Warner Bros. Discovery, Inc. (WBD)

Here's Why Warner Bros. Discovery (WBD) is a Strong Momentum Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Warner Bros. Discovery (WBD) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

Warner Bros. Discovery (WBD) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report.

Opinion | The Ellisons Play Their Trump Card in the Warner Bros. Battle

Nothing can stop the marriage of AI and Hollywood, but a friend in the White House helps.

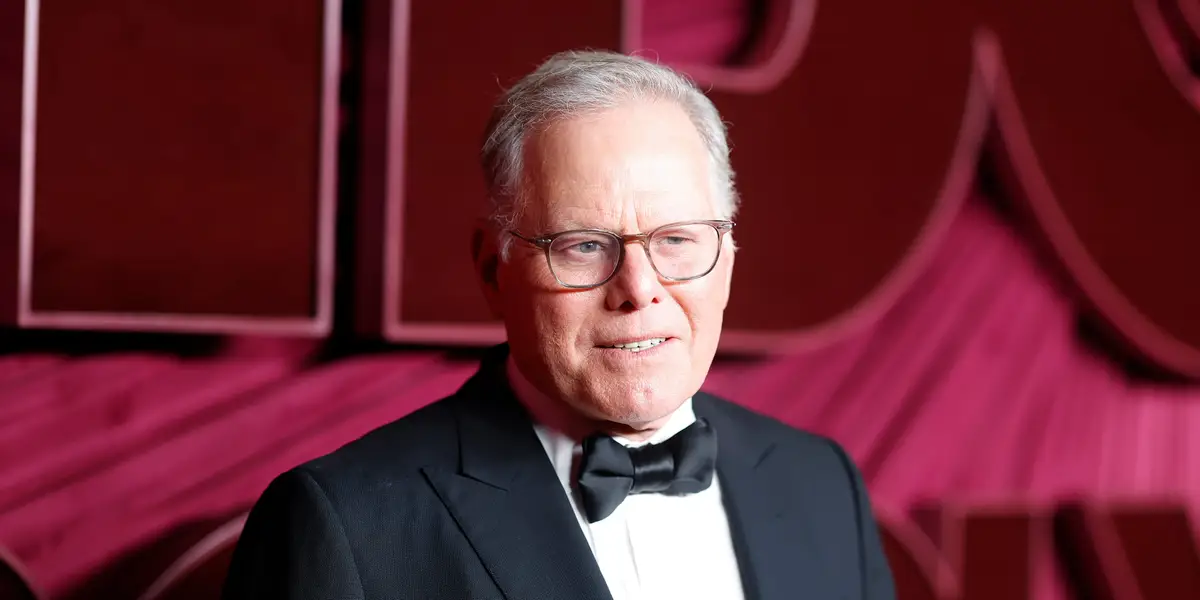

Warner Bros. Discovery CEO David Zaslav poised to pocket $500M from company sale: report

Zaslav's payout would come from 21 million shares that immediately vest upon a sale, according to Semafor.

Warner Bros. Bidding War Potential: How High Could WBD Shares Go?

Within the U.S. entertainment and media industry, one unlikely name is in the top echelon of stock market performers in 2025. That company is Warner Bros.

Warner Bros. Discovery confirms offers to buy all—or part—of the company

Warner Bros. Discovery, the parent company of CNN and HBO, announced Tuesday that it is up for sale after receiving unsolicited interest from multiple potential buyers.

Warner Bros. Discovery Is Up for Sale.

Warner Bros. Discovery may be setting the stage for its next act.

Will WBD's Strategic Separation Lay Groundwork for Future Growth?

WBD's upcoming split aims to sharpen focus, unlock growth and give investors a clearer view of long-term value drivers.

Warner Bros. Discovery pursues entire company sale ahead of spinoff plans

Warner Bros. Discovery is reviewing a potential sale of the company, citing unsolicited interest in the entire entity, even as it continues to pursue a spinoff of its cable assets, which is already underway.

3 Reasons to Hold WBD Stock Now Despite a 67.7% Year-to-Date Rally

WBD's 67.7% rally is backed by stronger streaming and studio execution, but separation risks and competition keep the stock a hold for now.

Can WBD's Distribution Engine Regain Momentum Amid Media Transition?

WBD leans on big franchises and digital pivots to stabilise its distribution arm amid shifting media habits and earnings pressure.

Here's Why Warner Bros. Discovery (WBD) Fell More Than Broader Market

In the latest trading session, Warner Bros. Discovery (WBD) closed at $17.67, marking a -1.23% move from the previous day.