Minerals Technologies Inc. (MTX)

Minerals Technologies Inc. (MTX) Hit a 52 Week High, Can the Run Continue?

Minerals Technologies (MTX) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Dorchester Minerals: 10% Yield On Energy Royalties, Plus Peers

Dorchester Minerals, L.P. operates similarly to energy trusts, collecting royalties and paying out 100% of its net income to unitholders. DMLP owns properties in 28 states, with oil providing 77% of its revenue. DMLP has a high dividend growth 5-year average of over 24% and a forward yield of 9.88%.

Formation Minerals, Inc. Announces Opportunistic Divestiture of Assets

Divestiture includes five non-core or under-performing properties JACKSBORO, TEXAS, May 22, 2024 – Formation Minerals, Inc.

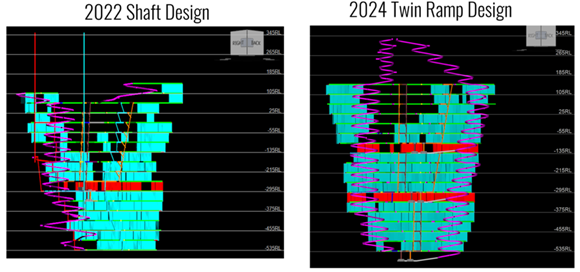

Study Finds Electrifying NioCorp's Critical Minerals Mine Could Lead to Faster Time to Full Production Plus Significant Economic and Environmental Gains

