Vertex Inc. (VERX)

Vertex Up 9.2% in 3 Months: Should You Buy, Sell or Hold the Stock?

VRTX rises 9.2% in three months but trails its industry as mixed new-drug sales and tightened 2025 guidance cloud near-term momentum.

Vertex Pharmaceuticals: JOURNAVX Prescription Demand And Povetacicept Developments Warrant "Strong Buy"

Vertex Pharmaceuticals (VRTX) is rated as a "Strong Buy" due to robust revenue growth and multiple expansion opportunities across its pipeline. JOURNAVX drives revenue with strong acute pain demand and is advancing into diabetic peripheral neuropathy (DPN) with two phase 3 studies enrolling through 2026. VRTX's BAFF/APRIL inhibitor povetacicept offers a 'pipeline in a pill' approach, targeting IgA Nephropathy and Primary Membranous Neuropathy, with key catalysts ahead and possible expansion opportunities.

Vertex Q3 Earnings Beat, Stock Down as Casgevy Sales Disappoint

VRTX tops Q3 earnings and revenue estimates on strong Trikafta and Alyftrek sales, but shares slip as Casgevy sales disappoint.

After Plunging 17.7% in 4 Weeks, Here's Why the Trend Might Reverse for Vertex (VERX)

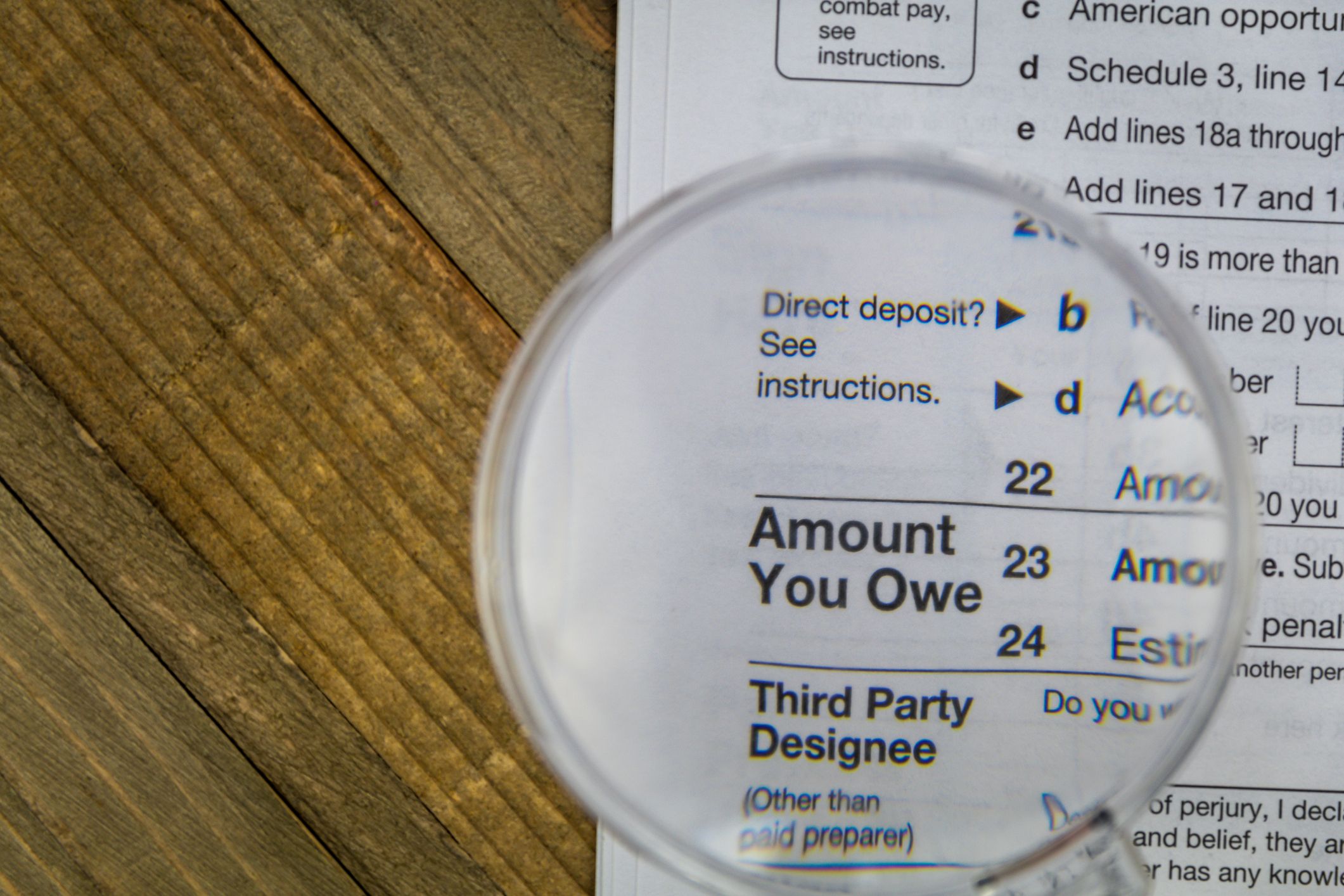

Vertex (VERX) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

Vertex Falls 10% After Reporting Mixed Q3 Results

Vertex (NASDAQ: VERX) delivered a split result this morning that left investors parsing mixed signals.

Vertex, Inc. (VERX) Q3 2025 Earnings Call Transcript

Vertex, Inc. ( VERX ) Q3 2025 Earnings Call November 3, 2025 8:30 AM EST Company Participants Joseph Crivelli - Vice President of Investor Relations David DeStefano - CEO, President & Chairman of the Board John Schwab - Chief Financial Officer Conference Call Participants Joshua Reilly - Needham & Company, LLC, Research Division Christopher Quintero - Morgan Stanley, Research Division Alexander Sklar - Raymond James & Associates, Inc., Research Division Adam Hotchkiss - Goldman Sachs Group, Inc., Research Division Jacob Roberge - William Blair & Company L.L.C., Research Division Brett Huff - Stephens Inc., Research Division Steven Enders - Citigroup Inc., Research Division Andrew DeGasperi - BNP Paribas, Research Division Patrick Walravens - Citizens JMP Securities, LLC, Research Division Robert Oliver - Robert W.

