Coinbase Global, Inc. (COIN)

An Update On Coinbase's Q1 2025 Earnings (Rating Upgrade)

Coinbase's S&P 500 inclusion is a massive liquidity event, driving momentum and attracting institutional investors, making it a unique, premium crypto investment. Regulatory progress like the STABLE Act and USDC growth, plus the Deribit acquisition, position Coinbase for long-term success as crypto adoption accelerates. Despite cybersecurity incidents, Coinbase's proactive response and industry-leading transparency reinforce its resilience and investor confidence.

Coinbase Says Cybersecurity Incident Could Cost It $400 Million

Coinbase disclosed that the cybersecurity incident it reported Thursday (May 15) could cost it as much as $400 million. The company's investigation into the incident is still underway, so the full impact of the cyberattack is not yet known, Coinbase said in a filing with the Securities and Exchange Commission (SEC).

Fintech stocks are hot again, as Coinbase and eToro whet investor appetite

Crypto broker Coinbase is slated to join the S&P 500 on Monday as the sector gains favor while trading platform eToro's IPO hits pay dirt and Chime files to go public.

Coinbase hack exposes customer data in $400m breach

Coinbase Global Inc (NASDAQ:COIN) has disclosed a major security breach involving the personal data of high-value customers, after hackers bribed outsourced support staff to access internal systems. The attackers demanded a $20 million ransom in exchange for deleting the stolen information.

Coinbase Says SEC Investigating Its Past Reporting of User Metrics

Coinbase Global reportedly said Thursday (May 15) that it is cooperating with the Securities and Exchange Commission (SEC) on the agency's investigation into how the cryptocurrency exchange used to report its user metrics. The company said the SEC is looking into whether Coinbase overstated the number of unique users in past disclosures, Bloomberg reported Thursday.

Coinbase said cyber crooks stole customer information and demanded $20 million ransom payment

Coinbase, the largest cryptocurrency exchange based in the U.S., said Thursday that criminals had improperly obtained personal data on the exchange's customers for use in crypto-stealing scams and were demanding a $20 million payment not to publicly release the info.

Coinbase Says Data Breach Could Cost Up to $400M. The Stock Is Falling.

The crypto exchange reported a breach of sensitive company and customer data to the SEC.

Coinbase Reimburses Customers Following $20 Million Extortion Attempt

Coinbase is reimbursing users following a data breach that turned into an extortion attempt. The breach happened when cybercriminals convinced “a small group” of company insiders to copy the data from its customer support tools for less than 1% of Coinbase's monthly transacting users, according to a Thursday (May 15) company blog post.

Coinbase says customers' personal information stolen in data breach

Crypto giant Coinbase has confirmed its systems have been breached and customer data, including government-issued identity documents, were stolen.

Coinbase: Now Could Be A Great Time To Buy And Hold

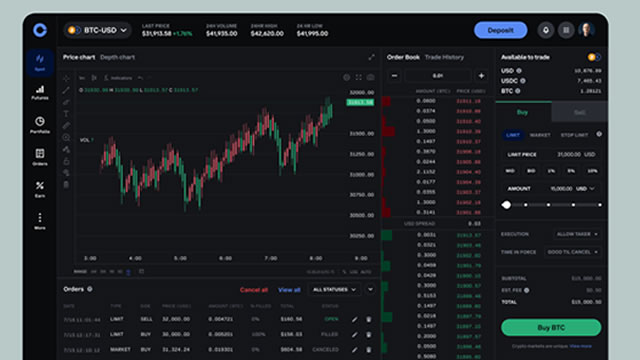

Coinbase is evolving from a trading-fee-dependent crypto exchange to a durable infrastructure provider, making it a strong buy. The company's strategic pivot includes growing recurring revenue, scaling derivatives, and expanding B2B monetization, positioning it for long-term success. Coinbase's strong balance sheet, robust EBITDA margins, and unjustified discount to peers highlight its undervalued potential.

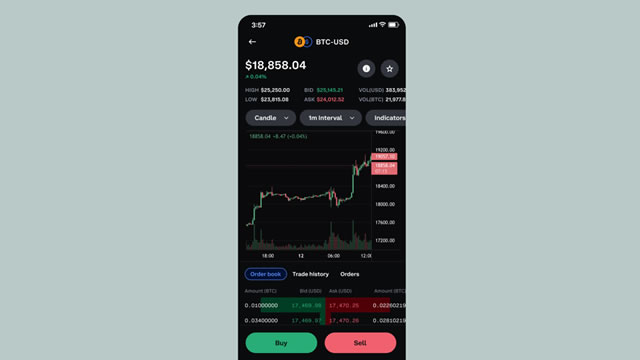

Coinbase to Join S&P 500, Shares Rally: ETFs to Buy

ETFs are set to gain as Coinbase is set to enter the S&P 500 on May 19.

Coinbase Soars 24% on S&P 500 Inclusion: What Lies Ahead for ETFs?

Coinbase shares surged 24% on May 13, 2025. The move marks their biggest one-day gain since the day after Donald Trump's election victory.