Airbnb, Inc. (ABNB)

Airbnb (ABNB) Q2 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for Airbnb (ABNB) give a sense of how its business performed in the quarter ended June 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

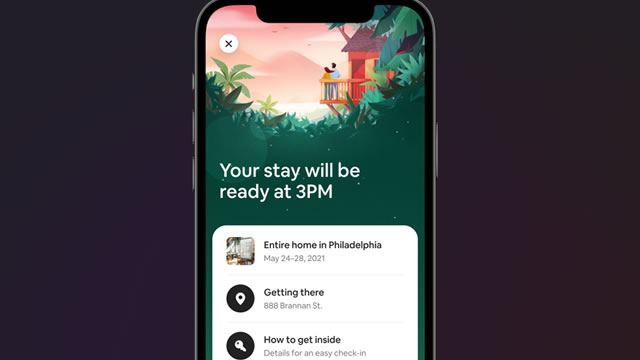

Airbnb details plans to expand beyond short-term rentals, including co-hosting and relaunching ‘experiences'

Airbnb CEO Brian Chesky suggested on Tuesday's Q2 earnings call with investors that the company will soon expand into new products and services, including co-hosting, a relaunch of Airbnb's “experiences,” guest services, and more.

Airbnb, Inc. (ABNB) Q2 Earnings and Revenues Lag Estimates

Airbnb, Inc. (ABNB) came out with quarterly earnings of $0.86 per share, missing the Zacks Consensus Estimate of $0.92 per share. This compares to earnings of $0.98 per share a year ago.

Airbnb Stock Tumbles On Earnings Miss, Warning About Slowing U.S. Demand

Airbnb stock tanked late Tuesday after the vacation rental booking company reported mixed Q2 results.

Airbnb shares drop 12% as company flags weakening US demand

Vacation rental company reports second-quarter profit of $555m compared to last year's $650m

Airbnb stock sinks on weak third quarter revenue guidance

Airbnb Inc (NASDAQ:ABNB, ETR:6Z1) shares sank almost 14% afterhours as the alternative accommodation platform's revenue guidance for the third quarter fell short of expectations. For Q3, Airbnb projects revenue in the range of $3.67 billion to $3.73 billion, representing year-over-year growth of 8% to 10%, missing estimates of $3.86 billion.

Airbnb Shares Fall on Earnings Miss

The short-term rental company had warned in May that earnings growth in the second quarter would face signiificant headwinds.

Airbnb says it's seeing ‘some signs of slowing demand' in the U.S.

Vacation-rental platform Airbnb Inc. on Tuesday reported second-quarter profits that missed expectations and warned of “some signs of slowing demand from U.S. guests,” as travelers hold off on booking overnight stays for later in the year and temper their spending elsewhere.

Airbnb shares drop 14% on earnings miss as company warns of slowing U.S. demand

Airbnb shares drop 14% on earnings miss as company warns of slowing U.S. demand

Airbnb's (ABNB) Pre-Q2 Earnings Analysis: Should You Buy or Hold?

Airbnb's (ABNB) second-quarter results are expected to reflect strength in its core business and the impacts of global expansion amid macro headwinds.

The Top 3 Travel Stocks to Buy Now: Summer 2024

As the world continues to embrace travel with renewed vigor in the post-pandemic era, the industry is poised for significant growth throughout the remainder of 2024. With August already here, some investors may worry that the best opportunities have already been seized.

Airbnb: A Resilient Player In The Face Of Economic Slowdown

Market selloff due to economic data presents investment opportunity. Airbnb's strong growth potential is supported by under-penetration in the lodging market. Airbnb demonstrates strong bargaining power, maintaining a 3% annual growth in booking value per night despite economic pressures.