Kennametal Inc. (KMT)

Why Is Kennametal (KMT) Down 1.5% Since Last Earnings Report?

Kennametal (KMT) reported earnings 30 days ago. What's next for the stock?

Here's Why It is Appropriate to Retain Kennametal (KMT) Now

Kennametal (KMT) is poised to gain from strength across the aerospace & defense end markets. The company's measures to reward its shareholders are encouraging.

Kennametal (KMT) Q4 Earnings Beat Estimates, Revenues Down Y/Y

Kennametal's (KMT) fiscal fourth-quarter 2024 revenues decrease 1% due to the lackluster performance of the Metal Cutting segment.

Kennametal Inc. (KMT) Q4 2024 Earnings Call Transcript

Kennametal Inc. (NYSE:KMT ) Q4 2024 Earnings Conference Call August 7, 2024 9:30 AM ET Company Participants Michael Pici - Vice President of Investor Relations Sanjay Chowbey - President and Chief Executive Officer Pat Watson - Vice President and Chief Financial Officer Franklin Cardenas - Vice President and President of Infrastructure Conference Call Participants Grace Song - Morgan Stanley Joseph Ritchie - Goldman Sachs Julian Mitchell - Barclays Tami Zakaria - JPMorgan Steven Fisher - UBS Steve Barger - KeyBanc Capital Markets Michael Feniger - Bank of America Operator Good morning. I would like to welcome everyone to Kennametal Fourth Quarter and Fiscal 2024 Earnings Conference Call.

Here's What Key Metrics Tell Us About Kennametal (KMT) Q4 Earnings

While the top- and bottom-line numbers for Kennametal (KMT) give a sense of how the business performed in the quarter ended June 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Kennametal (KMT) Tops Q4 Earnings and Revenue Estimates

Kennametal (KMT) came out with quarterly earnings of $0.49 per share, beating the Zacks Consensus Estimate of $0.44 per share. This compares to earnings of $0.51 per share a year ago.

Wall Street's Most Accurate Analysts Weigh In On 3 Industrials Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Here's Why Investors Should Avoid Kennametal (KMT) for Now

Lower volume in general engineering, energy and earthwork end markets, and increasing operating expenses are weighing on Kennametal (KMT). Unfavorable foreign currency movement is an added concern.

Wall Street's Most Accurate Analysts Give Their Take On 3 Industrials Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

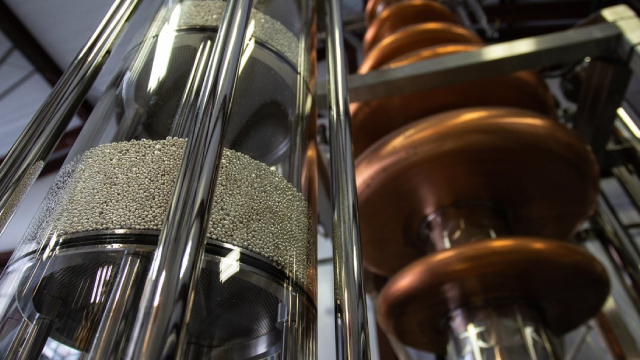

Natixis Advisors L.P. Has $379,000 Holdings in Kennametal Inc. (NYSE:KMT)

Natixis Advisors L.P. decreased its position in Kennametal Inc. (NYSE:KMT – Free Report) by 11.2% in the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 14,730 shares of the industrial products company’s stock after selling 1,858 shares during the period. Natixis Advisors L.P.’s holdings in Kennametal were worth $379,000 at the end of the most recent reporting period. Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Signaturefd LLC lifted its holdings in shares of Kennametal by 119.6% in the fourth quarter. Signaturefd LLC now owns 1,107 shares of the industrial products company’s stock valued at $29,000 after purchasing an additional 603 shares in the last quarter. CWM LLC lifted its stake in Kennametal by 191.1% in the 4th quarter. CWM LLC now owns 1,767 shares of the industrial products company’s stock worth $46,000 after acquiring an additional 1,160 shares in the last quarter. GAMMA Investing LLC purchased a new stake in Kennametal in the 4th quarter worth about $48,000. DekaBank Deutsche Girozentrale acquired a new stake in Kennametal during the 3rd quarter worth about $62,000. Finally, Acadian Asset Management LLC purchased a new position in Kennametal during the 3rd quarter valued at about $82,000. Kennametal Price Performance NYSE KMT opened at $26.00 on Monday. The company has a quick ratio of 1.09, a current ratio of 2.42 and a debt-to-equity ratio of 0.46. The stock has a market capitalization of $2.05 billion, a PE ratio of 19.26, a price-to-earnings-growth ratio of 3.55 and a beta of 1.76. Kennametal Inc. has a 12-month low of $22.08 and a 12-month high of $30.60. The company has a 50 day moving average price of $24.50 and a two-hundred day moving average price of $24.51. Kennametal (NYSE:KMT – Get Free Report) last released its quarterly earnings data on Wednesday, May 8th. The industrial products company reported $0.30 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.31 by ($0.01). The business had revenue of $515.80 million during the quarter, compared to analyst estimates of $518.50 million. Kennametal had a net margin of 5.29% and a return on equity of 9.35%. The firm’s revenue for the quarter was down 3.8% on a year-over-year basis. During the same period in the previous year, the firm posted $0.39 EPS. As a group, equities analysts predict that Kennametal Inc. will post 1.47 earnings per share for the current fiscal year. Kennametal Dividend Announcement The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, May 28th. Investors of record on Tuesday, May 14th will be paid a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 3.08%. The ex-dividend date of this dividend is Monday, May 13th. Kennametal’s payout ratio is 59.26%. Kennametal announced that its Board of Directors has initiated a stock buyback plan on Wednesday, February 7th that allows the company to repurchase $200.00 million in outstanding shares. This repurchase authorization allows the industrial products company to purchase up to 10.6% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company’s board believes its stock is undervalued. Analyst Upgrades and Downgrades Several analysts recently commented on KMT shares. Barclays raised their price target on shares of Kennametal from $24.00 to $25.00 and gave the stock an “equal weight” rating in a report on Thursday, May 9th. JPMorgan Chase & Co. lowered their price target on shares of Kennametal from $26.00 to $24.00 and set an “underweight” rating on the stock in a report on Thursday, February 8th. Finally, StockNews.com upgraded Kennametal from a “hold” rating to a “buy” rating in a report on Friday, May 10th. Two research analysts have rated the stock with a sell rating, two have given a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, Kennametal presently has an average rating of “Hold” and a consensus price target of $24.20. Read Our Latest Stock Report on Kennametal Insider Buying and Selling In other Kennametal news, VP John Wayne Witt sold 1,000 shares of the stock in a transaction that occurred on Thursday, March 7th. The stock was sold at an average price of $25.55, for a total transaction of $25,550.00. Following the transaction, the vice president now owns 1,343 shares in the company, valued at $34,313.65. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Corporate insiders own 1.61% of the company’s stock. About Kennametal (Free Report) Kennametal Inc engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide. The company operates through two segments, Metal Cutting and Infrastructure. Read More Five stocks we like better than Kennametal Best of the list of Dividend Aristocrats: Build wealth with the aristocrat index MarketBeat Week in Review – 5/13 – 5/17 Russell 2000 Index, How Investors Use it For Profitable Trading Take-Two Interactive Software Offers 2nd Chance for Investors How to Invest in Biotech Stocks Deere & Company’s Q2 Report: Strong Revenue, Cautious Outlook