Woodward Inc. (WWD)

Unveiling Woodward (WWD) Q4 Outlook: Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Woodward (WWD) for the quarter ended September 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

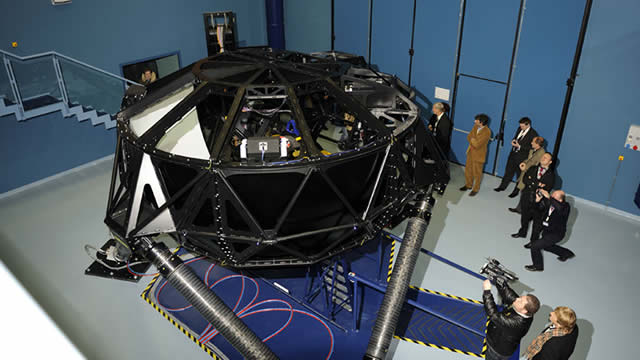

Woodward to Sell Gas Turbine Combustion Parts Business to GE Vernova

To focus on its core products and maximize value creation, WWD inks a deal to sell its heavy-duty gas turbines combustion parts business to GE Vernova.

Here's Why Woodward (WWD) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Here's Why Woodward (WWD) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Why Woodward (WWD) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Will Woodward (WWD) Beat Estimates Again in Its Next Earnings Report?

Woodward (WWD) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Google Labs VP Josh Woodward on new AI podcast tool features

CNBC's Deirdre Bosa and Kelly Evans discuss updates to Google's viral NotebookLM software with Google Labs Vice President Josh Woodward.

Woodward Surges 25% Year to Date: What Lies Ahead for the Stock?

WWD's Aerospace segment benefits from higher commercial OEM and aftermarket sales. However, the volatile China on-highway natural gas truck market is concerning.

Woodward Stock: Long-Term Prospects Remain Strong Despite Recent Dip

Woodward's Q3 earnings showed a 21% growth in net earnings and doubled free cash flow, despite a 7% stock price decline. Supply chain issues and fluctuating Chinese LNG truck demand led to revised guidance, impacting stock prices and FY2024 outlook. Despite short-term challenges, Woodward's long-term prospects remain strong with a $185.79 price target and a 13% upside.

Here's Why Woodward (WWD) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Woodward (WWD) Up 9.5% Since Last Earnings Report: Can It Continue?

Woodward (WWD) reported earnings 30 days ago. What's next for the stock?

Why Woodward (WWD) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.