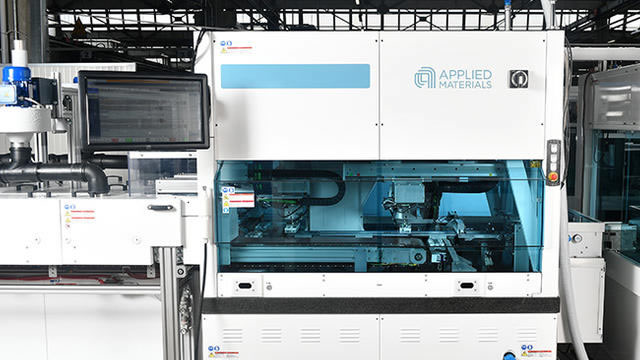

Applied Materials Inc. (AMAT)

Applied Materials (AMAT) Increases Yet Falls Behind Market: What Investors Need to Know

Applied Materials (AMAT) closed the most recent trading day at $245.84, moving +0.12% from the previous trading session.

Is Applied Materials (AMAT) Stock Outpacing Its Computer and Technology Peers This Year?

Here is how Applied Materials (AMAT) and Alpha and Omega Semiconductor (AOSL) have performed compared to their sector so far this year.

Investing In MKS Instruments, In The Supply Chain, Or In Its Major Semiconductor Equipment Customers

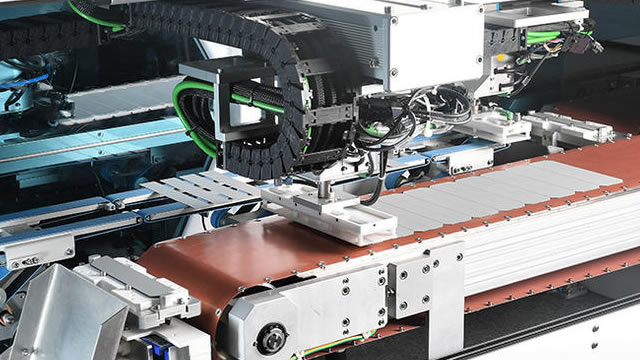

MKS Instruments is a major supplier to semiconductor equipment companies Lam Research and Applied Materials, with one-third of revenues from them. Investing in smaller supply chain companies offers growth potential but carries risks of stock price fluctuations and dependency on few customers. AMAT and LRCX exhibit strong share price growth compared to their three suppliers.

Applied Materials (AMAT) Surpasses Market Returns: Some Facts Worth Knowing

In the closing of the recent trading day, Applied Materials (AMAT) stood at $254.97, denoting a +1.39% change from the preceding trading day.

Wall Street Analysts See Applied Materials (AMAT) as a Buy: Should You Invest?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Applied Materials, Inc. (AMAT) is Attracting Investor Attention: Here is What You Should Know

Applied Materials (AMAT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

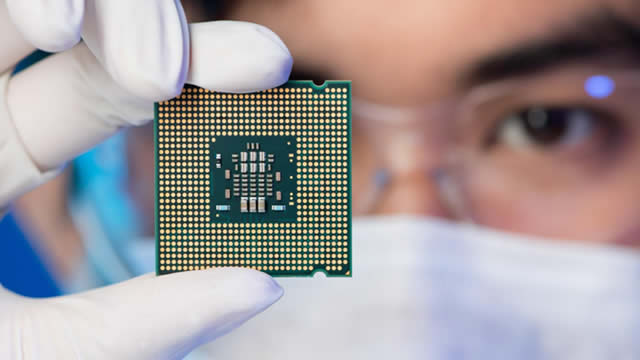

3 Seriously Underpriced Semiconductor Stocks to Snap Up Now

Not all semiconductor stocks with skin in the AI boom are egregiously overvalued. Despite the hot run in chip plays, there's still value in neglected plays that many investors are shying away from for one reason or another.

3 Nanotech Stocks That Could Make Your Grandchildren Rich

Advancements in semiconductor manufacturing, medical applications and materials science are projected to expand the nanotech market significantly in 2024. This backdrop forms the backdrop for my three nanotech stocks to buy.

3 Tech Stocks With the Potential to Turn $1K Into $1 Million

Are you wondering how fast you can turn a $1,000 investment into a million? Three years?

You've Been Warned! 3 Nanotech Stocks to Buy Now or Regret Forever

Nanotech stocks are among the hottest plays in the market right now, thanks to analysts predicting astronomical growth for the market. For example, Fortune Business Insights forecasted the market would grow to $91.18 billion in 2024 and reach $332.73 billion by 2032.

Applied Materials, Inc. (AMAT) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Applied Materials (AMAT). This makes it worthwhile to examine what the stock has in store.

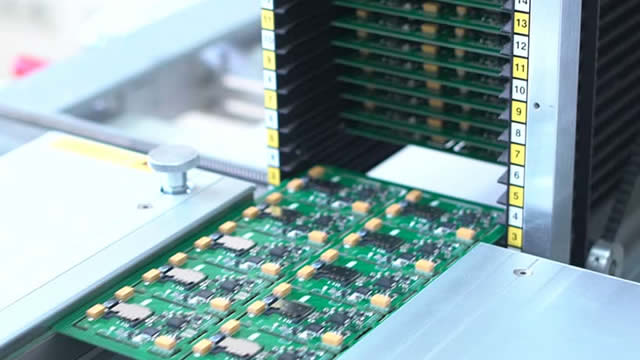

7 Semiconductor Stock Superstars to Make Your Portfolio Sizzle

While it's easy to get locked into semiconductor stocks to buy thanks to the mercurial rise of Nvidia (NASDAQ: NVDA ), there's more to the sector than just one enterprise focused on artificial intelligence. Fundamentally, the chip-manufacturing ecosystem is enticing because it represents the building blocks of innovation.