Mine Electrification and Replacement of Vertical Shafts with Railveyor™ System Could "Significantly" Reduce Initial CAPEX and OPEX1 for the Underground Mine Portion of NioCorp's proposed Elk Creek Critical Minerals ProjectNew Approach Could Cut NioCorp's Time to Full Commercial Production by as Much as 5 MonthsDue to the Lower Power Consumption of the Railveyor System, Mine Electrification Could Reduce the Underground Mine's Carbon FootprintMoving to an Electrified Mine with a Railveyor System Not Expected to Delay Completion of an Updated Feasibility Study, NioCorp Says CENTENNIAL, CO / ACCESSWIRE / May 20, 2024 / A scoping study completed by Optimize Group Inc. ("Optimize") (Click Here NioCorp's contract mineral reserve engineering firm, suggests that NioCorp Developments Ltd. ("NioCorp" or the "Company") (Nasdaq:NB) could significantly cut CAPEX and OPEX costs, reach full commercial production sooner, and operate with a lower carbon footprint by electrifying its proposed Elk Creek Critical Minerals Mine ("Elk Creek Mine") via a Railveyor™ system instead of utilizing its currently planned vertical mining shafts.1 The development of the Elk Creek Mine and receipt of any of the benefits identified by the Optimize study are subject to, among other matters, the receipt of sufficient project financing to construct the planned Elk Creek Project facility.A Railveyor system is a fully electric and autonomous bulk material handling system that delivers mined ore to processing facilities via a narrow-gauge light rail system propelled by low-horsepower drive stations adjacent to the rail route."This analysis points to many potentially powerful benefits of electrifying our Elk Creek Mine, both from an economic and an environmental perspective," said Mark A. Smith, CEO and Chairman of NioCorp. "The Optimize study hints at some very compelling potential benefits of this technology to NioCorp, including getting our critical minerals to market sooner and potentially lowering the CAPEX and OPEX associated with our underground operations.""The Railveyor system is a tried-and-true technology that has been in operation for years in underground mines," said Scott Honan, NioCorp's Chief Operating Officer. "NioCorp is examining this option very seriously, and we do not anticipate that choosing this technology pathway will delay an update to the Feasibility Study for our Elk Creek Critical Minerals Project."Findings of the Optimize StudyThe study by Optimize examined the impacts of the following: removing the Elk Creek Mine's currently planned two vertical mining shafts and all required shaft infrastructure; creating a new twin ramp design to be used by the Railveyor system; determining the suitability for a Railveyor haulage system; considerations for electrification of the underground mobile equipment fleet; and a conceptual portal cut design to provide mobile equipment access through the upper soil layer from ground surface to the start of the ramp system in the underlying limestone.The initial findings from the study by Optimize suggest that this new design could result in the following benefits:Potential significant reduction in initial CAPEX requirements due to reduced pre-development time and reduced infrastructure complexity;Increased schedule flexibility allowing for exploitation of stopes in an economically advantageous sequence; andOverall reduction in operating cost-per-tonne ore.NioCorp's existing Feasibility Study shows full ore production at month 45 of the Elk Creek Project. In contrast, according to the Optimize study, the new twin ramp scenario could achieve full production at month 40, a savings of 5 months, due to the simplification of pre-development construction activities.It should be noted that this scoping study was restricted to initial mine design, cost modelling, and scheduling. There has been no work completed on portal boxcut geotechnical, updated mine electrical distribution system, or modification to surface ventilation infrastructure. All assumptions utilized industry standards and best engineering judgment. NioCorp would require more study work to determine if this approach would be beneficial for the Company, but initial findings are positive.Project Outcomes SummaryItem2022 Shaft Scenario2024 Twin Ramp ScenarioDifference with Twin Ramp System% DifferenceInitial CAPEX (US$000s)$356,000$167,100-$188,900-53.1%Sustaining CAPEX (US$000s)$198,400$214,700$16,3008.2%TOTAL CAPEX (US$000s)$554,400$381,800-$172,600-31.1%OPEX/tonne$42.32$41.68-$0.63-1.5%The Railveyor SystemThe design examined by Optimize removes the production shaft, ventilation shaft, and all material handling infrastructure. The removed infrastructure is replaced with two ramps. Ramp 1 would be for all personnel and equipment movement. The ramp has been designed with a maximum gradient of +/-15%. Ramp 2 would be for the Railveyor haulage system, and this ramp has been designed with a maximum gradient of +/-18%. The twin ramp configuration will allow for flow through ventilation of fresh air down ramp 1 and returning up ramp 2."The beauty of the Railveyor system is its simple and rugged design," said Scott Honan, NioCorp's COO. "It is well suited to operate in the challenging environment of an underground mine, and can be easily operated and maintained by individuals with a basic underground mining skill set."According to Railveyor, the haulage system utilizes a train system with cars that will hold approximately 1.2 tonnes of material. These cars differ from a traditional train system inasmuch as the cars connect to create a single long trough akin to a conveyor belt. This system allows for simple continuous loading like a conveyor system with the haulage flexibility of a train system.In addition to the Railveyor system running on electricity, the new design would use battery-powered equipment instead of currently planned diesel-powered equipment, which the study found would significantly reduce emissions.According to Railveyor, these types of systems have been used in a number of hard rock mines around the world. More information on Railveyor can be seen here: Click Here A video describing the technology can be seen here: Click Here are thrilled to see NioCorp exploring the integration of the Railveyor system for the Elk Creek Mine," said Tas Mohamed, CEO of Railveyor. "Our technology not only provides a cost-effective and efficient material handling solution, but also aligns perfectly with the industry's move towards sustainability. By reducing power consumption and emissions, the Railveyor system supports NioCorp's goals of economic efficiency and environmental responsibility, making it an ideal choice for modern mining operations.""Our TrulyAutonomous system is designed with automated safety features to ensure operational reliability, thereby enhancing the overall safety profile of the mine," added Jerome Rodriguez, EVP of Sales at Railveyor. "The compact design of the Railveyor system allows access to deeper mineral deposits and the ability to operate close to the ore body, maximizing the resource extraction potential of the mine. These advantages are further supported by findings from the CanmetMINING study.