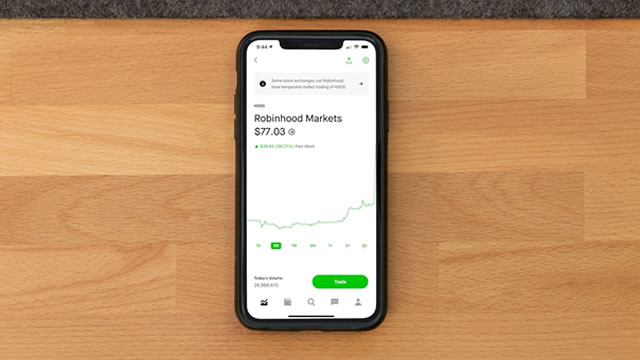

Robinhood Markets, Inc. (HOOD)

Robinhood Stock Rally Reels In Options Traders

Electronic trading stock Robinhood Inc (NASDAQ:HOOD) was last seen up 4.8% at $76.07, moving back up toward its June 6, four-year high of $77.80.

HOOD vs. BGC: Which Fintech Brokerage Stock Has More Upside?

Is Robinhood's innovation-fueled growth a better bet than BGC Group's institutional strength in today's fintech market? Let's find out.

Top Fintech Stocks That are Transforming the Future of Finance

The fintech industry is set to disrupt traditional finance. HOOD, NU and SOFI are leading fintech?

Robinhood Markets, Inc. (HOOD) Stock Sinks As Market Gains: Here's Why

In the latest trading session, Robinhood Markets, Inc. (HOOD) closed at $73.84, marking a -1.39% move from the previous day.

HOOD's May 2025 DARTs Rise Y/Y: Is Product Expansion a Catalyst?

Robinhood's May DARTs increase across equities, options and crypto as product rollouts aim to boost market share and revenues.

Buy or Sell HOOD Stock At $72

Robinhood Markets (NASDAQ:HOOD) has surged over 25% in the past month, fueled by speculation of its inclusion in the S&P 500 index. Such an inclusion would have triggered significant inflows from index-tracking funds.

Beyond Free Trades: 3 Ways Robinhood Continues to Innovate

Through genius innovations like commission-free trading, Invest America, Gold Card, and crypto and betting markets, Robinhood is becoming a juggernaut in the fintech space. With its one-stop shop approach, the company is acquiring users rapidly.

HOOD Misses Out on Joining the S&P 500: What This Means for Investors

Robinhood's S&P 500 snub halts its six-day rally, triggering a sharp dip and raising questions about its valuation and momentum.

Robinhood Markets, Inc. (HOOD) Is a Trending Stock: Facts to Know Before Betting on It

Robinhood Markets (HOOD) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Robinhood Quietly Built The Most Profitable Platform In Fintech

Robinhood's competitive edge sits at the intersection of speed, design, engagement, and integration. What sets Robinhood apart is how it's reimagined the financial services experience from the ground up for a digitally native audience. That rearchitecture isn't limited to trading - it now spans everything from banking and credit to retirement and crypto - and it's being scaled rapidly across product lines in a way that traditional institutions struggle to match. A big part of that advantage comes from Robinhood's product velocity and unified platform design. In just the past year, the company has rolled out a range of new offerings, all within a single, cohesive app experience.

Robinhood Drops on S&P Snub—Is a Bigger Pullback Coming?

Shares of Robinhood Markets Inc. NASDAQ: HOOD are down more than 5% after the stock was denied entry into the S&P 500 index. The stock had rallied more than 30% in the month leading up to the decision on hopes (and likely expectations) that HOOD stock would be added to the index as it rebalanced.

Robinhood misses out on S&P 500 inclusion, shares fall

Robinhood Markets Inc (NASDAQ:HOOD) shares fell more than 5% on Monday after the trading platform was not included in the S&P 500 during the index's quarterly rebalancing. Shares of Robinhood were down 5.4% at about $71 late morning on Monday.