Snap-on Inc. (SNA)

Snap-on to Report Q3 Earnings: How is the Stock Placed Ahead?

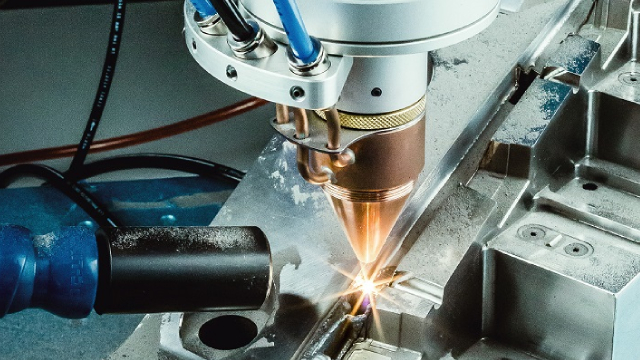

SNA's quarterly performance is likely to benefit from strategic initiatives such as enhancing the franchise network, cost-control efforts and increasing brand awareness.

What Analyst Projections for Key Metrics Reveal About Snap-On (SNA) Q3 Earnings

Evaluate the expected performance of Snap-On (SNA) for the quarter ended September 2024, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Snap-on's Growth Strategies & Business Model Aid: What's Next?

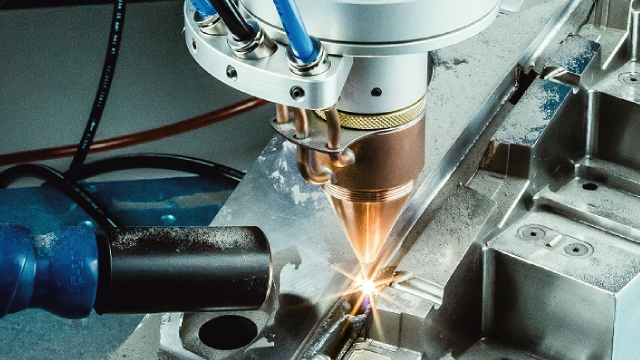

SNA's performance benefits from strategic initiatives such as enhancing the franchise network, cost-control efforts and increasing brand awareness.

SNA's Value-Creation & RCI Processes on Track: How to Play Ahead?

Snap-on witnesses business momentum driven by contributions from its Value-Creation plan, the RCI process and other cost-reduction initiatives.

Snap-On (SNA) Reliance on International Sales: What Investors Need to Know

Explore how Snap-On's (SNA) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

Snap-on (SNA) Q2 Earnings Miss Estimates, Organic Sales Decline

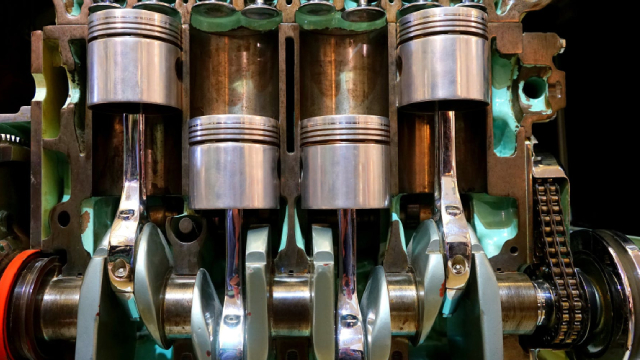

Snap-on's (SNA) Q2 results showcase a core value creation mechanism by making the task easier and more efficient across various industries and environments.

Compared to Estimates, Snap-On (SNA) Q2 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Snap-On (SNA) give a sense of how the business performed in the quarter ended June 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Snap-On (SNA) Q2 Earnings and Revenues Miss Estimates

Snap-On (SNA) came out with quarterly earnings of $4.91 per share, missing the Zacks Consensus Estimate of $4.94 per share. This compares to earnings of $4.89 per share a year ago.

Snap-On: A Good Company, But Wait For A Better Entry Point

Snap-on Incorporated is a high-quality company with strong dividend growth, but currently lacks value for investors. Recent earnings results show mixed performance, with revenue unchanged but earnings-per-share improving. The company has a solid track record of dividend growth, but the current valuation may make it slightly overvalued for potential investors.

Snap-on (SNA) to Post Q2 Earnings: What Should You Know?

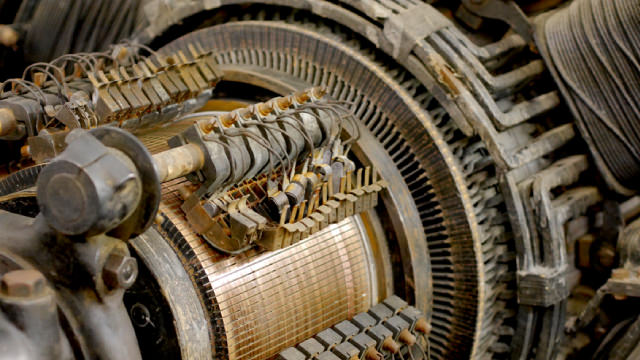

Snap-on's (SNA) Q2 results are expected to reflect continued gains from the RCI process, the Value Creation plan and innovation amid challenging macroeconomic conditions.

Snap-on's (SNA) Strategies & Business Model Aid: Apt to Retain?

Snap-on's (SNA) performance benefits from strategic initiatives such as enhancing the franchise network, cost-control efforts and increasing brand awareness.

Why Snap-On (SNA) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.