[2]Optimize has deep familiarity with the Elk Creek Mine. Optimize has provided mining consulting services to NioCorp since 2019, including the work performed on the Mineral Reserve and Resource Estimates in NioCorp's current Feasibility Study. Railveyor provided initial costing information and design criteria for the Optimize study. Additionally, on April 17, 2024, certain members of the NioCorp and Optimize teams visited an operating Railveyor system. That system has been in operation for more than five years.Qualified PersonsGavin Clow P.Eng, Manager of Mining of Optimize Group, is a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information, and verified the data, contained in this press release.Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this press release.# # #For More Information: Jim Sims, Chief Communications Officer, NioCorp Developments Ltd., 720-334-7066, [email protected] NioCorpNioCorp is developing a critical minerals project in Southeast Nebraska that is expected to produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Elk Creek Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron magnets, which are used across a wide variety of defense and civilian applications. @NioCorp $NBAbout Optimize GroupOptimize Group is an international project engineering company with offices in Canada and Australia. From geology to mineral processing, we provide project development and delivery, operational excellence, and due diligence. Integrated at the core we deliver ‘Optimized Mine Plans' and ‘Just Right Plants' with a commitment to help build a sustainable future. Our experienced team works collaboratively, draws on practical and innovative thinking.Forward-Looking StatementsThis press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include, but are not limited to, statements regarding the expected benefits from electrifying the Elk Creek Mine, utilizing a twin ramp design in the Elk Creek Mine and using a Railveyor system for the transport of mined ore, identified in the Optimize study, including potential reduces cost, reduced emissions, faster time to production, lower power consumption, faster removal of mined ore, increased schedule flexibility allowing for exploitation of stopes in an economically advantageous sequence and easier operation and maintenance, the Company's completion of an updated Feasibility Study and the timing thereof, and NioCorp's expectation to produce niobium, scandium and titanium and the potential to produce rare earths at the Elk Creek Project. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations, and assumptions relating to: the potential geotechnical or hydrogeologic implications of accessing the mine via a twin ramp design, NioCorp's ability to recognize the potential benefits of electrifying the Elk Creek Mine, implementing a twin ramp design or utilizing a Railveyor system identified in the Optimize study, NioCorp's ability to secure sufficient project financing for the construction of the Elk Creek Project on acceptable terms, or at all, the technical implementation of the recommendations of the Optimize study and the future costs of implementing a twin ramp design and utilizing a Railveyor system. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the U.S. Securities and Exchange Commission and with the applicable Canadian securities regulatory authorities and the following: NioCorp's ability to recognize the anticipated benefits of the business combination with GX Acquisition Corp. II (the "Business Combination") and the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement" and, together with the Business Combination, the "Transactions") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP, including NioCorp's ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreement over the next three years; unexpected costs related to the Transactions; the outcome of any legal proceedings that may be instituted against NioCorp following closing of the Transactions; NioCorp's ability to continue to meet the listing standards of the NASDAQ; NioCorp's ability to operate as a going concern; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood any of the foregoing; NioCorp's requirement of significant additional capital; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness or the Yorkville Equity Facility Financing Agreement may impair NioCorp's ability to obtain additional financing; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; the possibility that NioCorp does not receive a final commitment of financing from the Export-Import Bank of the United States on the anticipated timeline, on acceptable terms, or at all; NioCorp's limited operating history; NioCorp's history of losses; the material weaknesses in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weaknesses and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the Transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; variations in the market demand for, and prices of, niobium, scandium, titanium and rare earth products; current and future off take agreements, joint ventures, and partnerships; NioCorp's ability to attract qualified management; the effects of global health crises on NioCorp's business plans, financial condition and liquidity; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; the results of technological research; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining industry; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.[1] The study, conducted by Optimize, reflects 2024 dollars, whereas NioCorp's existing Feasibility Study utilized cost estimates that are in the process of being updated. The scoping study by Optimize did not assess the geotechnical or hydrogeologic implications of accessing the Elk Creek Mine via a twin ramp system. The Company expects to assess the geotechnical and hydrogeologic implications of accessing the mine via a twin ramp study in the updated Feasibility Study if it chooses to pursue this option.[2] Source: Acuña, E. & Levesque, M. CanmetMINING mine electrification research: Goldex Railveyor study. October 2023. Click Here NioCorp Developments Ltd.

