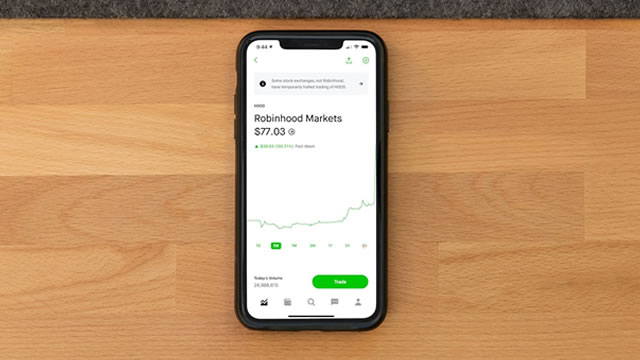

Robinhood Markets, Inc. (HOOD)

Robinhood stock tops $100 to new record, roaring 30% since being snubbed from S&P 500

Robinhood stock hit the $100 mark for the first time, capping off a week of fresh all-time highs and a major strategic swing in Europe. CEO Vlad Tenev said the goal is to merge crypto infrastructure with traditional finance by putting real products in customers' hands.

Robinhood Markets, Inc. (HOOD) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Robinhood Markets, Inc. (HOOD) concluded the recent trading session at $92.33, signifying a -1.39% move from its prior day's close.

Why Robinhood Stock Is Soaring: A Buying Opportunity?

HOOD jumps 12.8% after unveiling crypto futures, staking, and tokenized U.S. stocks for EU and U.S. users.

HOOD Launches Tokenized Stocks in EU: Betting on Digital Asset Boom?

Robinhood launches tokenized U.S. stocks in the EU, expanding beyond crypto as investor demand for digital assets surges.

Robinhood's Super App Ambition: From Zero Commission To Fintech Titan

Robinhood is evolving into a global, capital-light personal finance super-app, with strong recurring revenue from subscriptions, card, and crypto services driving profitability. International expansion, the Gold Card, and crypto/tokenization initiatives are accelerating growth, diversifying revenue, and deepening user engagement beyond U.S. retail trading. Financials highlight robust operating leverage, high margins, and aggressive buybacks, with guidance implying continued strong growth and improving per-share metrics.

How Robinhood's dive into stock tokens makes it a ‘must own' crypto investment

The financial-services platform is making a smart move by getting deeper into cryptocurrencies, analysts say, as it will expand its customer base.

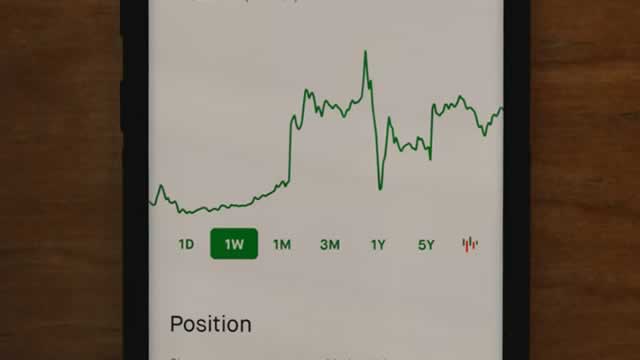

Robinhood Markets (HOOD) Surges 12.8%: Is This an Indication of Further Gains?

Robinhood Markets (HOOD) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term.

Robinhood to launch blockchain for trading tokenised US stocks and ETFs in Europe

Robinhood Markets Inc (NASDAQ:HOOD) is building its own blockchain to support the trading of tokenised real-world assets, in a major step that will shift the US fintech's crypto business beyond digital currencies. The new network, a so-called Layer 2 blockchain built on the Arbitrum system, will be designed to handle around-the-clock trading, self-custody of assets, and seamless movement between platforms.

Robinhood reveals secret blockchain play to power 24/7 stock trading

CNBC's MacKenzie Sigalos reports from Cannes, where Robinhood just unveiled tokenized shares of OpenAI and SpaceX — part of a larger push to put its entire brokerage stack on-chain and enable round-the-clock trading.

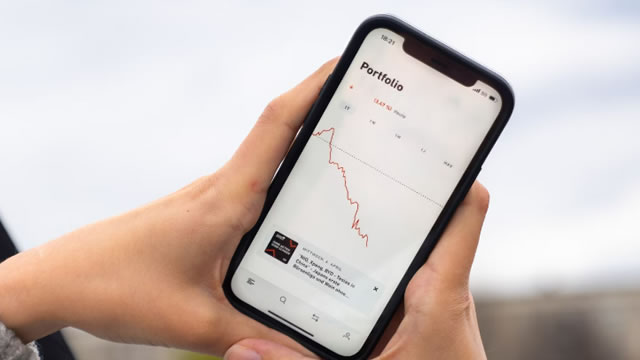

Markets Close Rollercoaster Q2 on Top

After starting calendar Q2 with a huge "Liberation Day" dip, the Nasdaq and S&P 500 once again close at new all-time highs.

Robinhood launches tokenized trading of US stocks for EU users

Robinhood Markets Inc (NASDAQ:HOOD) shares jumped almost 12% after the trading platform expanded its crypto and stock trading offerings in the European Union. The company has launched tokenized US stocks and ETFs for EU users, allowing commission-free trading of more than 200 major US stocks, accessible 24 hours a day, five days a week.

Robinhood stock soars as new crypto stock tokens open doors to overseas investors

The stock tokens give E.U. investors exposure to hundreds of U.S. stocks, as well as to private companies SpaceX and OpenAI.