PayPal Holdings Inc. (PYPL)

Fintech Stocks are a Compelling Long-Term Bet for Sustainable Returns

Fintech gains momentum as StoneCo, Block and PayPal reshape payments, lending and banking, drawing investors to fast-growing digital finance platforms.

PayPal downgraded by BofA as branded checkout turnaround stalls

Bank of America on Thursday downgraded PayPal Holdings Inc (NASDAQ:PYPL, XETRA:2PP) to “Neutral,” warning that the company's effort to revive growth in its core branded checkout business is taking longer than expected and that 2026 is shaping up to be an investment-heavy year. Analysts said the firm is stepping to the sidelines until there is clearer evidence that PayPal's turnaround is gaining traction.

PayPal's Ecosystem Expansion: Will Partnerships Boost Profitability?

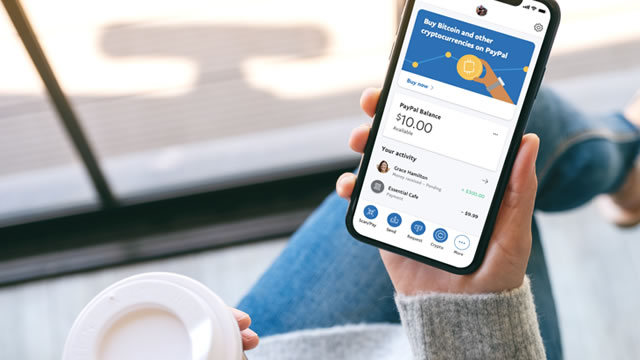

PYPL expands its ecosystem through new partnerships across major platforms to boost seamless commerce.

PayPal: Writing It Off Could Be A Grave Mistake (Rating Upgrade)

I double upgrade PayPal to a buy, citing overlooked long-term growth initiatives and a deeply discounted forward P/E near 11.5. PYPL is gaining traction in BNPL and Venmo, while innovating in agentic AI and optimizing legacy PSP for profitability. Despite sluggish near-term growth and FY2025 guidance, resilience in transaction activity and cash flow supports a constructive long-term view.

PayPal Holdings, Inc. (PYPL) Is a Trending Stock: Facts to Know Before Betting on It

Paypal (PYPL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

PayPal's Gloom Is Overdone: Prepare For The 2026 Comeback Story

PayPal Holdings, Inc. faces persistent headwinds in 2025, with consumer sentiments and competitive pressures weighing heavily on recovery prospects. Despite robust free cash flow ($6B–$7B) with a sticky consumer ecosystem, the market is dithering over mounting uncertainties. The market appears to be pricing in lower clarity through 2026 or later, as lower average order values and affordability concerns impact branded checkout growth.

PayPal's Branded Checkout & OpEx Concern: Will Growth be Affected?

PYPL flags softer Q4 branded checkout growth and rising 2026 OpEx as it pushes investments.

PayPal shares fall as CFO flags weaker holiday-quarter spending trends

PayPal Holdings Inc (NASDAQ:PYPL, XETRA:2PP) shares fell on Wednesday after the company's finance chief warned that consumers are continuing to trade down, dampening expectations for growth in the key holiday quarter. CFO Jamie Miller told the UBS tech conference that average order values remain under pressure and that fourth-quarter branded checkout growth is running “a couple points” slower than the third quarter, even as the company maintained its overall guidance.

PayPal Holdings, Inc. (PYPL) Presents at UBS Global Technology and AI Conference 2025 Transcript

PayPal Holdings, Inc. (PYPL) Presents at UBS Global Technology and AI Conference 2025 Transcript

PayPal Stock Drops. The CFO Delivers a Sobering Outlook.

The payments company expects its branded checkout service to grow more slowly in the fourth quarter. Other segments look brighter.

PayPal's Shift Is Accelerating

PayPal delivers $6.4B in operating cash flow and a 24.36% ROE, more than doubling the sector median profitability. Shares trade at just 11.5x forward earnings and 8.52x cash flow, both deeply discounted, versus sector and historical averages. Capital returns surged with $1.5B in Q3 buybacks and $5.7B over twelve months, plus a new $0.14 quarterly dividend.

PYPL Stock Down 27.5% YTD: Is it a Buying Opportunity or Time to Exit?

PayPal's sharp YTD slide contrasts with its push into next-gen commerce, AI, crypto and fast-growing Venmo, raising big questions for investors.