ASML Holding N.V. New York Registry Shares (ASML)

Brokers Suggest Investing in ASML (ASML): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Are You Looking for a Top Momentum Pick? Why ASML (ASML) is a Great Choice

Does ASML (ASML) have what it takes to be a top stock pick for momentum investors? Let's find out.

Here is What to Know Beyond Why ASML Holding N.V. (ASML) is a Trending Stock

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why Investors Need to Take Advantage of These 2 Computer and Technology Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Monopoly No More? ASML May Suddenly Have a New Competitor

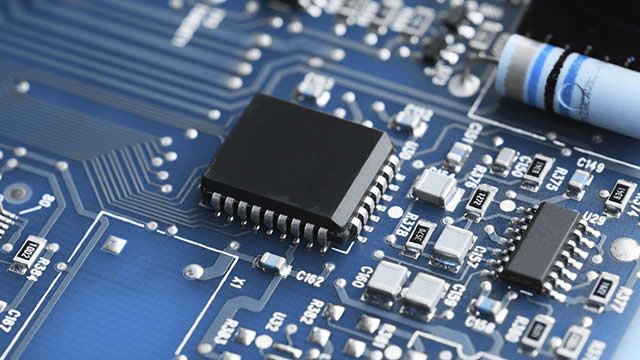

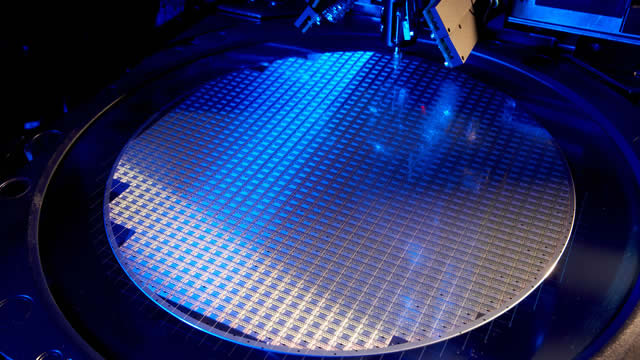

ASML Holding ( NASDAQ:ASML ) has long dominated the semiconductor world with its stranglehold on extreme ultraviolet (EUV) lithography machines.

4 Underrated Stocks to Buy and Hold for the Next Decade

In today's market, investor attention remains fixated on a handful of mega-cap AI leaders driving the latest rally.

ASML launches technical academy in Phoenix to train in-demand engineers

Chip equipment maker ASML on Thursday launched a technical academy in Phoenix to train engineers to service the Dutch company's complex chipmaking machines.

Is Trending Stock ASML Holding N.V. (ASML) a Buy Now?

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Are Computer and Technology Stocks Lagging ASML Holding (ASML) This Year?

Here is how ASML (ASML) and Ciena (CIEN) have performed compared to their sector so far this year.

Wall Street Bulls Look Optimistic About ASML (ASML): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

ASML Holding Soars 45% YTD: Is the Stock Still Worth Buying?

ASML's YTD surge, and expanding EUV and High-NA momentum raise questions on whether the stock's powerful run still has room to grow.

ASML's Mistral AI Investment: Is It a Catalyst for Next Growth Phase?

ASML Holding's investment in Mistral AI aims to fuse generative AI into its EUV systems, boosting innovation speed and strengthening its competitive edge.