Walmart Inc. (WMT)

Walmart's strong quarter shows Americans are still spending

Walmart beats Wall Street expectations with strong food and health sales driving 6% revenue growth to $179.5 billion, raising outlook for fiscal 2026.

Walmart will report earnings before the bell. Here's what to expect

Walmart will report fiscal third-quarter earnings on Thursday morning. The big-box retailer, which caters to shoppers across incomes, may offer the clearest snapshot of U.S. consumer health so far this retail earnings season.

Walmart Aims to Acquire R&A Data, Which Helps Marketplaces Combat Counterfeiters

Walmart is reportedly in talks to acquire R&A Data, a startup that already serves as a third-party vendor helping the retailer screen listings on its online marketplace for counterfeiting and other compliance issues.

Walmart's Earnings Will Illustrate How the American Consumer Is Doing

Walmart's going through plenty these days—but so are its customers. Both topics are likely to take center stage when the retail giant reports its third-quarter results on Thursday.

Walmart to see continued share gains despite slower sales growth in Q3, analysts project

Walmart Inc (NYSE:WMT, XETRA:WMT) will report its third quarter earnings on November 20, and Bank of America is forecasting adjusted earnings of $0.60 per share alongside 3% comparable sales growth in the US, a pace the firm says reflects a deceleration in line with recent third-party spending data. Bank of America noted that Bloomberg Second Measure observed slower sales trends for Walmart during the quarter, consistent with its comp estimate, though the retailer is still tracking a compound annual US comp growth rate of 7% versus 2019.

Walmart Earnings Preview: Tariff Impact Fading, Still Looking For Margin Gains Ahead

If the sell-side consensus estimate is met for Walmart's (WMT) fiscal Q3 '26, Walmart will print its first trailing-twelve-month revenue in excess of $700 billion. The stock never looks cheap on a PE valuation, which is very similar to how most consumer staple stocks trade. Walmart comps have averaged 5.4% the last 10 quarters, although the recent quarters have been in the 4.5% range.

WMT Gears Up for Q3 Earnings Release: Buy, Sell or Hold the Stock Now?

Walmart readies for Q3 results as strong store and digital momentum meet cost pressures, leaving investors weighing their next move.

KG: A.I. Spend Rattles Tech Trade, WMT & HD Most Important Non-NVDA Weekly Earnings

Construction spending is still holding up in a fog caused by a lack of economic data, says Kevin Green. He takes a look at the latest, long-delayed print as the numbers hit the wire.

Unlocking Q3 Potential of Walmart (WMT): Exploring Wall Street Estimates for Key Metrics

Evaluate the expected performance of Walmart (WMT) for the quarter ended October 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

McMillon to Retire as Walmart CEO in January, Furner to Step in

WMT names John Furner as its next CEO after Doug McMillon's planned 2026 retirement, prompting an early but easing market reaction.

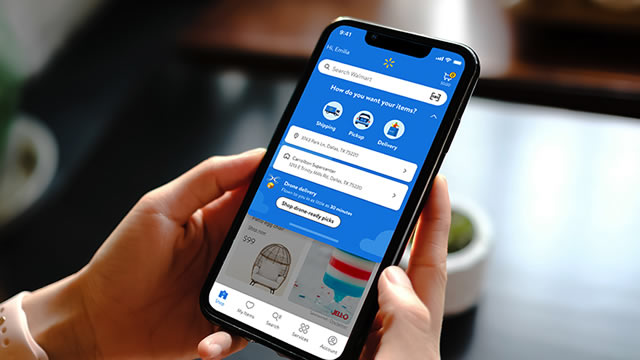

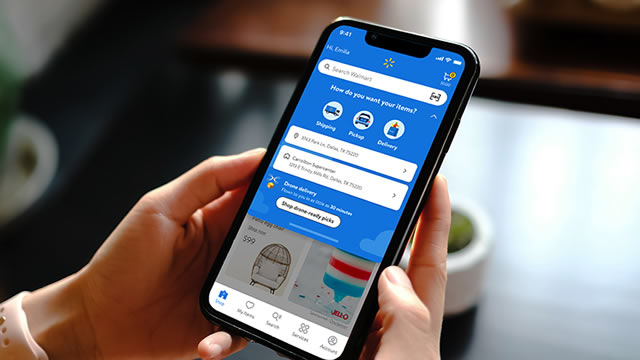

Walmart Drives Holiday Momentum With Bigger, Faster Savings Push

WMT amps up holiday momentum with deeper deals, faster fulfillment and member perks to keep shoppers engaged all season long.

Holiday Earnings Wish List: I'll Take Target Over Walmart Amid Leadership Shake-Ups

Target Corporation offers an attractive investment opportunity due to its low valuation, aggressive cost-cutting, and focus on value amid economic headwinds. TGT's upcoming leadership change and appealing dividend may help ease sociopolitical tensions and support a short-term rally during a tepid holiday season. Walmart Inc. remains operationally strong but its high valuation makes it less appealing compared to TGT, despite solid sales and digital growth.