Snap-on Inc. (SNA)

Snap-On (SNA) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Snap-On (SNA) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

How Will Snap-On Stock React To Its Upcoming Earnings?

Snap-on (NYSE:SNA), a prominent American designer, manufacturer, and marketer of premium tools and equipment for the transportation sector, is set to report its earnings on Thursday, July 17, 2025. For traders focusing on events, evaluating the stock's historical performance in relation to earnings releases can offer useful insights.

Seeking Clues to Snap-On (SNA) Q2 Earnings? A Peek Into Wall Street Projections for Key Metrics

Get a deeper insight into the potential performance of Snap-On (SNA) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Snap-on Gears Up for Q2 Earnings: What Lies Ahead for the Stock?

SNA grapples with macro headwinds and cost inflation amid a slowdown in its Tools Group segment.

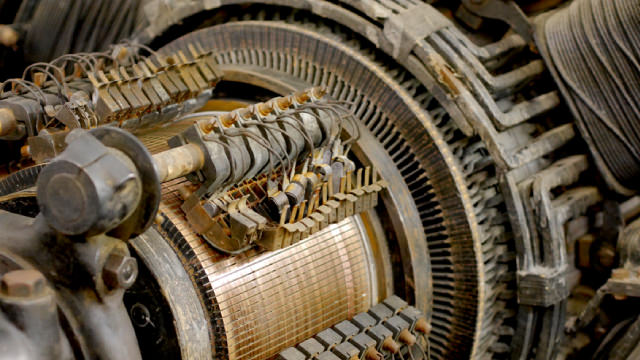

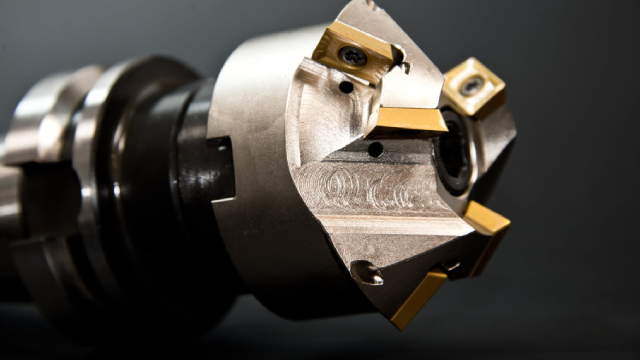

Snap-On: Margins Will Keep Expanding As Vehicles Become More Complex

As vehicles include more electronic components and become more complex, fixing them requires more diagnostic tools. Snap-on is the market leader in diagnostic computers, a segment with higher margins and growth rates. Unlike spanners and screwdrivers, diagnostic tools are sticky and harder to replace.

Don't Overlook Snap-On (SNA) International Revenue Trends While Assessing the Stock

Examine Snap-On's (SNA) international revenue patterns and their implications on Wall Street's forecasts and the prospective trajectory of the stock.

Snap-on Stock Dips 3.4% in a Month: Time to Buy or Red Flag?

SNA struggles with soft Q1 results and weak demand trends, casting doubt on its near-term growth prospects.

Snap-on: Buy This Must-Own Dividend Stock While It's Down

Snap-on NYSE: SNA certainly gave its investors a reason to sell when it released its Q1 earnings report in May 2025. However, despite the weaknesses, the report also highlights why this is a must-own stock.

Snap-on Incorporated (SNA) Q1 2025 Earnings Call Transcript

Snap-on Incorporated (NYSE:SNA ) Q1 2025 Earnings Conference Call April 18, 2025 10:00 AM ET Company Participants Sara Verbsky - VP, IR Nick Pinchuk - CEO Aldo Pagliari - CFO Conference Call Participants Scott Stember - Roth MKM David MacGregor - Longbow Research Gary Prestopino - Barrington Research Sherif El-Sabbahy - Bank of America Luke Junk - Baird Patrick Buckley - Jefferies Operator Good day and welcome to the Snap-on Incorporated 2025 First Quarter Results Conference Call. All participants will be in a listen-only mode.

Snap-on Q1 Earnings & Revenues Miss Estimates, Stock Declines 6%

SNA's Q1 results reflect sales and earnings decline amid economic uncertainty, with segmental softness particularly in the Tools Group.

Snap-on Stock Sinks as Toolmaker Attributes Soft Q1 Results to 'Uncertainty'

Shares of Snap-on (SNA) dropped sharply Thursday as its CEO attributed the toolmaker's weaker-than-expected results for the first quarter to "heightened macroeconomic uncertainty."

Snap-On (SNA) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for Snap-On (SNA) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.