Robo Global Robotics and Automation Index ETF (ROBO)

ROBO Vs. BOTZ: Which Is The Best "Robotics" ETF?

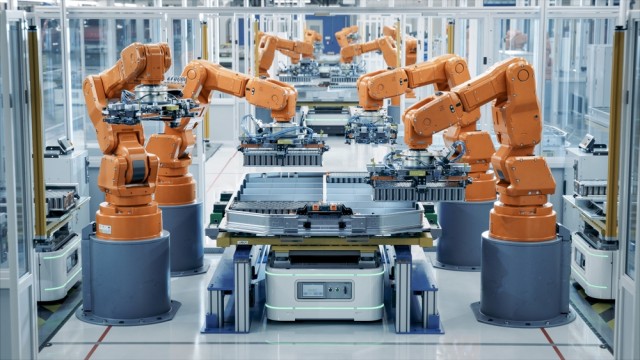

Robotics is a practical, growing industry with significant applications in industrial, healthcare, and home sectors, not just "sci-fi" humanoid robots. I prefer the ROBO ETF for its diversified, global exposure to robotics and automation technology, despite its high expense ratio. BOTZ ETF is less appealing due to its concentrated holdings and overlap with general tech ETFs, making it less focused on pure robotics.

2024 Recap for Pure-Play Robotics Ecosystem & Outlook Ahead

Let's start with the bad news. The robotics space has underperformed broader tech over the past 18 months.

ROBO: Bet On The Consumers, Not The Innovators

The ROBO Global Robotics and Automation Index ETF is too diversified, failing to outperform the S&P 500 over multiple time frames. The real beneficiaries of automation are the users, not the creators, making a simple S&P 500 index fund a better investment. The ETF's holdings are fairly priced with limited upside, and higher interest rates could make them vulnerable to market corrections.

Axogen: Pioneering Nerve Repair With Innovative Off-the-Shelf Tissue Solutions

In this ROBO Global Healthcare Technology and Innovation Index spotlight, we focus on Axogen (AXGN). The index underlies the $56.2 million ROBO Global Healthcare Technology and Innovation ETF (HTEC).

ROBO Global Q3 Index Performance Commentary

The ROBO Global Robotics and Automation Index (ROBO) returned 5.6% during the third quarter of 2024. The robotics space overall has still underperformed over the past year, due to a mix of megacap divergence as well as a lag in end-market.

Deep Dive: Is the Humanoid Opportunity Legit or Overhyped? What's Beyond?

The humanoid robotics market is currently in its infancy, with low overall exposure and a predominantly private company landscape, with companies like Unitree and Figure, and Agility Robotics, among others, creating a stir. While the market size is currently small, we have significant exposure to many of the enabling technologies.

Capture Diversified Robotics Exposure With ROBO

It shouldn't come as a surprise to hear that the robotics sector has been a highly popular investment theme this year. Following years of innovation within the space, experts remain confident in the value that the sector can bring.

A ROBO Rebound Ahead?

If you've been following along – we've been sharing how we've been in the “Eye of the Robo Storm” not only in terms of old market maturation and cyclicality awaiting the pull-through from globalization of manufacturing, but new markets blossoming from major advancements in energy and AI bringing a massive upgrade cycle and new markets

Assessing the Broad Robotics Landscape

The robotics market has weathered a challenging 14-month period. It has faced headwinds such as rising rates, China's slowdown, labor issues, and project delays.

A Bright Robotics Future Ahead

This probably will surprise most people reading this, but the robotics space overall faced one of its most challenging years in recent memory. There was 14 months of consecutive negative PMI in the US and slower-than-expected growth in China, per Schwab's Market Update on June 4th.

The Roadmap for Robotics

VettaFi is dedicated to providing indexes that track the rapidly evolving fields of robotics, artificial intelligence, and healthcare technologies. The ROBO Global suite was the pioneer behind the world's first robotics index, along with affiliated ETFs, launched back in 2013.