Vistra Corp (VST)

Vistra Corp. (VST) Laps the Stock Market: Here's Why

In the most recent trading session, Vistra Corp. (VST) closed at $87.22, indicating a +1.52% shift from the previous trading day.

Vistra Corp. (VST) Is a Trending Stock: Facts to Know Before Betting on It

Vistra (VST) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

3 Utility Stocks to Buy With Rate Cuts on the Horizon

Invest in utility stocks like Vistra (VST), Atmos Energy (ATO) and Primo Water (PRMW) for steady returns and reduction of risk in a recovering economy.

Vistra Corp. (VST) Rises As Market Takes a Dip: Key Facts

Vistra Corp. (VST) closed at $88.19 in the latest trading session, marking a +0.7% move from the prior day.

Reasons to Add Vistra (VST) to Your Portfolio Right Away

Vistra (VST) continues to serve its customers efficiently and makes investments to strengthen its existing operations. It is increasing shareholders' value through buybacks and dividends.

3 Reasons Why Growth Investors Shouldn't Overlook Vistra (VST)

Vistra (VST) could produce exceptional returns because of its solid growth attributes.

Wall Street Analysts Think Vistra (VST) Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Vistra: This Sector Outperformer Looks Undervalued At This Price

The Harbor Energy acquisition is highly accretive and drives cash flow growth of 12%. VST stock hedges prices and fuel costs and benefits from electricity demand growth in key US markets such as Texas. Despite outperformance, Vistra is undervalued trading at 0.6x PEG or 9x P/Cash Earnings, and has a 20% upside on consensus price target.

Investors Heavily Search Vistra Corp. (VST): Here is What You Need to Know

Vistra (VST) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

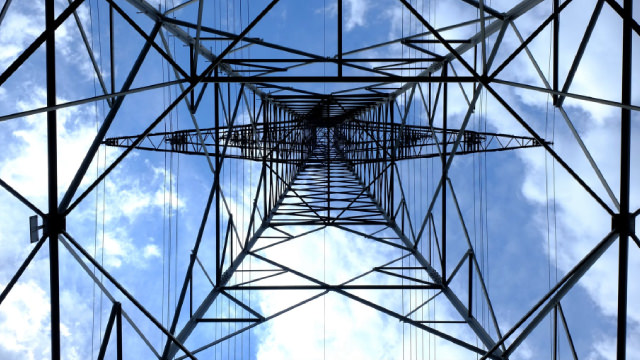

Data Centers to Drive Growth in Utilities: Stocks to Benefit

Data centers should create fresh demand for electricity in the United States and boost the prospects of Dominion (D), Vistra (VST) and PG&E Corp. (PCG).

Wall Street Analysts Believe Vistra (VST) Could Rally 25.91%: Here's is How to Trade

The mean of analysts' price targets for Vistra (VST) points to a 25.9% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

Here's Why You Should Add Vistra (VST) to Your Portfolio Now

Vistra (VST) makes a strong case for investment, given its growth prospects, strong return on equity and ability to increase shareholders' value.