporated (TXN) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Texas Instruments (TXN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why Texas Instruments (TXN) Outpaced the Stock Market Today

Texas Instruments (TXN) concluded the recent trading session at $202.29, signifying a +1.55% move from its prior day's close.

Texas Instruments Incorporated (TXN) Presents at Bank of America Global Technology Conference Transcript

Texas Instruments Incorporated (NASDAQ:TXN ) Bank of America Global Technology Conference June 4, 2025 2:20 PM ET Company Participants Dave Pahl - Head of Investor Relations & VP Rafael R. Lizardi - Senior VP & CFO Conference Call Participants Vivek Arya - BofA Securities, Research Division Vivek Arya Good morning.

Why Texas Instruments (TXN) Outpaced the Stock Market Today

In the closing of the recent trading day, Texas Instruments (TXN) stood at $190.72, denoting a +1.4% change from the preceding trading day.

Texas Instruments: Dead In The Water For Four Years Straight, But I'm Back To Bullish Again

Texas Instruments is 70% through its heavy CAPEX cycle, giving management flexibility to prioritise free cash flow and improve financial performance. Risks remain: margins are still pressured, inventory is high, and macro uncertainty lingers, but TXN's proven management and ROIC track record inspire cautious optimism. I view TXN in nibble territory at current price; with a strong buying opportunity at $140-150 per share.

Texas Instruments Incorporated (TXN) Bernstein's 41st Strategic Decisions Conference - (Transcript)

Texas Instruments Incorporated (NASDAQ:TXN ) Bernstein's 41st Strategic Decisions Conference Call May 30, 2025 11:00 AM ET Company Participants Haviv Ilan - President and Chief Executive Officer Conference Call Participants Stacy Rasgon - Bernstein Stacy Rasgon Great. Thank you all for coming.