American Express Co. (AXP)

Earnings Growth & Price Strength Make American Express (AXP) a Stock to Watch

Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service.

American Express Company (AXP) Is a Trending Stock: Facts to Know Before Betting on It

American Express (AXP) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Shares of These Companies Soared Following Robust Results

The Q3 cycle continues to be one of positivity, with growth remaining strong and an above-average number of companies beating expectations. These companies saw big positivity following their better-than-expected results.

Every American Express (AXP) Investor Should Keep an Eye on This Number

American Express possesses pricing power, which supports the view that it's a high-quality business. Cardholders appreciate the incredibly valuable perks and rewards that they receive.

Finance Sector Provides Flying Start to Q3 Earnings Season

American Express was the latest Finance player to beat Q3 expectations, offering positive, reassuring commentary on consumer health and the economy. These results echoed the same sentiment that we heard from the big banks.

Finance Sector Provides Flying Start to Q3 Earnings Season

American Express was the latest Finance player to beat Q3 expectations, offering positive, reassuring commentary on consumer health and the economy. These results echoed the same sentiment that we heard from the big banks.

2 Dividend Stocks That Can Pay You Forever

When it comes to picking dividend stocks, you not only want a firm that can support a generous payout, but one that can grow it at a fairly predictable rate over extended periods of time.

Q3 Earnings Season Starts Positively: A Closer Look

Note: The following is an excerpt from this week's Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Q3 Earnings Season Starts Positively: A Closer Look

Note: The following is an excerpt from this week's Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

American Express (AXP) Q3 Earnings and Revenues Top Estimates

American Express (AXP) came out with quarterly earnings of $4.14 per share, beating the Zacks Consensus Estimate of $3.96 per share. This compares to earnings of $3.49 per share a year ago.

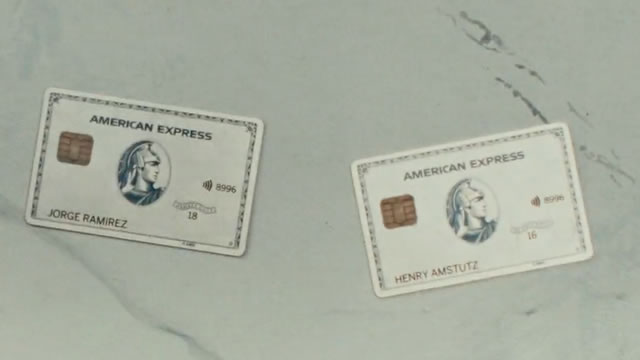

AXP Gains Edge as RewardPay Debuts First-Ever Tax Pooling Rewards

American Express taps RewardPay's new tax pooling system to turn business tax payments into reward-earning, cash flow-friendly transactions.

American Express (AXP) Surpasses Market Returns: Some Facts Worth Knowing

In the latest trading session, American Express (AXP) closed at $323.09, marking a +2.16% move from the previous day.