Vertex: A Chance To Buy The Dip (Upgrade)

Vertex, Inc. shares have plunged over 60% YTD, but valuation is now compelling after a post-earnings dip. VERX offers steady low-teens growth, expanding margins, and a sticky tax compliance software product with strong net revenue retention. Despite a slight revenue outlook cut, adjusted EBITDA guidance was raised, and a $150 million buyback program was launched, signaling management confidence.

Vertex Gears Up to Report Q3 Earnings: Is a Beat in the Cards?

Strong Trikafta/Kaftrio demand, along with contributions from Alyftrek, Casgevy and Journavx, may have helped VRTX outperform in the third quarter.

Vertex Pharmaceuticals Remains A Buy Heading Into Q3 Earnings

Vertex Pharmaceuticals Incorporated remains a leader in cystic fibrosis treatments, fueling robust cash flow and funding a promising pipeline expansion. VRTX is seeing early but accelerating revenue from new products Casgevy and Journavx, with non-CF revenue projected to reach 16-20% by 2032. The VRTX pipeline includes potential blockbusters in kidney disease, with key FDA decisions expected in 2026, supporting long-term growth prospects.

Vertex (VERX) Earnings Expected to Grow: Should You Buy?

Vertex (VERX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Growth Fund Dumps $25 Million in Vertex Stock as Weak Quarter Hit Returns

Pennsylvania-based Conestoga Capital Advisors sold 855,435 Vertex shares for an estimated $24.8 million based on average prices for the quarter ended September 30. The change represents 0.4% of 13F reportable assets under management for the period.

Wall Street Analysts Believe Vertex (VERX) Could Rally 44.47%: Here's is How to Trade

The mean of analysts' price targets for Vertex (VERX) points to a 44.5% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.