Robinhood Markets, Inc. (HOOD)

Where Will Robinhood Markets' Stock Be in 3 Years?

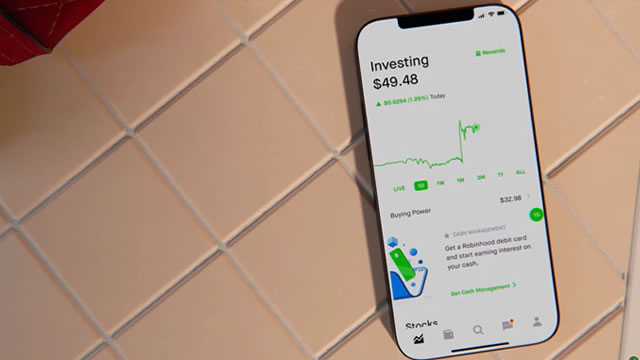

Robinhood Markets (HOOD 3.76%), the online brokerage that popularized commission-free trading, went public in July 2021 at $38 a share. Its stock hit an all-time high of $70.29 less than a week later, but it dropped below $7 by the following June.

The Smartest Financial Stocks to Buy With $200 Right Now

Thanks to fractional shares and commission-free trading, anyone can invest these days, whether you've got $200 or $2 million. Investing can be risky and time-consuming, so it's a good idea to start investing as early as possible and with a smaller amount of money so your losses don't impact you too much financially.

Why Robinhood Markets, Inc. (HOOD) Dipped More Than Broader Market Today

Robinhood Markets, Inc. (HOOD) closed at $36.94 in the latest trading session, marking a -0.38% move from the prior day.

Robinhood CEO talks comeback, crypto, and investing tools

2024 was a big year for Robinhood (HOOD). The stock is up more than 220% over the past year as the company has expanded both its offerings and customer base.

Get Ahead of the January Effect With These 2 Fintech Stocks

As 2024 concludes, investors await the Santa Claus rally lifting stocks in the last week of December and the January effect to kick in the following month. The January effect occurs when investors buy back into the market after taking their tax losses and selling their underperforming stocks to offset capital gains from cashing in on their winners.

Why Robinhood Continues Dominating the Market

Robinhood's (HOOD -3.63%) most recent data release showed another great month of momentum in November, and that should keep the company growing in 2024. In this video, Travis Hoium shows why this remains one of the hottest stocks in fintech.

Prediction: Robinhood Will Beat the Market. Here's Why

Robinhood (HOOD -3.63%) is no longer a YOLO trading platform like it was during the pandemic. The company has built professional tools and is growing rapidly in retirement accounts, which is a big reason the stock is up in 2024.

Robinhood CEO reveals why the company is donating to Trump's inaugural fund

Robinhood co-founder and CEO Vlad Tenev unpacks the company's $2 million donation to the Trump inaugural fund on 'The Claman Countdown.'

It's 'a stock picker's market': Robinhood strategist

The Federal Reserve's inflation progress is expected to stall in 2025, according to Robinhood's new year outlook. Robinhood Financial's head of investment strategy Stephanie Guild joins Seana Smith and Madison Mills on Catalysts to discuss her expectations for the market (^DJI,^GSPC, ^IXIC).

Trade Tracker: Bryn Talkington buys Robinhood

Bryn Talkington, managing partner at Requisite Capital Management, joins CNBC's 'Halftime Report' to discuss why she's buying Robinhood now.

Why Robinhood Stock Could Keep Charging Higher

Subscribers to Schaeffer's Weekend Trader options recommendation service received this HOOD commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters.

Robinhood Markets Stock: Buy, Sell, or Hold?

It's been a fantastic year for stock market investors. At the time of this writing, the S&P 500 index has returned 28% thus far in 2024 amid a resilient macroeconomic backdrop and record corporate earnings.