Financial Select Sector SPDR Fund (XLF)

Final Trades: Diamondback Energy, Owens Corning, Synovus and the XLF

The Investment Committee give you their top stocks to watch for the second half.

XLF: Are Rate Cuts Good Or Bad?

XLF is a low-cost, passively managed ETF heavily weighted in top financial companies, including banks and payment processors like Visa and Mastercard. The Fed's imminent rate cuts will impact financials, with mixed effects on XLF due to lower NIMs and increased loan activity. XLF should be able to perform well in rate-cutting cycles, but it depends on how and why rates are lowered.

4 Sector ETFs Seeing Rise in Earnings Estimates

Estimates for the Q3 of 2024 for Tech, Finance, Retail, and Utilities sectors have increased in recent weeks.

4 Sector ETFs Set to Gain From Rising Estimates

Analysts have raised the 3Q2024 earnings estimates for the Tech, Finance, Retail, and Utilities sectors lately.

Should You Invest in the Financial Select Sector SPDR ETF (XLF)?

Launched on 12/16/1998, the Financial Select Sector SPDR ETF (XLF) is a passively managed exchange traded fund designed to provide a broad exposure to the Financials - Broad segment of the equity market.

Time to Buy Financial & Bank ETFs?

Financial ETFs rebounded this year after a prolonged period of volatility. Fed rate cut hopes may boost bank stocks even more.

Financial Sector Shines as Key Players Continue to Beat Earnings

As the year's second half unfolds, we've observed a notable shift in market momentum, with investors rotating from leading sectors into those that previously lagged. The financial sector, in particular, has emerged as a standout performer, significantly outpacing the broader market.

XLF: Stress Tests Passed, But That's Not The Only Test

The US Federal Reserve released annual stress test results for 31 banks, showing they are well-positioned to withstand a severe recession. The largest financial sector vehicle, the Financial Select Sector SPDR ETF, holds 71 stocks with the 7 largest stocks comprising nearly half of its assets. Despite decent stress test results, I assess XLF as an ETF that has run its course for a while, without offering compelling upside.

Should You Invest in the Financial Select Sector SPDR ETF (XLF)?

If you're interested in broad exposure to the Financials - Broad segment of the equity market, look no further than the Financial Select Sector SPDR ETF (XLF), a passively managed exchange traded fund launched on 12/16/1998.

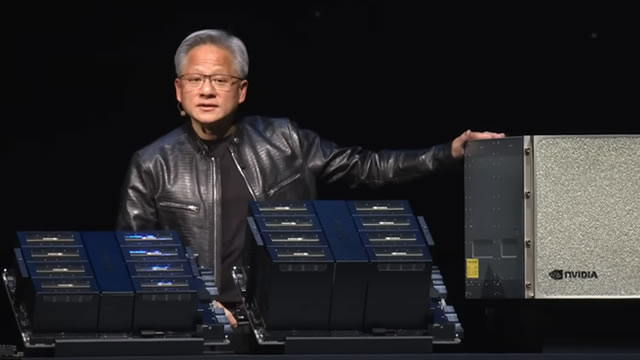

Nvidia Is Surging. Why That's a Problem for a Tech ETF.

The IRS has rules about concentration levels in funds. As the Tech Select Sector SPDR rebalances, one of the big three—Apple, Microsoft, or Nvidia—could get demoted.

Financial Sector: Potential Trend Change Looms with Double Top

Previously an outperformer with a year-to-date gain of over 11%, the financial sector now finds itself at a critical juncture after giving back some of its gains. Just six trading days ago, the Financial Select Sector SPDR ETF NYSE: XLF made a new high but has since pulled back over 2%.