iShares Self-Driving EV and Tech ETF (IDRV)

IDRV: A Good Bet Beyond Tesla

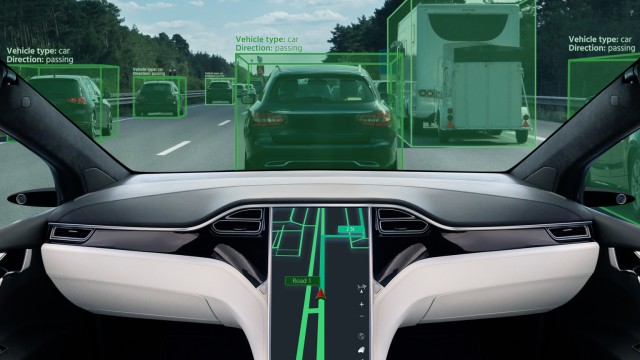

The iShares Self-Driving EV and Tech ETF offers a cost-effective way to invest in global companies advancing self-driving tech and electric vehicles. IDRV's holdings include Tesla, Li Auto, Arcadium Lithium, XPeng, and BYD, providing a comprehensive view of the EV sector and supply chain. The fund's sector allocation focuses on Consumer Discretionary, Industrials, Materials, and Information Technology, with significant investments in Chinese firms.

IDRV: Starting To Turn The Car Around, Buy Rating

The iShares Self-Driving EV and Tech ETF tracks companies in the EV and tech sectors, focusing on electric vehicles, batteries, and related technologies across 40+ countries. Solid-state batteries and ADAS technology are key industry trends, enhancing EV range, energy density, and safety. Risks include sustainable charging, safety, system failures, and infrastructure readiness; however, the global self-driving EV market is growing at 36% annually.

IDRV: Tariffs And Lack Of U.S. Tech Are Significant Drawbacks

iShares Self-Driving EV and Tech ETF is a hold due to challenges in the autonomous vehicle industry, lack of U.S. large tech companies, and risk of import tariffs. The Fund is globally diversified with even weights on U.S., European, and Asian companies, but lacks well-established U.S. large tech companies. Performance, expenses, and dividends of IDRV compared to peer funds show suboptimal returns despite a lower expense ratio and growing dividend yield.

Chinese Electric Vehicle Earnings Put These ETFs in Focus

EV makers like Nio, Xpeng and Tesla were among the most actively traded stocks on May 21. While upbeat earnings from Xpeng boosted the stock.