Triumph Group Inc. (TGI)

Elon Musk's $1 trillion pay deal: Triumph, theatre and the Tesla paradox

Elon Musk has done it again, danced his way through controversy and out the other side with a shareholder-approved payday so big it almost breaks capitalism's imagination. The Tesla Inc (NASDAQ:TSLA) boss has just won backing for a record-breaking compensation package that could, on paper, be worth nearly $1 trillion.

Triumph Financial: One Of The Last 8.5% Yielding Preferred Shares Remaining

Triumph Financial specializes in the transportation sector and offers a preferred share yielding nearly 8.5% at a discount. TFIN's net interest spread and margin are declining but remain higher than many of its peers. Loan growth remains strong year-over-year, but deposit volatility has pushed the loan-to-deposit ratio to 100%, increasing reliance on external financing.

Triumph Financial, Inc. (TFIN) Q3 2025 Earnings Call Transcript

Triumph Financial, Inc. (NYSE:TFIN ) Q3 2025 Earnings Call October 16, 2025 10:30 AM EDT Company Participants Luke Wyse - Executive VP & Head of Investor Relations Aaron Graft - Founder, Vice Chairman, President & CEO Dawn Salvucci-Favier - President of Intelligence Tim Valdez - Chairman of the Factoring Segment Todd Ritterbusch - President William Voss - Executive VP & CFO Conference Call Participants Matt Olney - Stephens Inc., Research Division Timothy Switzer - Keefe, Bruyette, & Woods, Inc., Research Division Joseph Yanchunis - Raymond James & Associates, Inc., Research Division Gary Tenner - D.A. Davidson & Co., Research Division Harold Goetsch - B.

Triumph Financial (TFIN) Q3 Earnings Beat Estimates

Triumph Financial (TFIN) came out with quarterly earnings of $0.19 per share, beating the Zacks Consensus Estimate of $0.12 per share. This compares to earnings of $0.19 per share a year ago.

Triumph's True Value Is Hidden

Triumph Financial combines a highly profitable regional bank and factoring business with innovative, early-stage payments and intelligence offerings for the trucking industry. The company's unique integration of banking, payments, and data analytics creates a powerful network effect and competitive moat within a fragmented freight market. While current earnings are depressed by the freight recession and significant investments in technology, Triumph's structural advantages and capital allocation provide substantial long-term upside potential.

Triumph Group (TGI) is a Top-Ranked Momentum Stock: Should You Buy?

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Triumph Financial, Inc. (TFIN) Q2 2025 Earnings Call Transcript

Triumph Financial, Inc. (NASDAQ:TFIN ) Q2 2025 Earnings Conference Call July 17, 2025 10:30 AM ET Company Participants Aaron P. Graft - Founder, Vice Chairman, President & CEO Dawn Favier - Corporate Participant Kimberly Fisk - President of Factoring Luke Wyse - Executive VP & Head of Investor Relations Todd N.

Here's Why Triumph Group (TGI) is a Strong Momentum Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Darden's Triumph Amid QSR Woes (Q4 Earnings Preview)

This earnings season has been dominated by concerns over geopolitical tensions and potential tariffs, overshadowing the actual financial results. Darden, however, seems particularly insulated from tariffs. Moreover, it is seeing strong traffic growth, even though consumers are more cautious.

Triumph Group (TGI) Reports Q4 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Triumph Group (TGI) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Triumph Group (TGI) Surpasses Q4 Earnings and Revenue Estimates

Triumph Group (TGI) came out with quarterly earnings of $0.48 per share, beating the Zacks Consensus Estimate of $0.31 per share. This compares to earnings of $0.31 per share a year ago.

Reasons to Include Triumph Group Stock in Your Portfolio Now

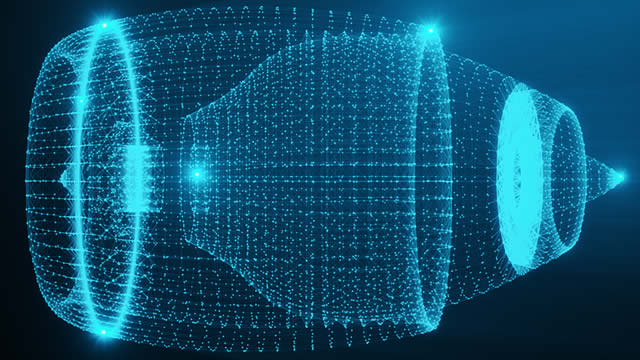

TGI is a solid pick in the aerospace-defense equipment industry, given its growth prospects, better solvency and liquidity position, robust backlog, and rising aftermarket business.