ProShares Ultra Gold (UGL)

UGL: A $4,200 Gold Breakout Play

ProShares Ultra Gold ETF is initiated with a 'buy' rating, targeting traders seeking leveraged exposure to gold's ongoing breakout. UGL offers 2x daily gold returns, outperforming miners and spot ETFs during bullish trends, but is best suited for short-term strategies. Mining stocks present alternative 'leveraged' gold exposure, but UGL avoids risks like equity dilution, management, and jurisdiction issues.

UGL: Why $3,500 Is Key For The Gold Trade

Gold has outperformed major asset classes, but momentum is slowing and other metals are currently leading in 2025. I rate ProShares Ultra Gold ETF (UGL) a hold, citing risks of leveraged ETFs and gold's technical resistance at $3,500. Periods of high volatility and seasonality make UGL less attractive now; a breakout above $3,500 would improve the outlook.

UGL: A Steady Decay History, And Leveraged ETF Dashboard

Leveraged ETFs have a non-linear behavior, and their price may drift relative to the underlying. This article reports drift data for 22 of them. ProShares Ultra Gold ETF shows significant decay in the long term due to beta-slippage and contango.

UGL 2x Gold 15% Dump: Start To Be A Potentially Risky Choice

Leveraged ETFs like ProShares Ultra Gold are risky during sideways or downtrending markets, with a high expense ratio of 0.95%. A critical period is approaching for gold due to a bullish U.S. dollar, rising Treasury yields. The spread between UGL and its unleveraged counterpart, such as SPDR® Gold Shares ETF, is widening and has reached a new high, indicating an overbought condition.

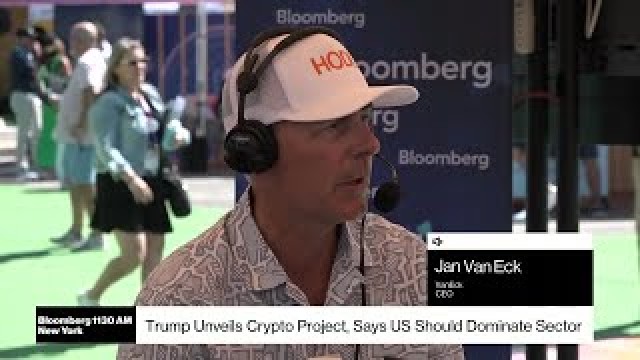

VanEck CEO: Bitcoin and Gold are Hedges for Fiscal Turbulence

VanEck CEO Jan van Eck joins Bloomberg Live from Future Proof and gives his financial view ahead of the Fed Decision.

UGL Drift And Leveraged ETF Watchlist

Leveraged ETFs like ProShares Ultra Gold can magnify returns, but are prone to drift. A drift watchlist with 22 of them. Leveraged ETFs in semiconductors show the largest drifts. UGL drift history points to an unattractive risk/reward trade-off.

UGL: 2x Daily Returns On Gold, But Be Careful Of Cycle

ProShares Ultra Gold ETF is a daily leveraged play on Gold. If Gold trades sideways and volatile, the UGL ETF would not perform 2x as well as Gold. If Gold is in a secular bull trend, this is a geared way to play it for traders.

Gold Shatters Expectations With A Record High Of $2,450 Per Ounce Amid Expectations Of Lower Interest Rates

The price of gold has reached a new record high of $2,450 per ounce, marking a significant milestone in the commodity markets.