Advanced Micro Devices, Inc. (AMD)

3 Stocks Near 52-Week Lows Ready for a Rebound

One of the biggest mistakes investors make when trading their portfolios and putting capital to work is staying away from discounts. It is human nature to avoid a stock chart that has been down and to the right as fears of a continuation in the same direction start to kick in.

We asked DeepSeek AI what will be AMD stock price at the end of 2025

Advanced Micro Devices (NASDAQ: AMD) stock's performance in 2024 has been a major surprise. The equity entered the year strong, rallying approximately 40% between January and March, but then entered a downtrend it hasn't escaped to date.

AMD Stock: Can the PC Refresh Cycle Spark a Rally?

Investors in Advanced Micro Devices NASDAQ: AMD have faced a year full of letdowns. As of the Mar. 12 close, shares are down 49% over the past 52 weeks.

2 Artificial Intelligence (AI) Stocks to Buy Before They Soar 82% and 124%, According to Certain Wall Street Analysts

The recent pullback in the stock market may have some investors on edge. The stocks selling off the most over the last couple of weeks are the same ones that led the stock market higher over the previous two years: artificial intelligence stocks.

AMD and Nvidia Stock Investors Just Got Amazing News From Oracle

In today's video, I discuss Nvidia (NVDA 6.43%), Advanced Micro Devices (AMD 4.17%), and why investors should be cheering after Oracle 's (ORCL 4.65%) earnings. To learn more, check out the short video, consider subscribing, and click the special offer link below.

3 Chips Stocks in Focus as Traders Buy Up Tech

The tech sector is rebounding today, pushing the Nasdaq Composite Index (IXIC) up triple digits, as investors buy the dip following an extended broad-market selloff.

AMD Stock: Why Selling Now Could Be a Big Mistake

In this video, I will cover the recent updates regarding AMD (AMD 1.80%) and why selling now could be a huge mistake. Watch the short video to learn more, consider subscribing, and click the special offer link below.

AMD Gears Up For Breakout Year In Artificial Intelligence GPUs Business: Analyst

Fresh off a series of investor meetings with Advanced Micro Devices Inc's AMD CEO Lisa Su, JPMorgan analyst Harlan Sur says the company is increasingly confident about delivering over 20% growth in 2025.

Should You Buy Advanced Micro Devices (AMD) Stock After Its 51% Drop?

The stock market is in the midst of a sell-off right now, with the Nasdaq Composite down more than 9% from its recent all-time high. However, the decline in Advanced Micro Devices (AMD 0.14%) stock started one year ago, and it's down 51% from its best-ever level.

AMD: Outperforming Nvidia GPUs In Some AI Inference Applications

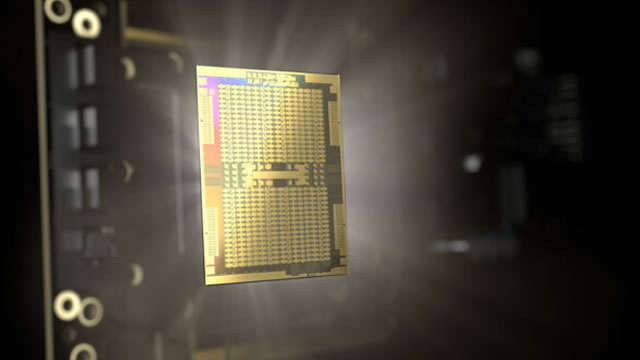

Over the last year, AMD's share price declined by -53.4% compared to a return of +22.3% for Nvidia's stock. When looking exclusively at market performance, one would think that AMD is significantly behind Nvidia in the AI GPU arms race. The reality is otherwise, as AMD's MI325X platform may actually surpass Nvidia's Hopper H200 GPUs in some inference applications.

Advanced Micro Devices (AMD) Advances While Market Declines: Some Information for Investors

Advanced Micro Devices (AMD) closed at $96.76 in the latest trading session, marking a +0.13% move from the prior day.

Ocular Therapeutix Axpaxli Advances In Phase 3 For Wet AMD, Analyst Forecasts Huge Upside

Needham initiated coverage on Ocular Therapeutix Inc OCUL, noting the company's lead asset, Axpaxli, an investigational axitinib-based intravitreal implant for wet age-related macular degeneration (wet AMD).