Hudson Technologies Inc. (HDSN)

3 Value Stocks That Look Undervalued After the Recent Market Pullback

Intel is up a lot this year but still well below all-time highs as its turnaround takes hold. SharkNinja is about to be hit by tariffs, but it should be just a one-time reset for this growth company.

Hudson Technologies: Weak Stock, But Strong Business Remains A Buy

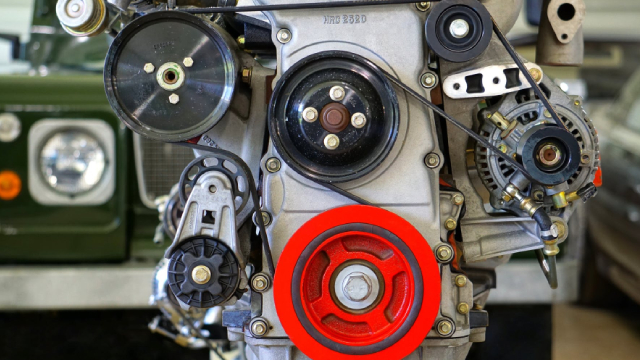

Hudson Technologies (HDSN) delivered 20% Q3 revenue growth, driven mainly by volume, but faces delayed tailwinds from the AIM Act and A2L transition. A sudden CEO transition introduces operational risk and signals a strategic pivot, with HDSN aiming to expand beyond refrigerant reclamation into broader HVAC services. HDSN secured a $210 million, 5-year Defense Logistics Agency contract, providing revenue stability and supporting its long-term growth outlook despite near-term pricing headwinds.

Hudson Technologies: EPS +59%, Stock -22%, A Market Overreaction At Its Finest

Hudson Technologies is a leading player in the reclaimed refrigerant market, uniquely positioned for long-term growth amid the AIM Act HFC phase-down. HDSN reported strong Q3 results with 20% revenue growth and expanding margins, aided by higher volumes, rising prices, and a new $210M DLA contract. Recent stock volatility is driven by near-term supply abundance, CEO resignation, and investor concerns about delayed supply/demand balance until 2029.

Hudson Technologies (HDSN) Q3 Earnings Surpass Estimates

Hudson Technologies (HDSN) came out with quarterly earnings of $0.27 per share, beating the Zacks Consensus Estimate of $0.21 per share. This compares to earnings of $0.17 per share a year ago.

Is Hudson Technologies (HDSN) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

HDSN or SITE: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Industrial Services sector might want to consider either Hudson Technologies (HDSN) or SiteOne Landscape (SITE). But which of these two stocks presents investors with the better value opportunity right now?

Hudson Technologies (HDSN) is a Great Momentum Stock: Should You Buy?

Does Hudson Technologies (HDSN) have what it takes to be a top stock pick for momentum investors? Let's find out.

Hudson Technologies: The Perfect Tariff-Spread Play You Should Consider

Hudson Technologies is a dominant U.S. refrigerant reclaimer, benefiting from industry phase-outs and regulatory tailwinds like the AIM Act and import tariffs. Recent Q2 results were strong: revenue and EPS beat expectations, margins improved, inventory declined, and the balance sheet remains debt-free with robust cash. Tariffs on imported refrigerants and steel create a pricing floor, boosting profitability on U.S.-sourced reclaimed refrigerants and protecting against foreign dumping.

Hudson Tech (HDSN) Upgraded to Strong Buy: What Does It Mean for the Stock?

Hudson Tech (HDSN) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

HDSN vs. SITE: Which Stock Is the Better Value Option?

Investors with an interest in Industrial Services stocks have likely encountered both Hudson Technologies (HDSN) and SiteOne Landscape (SITE). But which of these two stocks presents investors with the better value opportunity right now?

Is Hudson Technologies (HDSN) a Great Value Stock Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Hudson Technologies, Inc. (HDSN) Q2 2025 Earnings Call Transcript

Hudson Technologies, Inc. (NASDAQ:HDSN ) Q2 2025 Earnings Conference Call July 30, 2025 5:00 PM ET Company Participants Brian F. Coleman - Chairman of the Board, President & CEO Brian J.