Venture Minerals appoints Philippa Leggat as managing director on resignation of Andrew Radonjic

Andrew Radonjic, the long-term Venture Minerals Limited (ASX:VMS, OTC:VTMLF) managing director, has tendered his resignation, effective today, and former non-executive director Philippa Leggat will assume the role. Radonjic had been at the helm since 2006 and his tenure with Venture included the pivotal discovery of the Jupiter Rare Earths Project in Western Australia. In his 17-year period with the company, Radonjic navigated the business through some challenging economic periods, such as the global financial crisis and the COVID-19 pandemic, while expanding Venture's exploration portfolio. New MD Leggat, who joined the board in late 2023, led the board renewal process, which brought significant talent to the company, including Tim Lindley and Nick Cernotta. The initial drilling results from the Jupiter project highlighted its substantial potential, helping Venture attract high-calibre candidates. With more than 20 years of experience in the mineral industry, Leggat brings a wealth of knowledge gleaned from roles as an executive director and advisor to several ASX-listed companies, where she has been instrumental in capital raising, exploration, development and project evaluation. Leggat has a proven track record in negotiating value-accretive project acquisitions and effectively communicating an organisation’s competitive advantages to enhance its profile. In addition to advisory roles, Leggat has held key positions in various ASX-listed companies, including CEO of Comet Resources, executive director of Geopacific Resources and non-executive director of Kula Gold and Ensurance Ltd. She also serves as a non-executive director of Harena Resources, a private company focused on developing a significant ionic clay rare earths project in Madagascar. Non-executive chair Tim Lindley said: “We are excited to be appointing Philippa Leggat as managing director at this pivotal time for the company, where there is a clear opportunity to significantly advance the Jupiter Rare Earths Project, restructure the company to best position VMS for opportunities in critical minerals, and create substantial shareholder value. “We have a vision to make Venture one of the best rare earths and critical minerals companies in Australia. Philippa’s appointment is the next key step in that journey. "We strongly believe Philippa has the skills, capabilities and tenacity to drive the company forward through the next important phases for Venture Minerals. “We acknowledge Andrew’s 17 years of service as technical director and managing director. We thank him particularly for his valuable contribution in securing Jupiter for Venture shareholders and wish him all the best in his future endeavours.” Managing director Philippa Leggat said: “In Tim and Nick we have secured expert guidance that is founded on decades of delivering shareholder returns through capital markets and resource expertise. “I hope investors recognise how unusual it is to see people like these venturing into the junior end of the market. This is not their natural habitat and the implication of that for shareholders should set hearts racing. “We will be moving quickly in the coming weeks to focus our efforts on Jupiter, an asset with world-class potential, and we thank Andrew for bringing the opportunity to Venture. “It is my privilege to be handed the reigns of this incredible opportunity with Nick and Tim’s support. Venture has a once-in-a-lifetime opportunity; the asset, the people and the timing at the bottom of the pricing cycle. Welcome to the Jupiter journey.” Ocado Group PLC (LSE:OCDO) is in the midst of an identity crisis. Ocado, via its ocado.com joint venture with Marks & Spencer Group plc, operates its own online grocery store in the UK. This we all know; Ocado vans are a mainstay of Britain’s congested traffic lanes. But at its heart, Ocado is – or is at least trying to position itself as – a technology company. Not everyone has got the memo though, particularly Britain’s investment class, which has refused to price Ocado’s shares in alignment with other tech stocks. This has led rumours swelling that Ocado is poised to handle its identity crisis in the same fashion as many other British technology companies before it- by moving its primary listing stateside. Some have completely dismissed these rumours, including Shore Capital Markets’ Clive Black, who in April called it a “stunt from wherever to boost the heavily loss-making British ‘tech’ company’s share price”. But is there a legitimate point behind the rumours and if so, what would be the justification for Ocado seeking a more welcoming investment class outside of the Square Mile? By the numbers Technology is without a doubt Ocado’s fastest-growing sales line. In full-year results published in February, technology sales grew 44% year on year while retail grew just 7%. Tech is still a significantly smaller segment though, bringing in £429 million worth of sales in 2023 compared to retail’s £2.4 billion-plus. Any potential divorce between the two would make Ocado a substantially smaller operation. It would also make Ocado “higher quality, with higher margins, more recurring revenue and much lower capex”, said one investment analyst speaking with Proactive on the matter. As of 17 May, Ocado’s share price is effectively a 1:1 ratio of all combined operations on a price-to-sales basis. If using Ocado’s forward guidance of mid-to-high single-digit revenue growth, the PS ratio dips below 1:1. Not unheard of in the low-margin retail space, but criminally cheap in the tech space. Undervalued, underappreciated Simply put, Ocaco is objectively undervalued as a tech company. But according to the analyst, this is “not necessarily a lack of understanding” among the investment community. “It might be more about a lack of belief in the business model, especially compared to North American investors who are more open to futuristic bets.” Ocado also has a history of disappointing financial results, breeding further scepticism among Square Mile investors. Garyth Stone, managing director of investment bank Houlihan Lokey (NYSE:HLI)’s consumer, food and retail group, said: “The UK market focuses more on cash flow, profitability, and dividend stability… If (Ocado moved its listing) to the NASDAQ, it might get a fresher perspective from US investors.” True, British tech companies do command superior valuations stateside (hello Arm Holdings PLC (NASDAQ:ARM)), but there is a key difference between Ocado and Arm, or indeed other British companies that have made the move, such as Darktrace and non-tech companies like Flutter. These companies that have moved stateside have done so partially because that is where most of their sales come from. Ocado, on the other hand, is still a UK-centric business. Stone agreed that US investors prefer companies with significant US sales, “but listing on the NASDAQ, which is more internationally focused than the New York Stock Exchange, could still be beneficial. It's not a magic bullet, but it could be a sensible move”. Spinning out Listing change or no listing change, some analysts see a spinning out of Ocado’s retail operations as a very logical next step that is likely being considered by management. AJ Bell analyst Russ Mould echoed this sentiment: "In doing so, Ocado would no longer be associated with the little vans that deliver loaves of bread to Mrs Miggins. That act in itself would be an important first step in trying to get the market to look at the business in a different way." This may have already been foreshadowed with the recent addition of Gavin Patterson to the board. As former chief executive of BT and former president and chief finance officer of Salesforce, Patterson ticks all of the boxes- B2B, tech and US capital markets. It’s almost too convenient. Commenting on his addition to the board, Patterson called Ocado “a true technology pioneer… It has developed and proven applications of AI and robotics that solve some of the most complex supply chain challenges in grocery and logistics. I look forward to working with the board and the leadership team at this exciting time”. Whether this ‘exciting time’ is an allusion to a stateside move will be determined in due course. One thing is for certain- the recent controversy over Ocado’s chief executive Tim Steiner’s salary won’t have sweetened London’s appeal. Dissenting shareholders (comprising nearly a fifth of total votes) were vexed at Steiner’s potential £15 million remuneration package, given shares are off 88% since the pandemic-era Halcyon days. Shareholder advisory firms, meanwhile, criticised Ocado’s refusal to pay a real living wage. All valid points that nonetheless feed into the thesis for listing in a place where middling issues like 1,800% bonus multipliers and fair hourly wages aren’t as contentious. Putting the ‘how’ aside, there is little doubt that Ocado needs to make big changes to turn the ship around and recover lost value. Don’t be massively surprised if the Square Mile loses another member in the process.

Sokoman Minerals Commences 2024 Exploration Program at the Fleur de Lys Gold Project, Northwestern Newfoundland

ST. JOHN'S, NL / ACCESSWIRE / May 16, 2024 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) ("Sokoman" or the "Company") is pleased to report that the 2024 exploration program at the 100%-owned Fleur de Lys gold project has commenced. An earlier-than-normal snow melt over the northern and central Baie Verte Peninsula has allowed prospecting to begin a full month earlier than usual.

Horizonte Minerals PLC Announces Appointment of Administrators

LONDON, UNITED KINGDOM / ACCESSWIRE / May 16, 2024 / Further to the announcement earlier today, Chad Griffin and Geoff Rowley of FRP Advisory were appointed as Joint Administrators of Horizonte Minerals plc ("Horizonte", or "the Company"), (AIM:HZM)(TSX:HZM) today, 16 May 2024. The Joint Administrators are now evaluating the Company's position to achieve the best possible recovery for the Company's creditors.