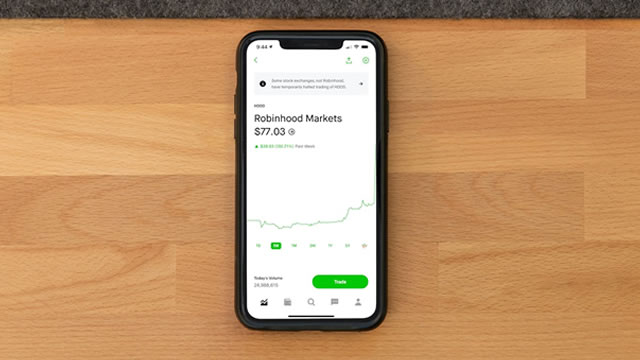

Robinhood Markets, Inc. (HOOD)

Robinhood To Rally Around 18%? Here Are 10 Top Analyst Forecasts For Thursday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

All You Need to Know About Robinhood Markets (HOOD) Rating Upgrade to Strong Buy

Robinhood Markets (HOOD) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Robinhood Markets, Inc. (HOOD) Laps the Stock Market: Here's Why

The latest trading day saw Robinhood Markets, Inc. (HOOD) settling at $22.07, representing a +1.99% change from its previous close.

Robinhood: Why I'm Buying More

Robinhood's revenue growth rates are expected to remain strong, with a 30% CAGR in 2024, making it undervalued at 13x forward EBITDA. Despite subdued free cash flow due to working capital usage, Robinhood's EBITDA is projected to reach $1 billion in 2024, showcasing its profitability. The platform's significant growth in retail trading, high net deposits, and increased Gold subscribers highlight robust customer engagement and revenue growth.

Robinhood Markets, Inc. (HOOD) Just Flashed Golden Cross Signal: Do You Buy?

Robinhood Markets, Inc. (HOOD) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, HOOD broke through the 20-day moving average, which suggests a short-term bullish trend.

Robinhood Markets, Inc. (HOOD) Crossed Above the 50-Day Moving Average: What That Means for Investors

After reaching an important support level, Robinhood Markets, Inc. (HOOD) could be a good stock pick from a technical perspective. HOOD surpassed resistance at the 50-day moving average, suggesting a short-term bullish trend.

Robinhood Markets, Inc. (HOOD) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Robinhood Markets (HOOD). This makes it worthwhile to examine what the stock has in store.

Massive News for Robinhood Investors

Robinhood's growth is taking a pause based on recent numbers.

Robinhood Stock Today: Why This Cash Secured Put Could Deliver A 53% Annualized Gain

The trader exits with a very high 5.88% return on capital at risk.

Robinhood Trading Platform to Pay $3.9M for Crypto-Withdrawal Failure

HOOD's trading platform will pay $3.9 million to settle claims that it failed to let customers withdraw cryptocurrency from their accounts from 2018 to 2022.

Robinhood reaches $3.9 mln settlement with California over crypto withdrawals

A cryptocurrency platform run by Robinhood Markets will pay $3.9 million for failing to let customers withdraw cryptocurrency from their accounts from 2018 to 2022, California Attorney General Rob Bonta said on Wednesday.

Robinhood lets Brits lend shares for extra income in bid to grow international footprint

Stock trading app Robinhood on Wednesday launched a new feature in the U.K. allowing retail traders to lend out any stocks they own outright in their portfolio to interested borrowers. Shares lent out via the Robinhood app will be treated as collateral, with Robinhood receiving interest from borrowers and paying it out monthly to lenders.