Walmart Inc. (WMT)

Amazon Overtook Walmart in Quarterly Revenue in Q4

Amazon overtook Walmart in quarterly revenue in the fourth quarter. Walmart said Thursday (Feb. 20) that it earned $180.5 billion during the quarter, while Amazon said Feb. 6 that it brought in $187.8 billion in the same period, CNBC reported Thursday.

Walmart's stock drop after earnings is bizarre, says former CEO Bill Simon

Bill Simon, Former Walmart U.S. CEO, joins 'Closing Bell Overtime' to talk Walmart stock sliding today and what its earnings say about the state of the consumer.

S&P 500 Gains and Losses Today: Epam Systems Leads Losses as Stocks Fall on Walmart Weakness

After hitting record highs over the past two sessions, the S&P 500 stepped back Thursday.

Walmart's Q4 Earnings Top Expectations

Retail giant Walmart (WMT -6.53%) reported fiscal 2025 fourth-quarter earnings on Thursday, Feb. 20, that came in just ahead of analysts' consensus expectations. Adjusted earnings per share (EPS) of $0.66 compared to the analysts' estimate of $0.65.

Walmart stock lower on earnings, Hasbro CEO interview: Wealth

On today's Wealth, host Brad Smith tackles key market trends while speaking to Wall Street experts. GLOBALT Investments senior portfolio manager Keith Buchanan joins the show to discuss political rhetoric's market impact (^DJI, ^IXIC, ^GSPC), while National Association of Home Builders (NAHB) CEO Jim Tobin shares his outlook on the US housing market.

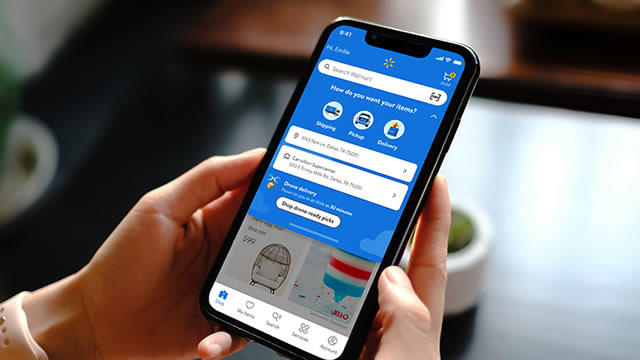

How Walmart won over wealthy shoppers

The discounter has gained traction with upper-income shoppers with a larger online assortment and faster online options, like home deliveries.

Walmart Customers Are Demanding Convenience—And Paying Up for It

People like Walmart's (WMT) prices. But they're also picking the retailer for convenience—and paying more to do it.

Tariff Storm Clouds Loom Over Walmart's Low-Price Empire

As Walmart navigates a shifting trade landscape, the specter of new tariffs imposed by the Trump administration is casting a shadow over the retail giant's hallmark promise: everyday low prices.

Stocks are slipping because Walmart's guidance renewed worries about U.S. consumers

U.S. stocks wavered Thursday after a strong run, with weak guidance from Walmart underlining nagging worries about the health of the American consumer.

Walmart is the Dow's worst performer today. Analysts aren't nervous.

Walmart was the Dow Jones Industrial Average's worst performer on Thursday, after the big-box retail chain forecast its first year-over-year drop in quarterly profit in three years.

Amazon surpasses Walmart in revenue for first time

Amazon leapfrogged Walmart in quarterly sales for the first time. Walmart reported $180.5 billion in sales during the most recent quarter while Amazon reeled in $187.8 billion in the same period.

Walmart: Recent Earnings Are Not Enough To Justify This Valuation

I rate Walmart Inc. stock a “sell” due to its high valuation and the unstable market environment, posing a risk if earnings aren't superb. Recent earnings have proven that WMT can't grow like in 2024 forever and pose a correction risk. I am bearish on US large caps, suggesting that even if WMT doesn't correct post-earnings, a downturn is inevitable.