Stock Market & Financial News

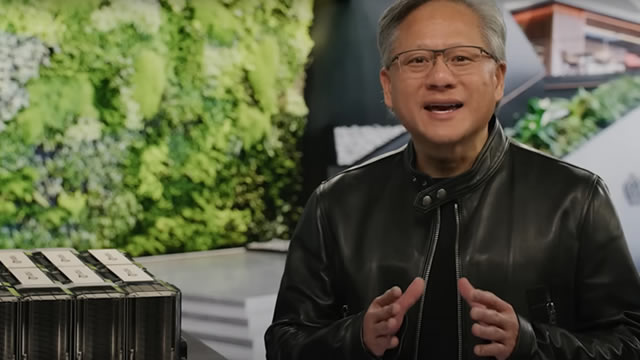

How Nvidia Grew Data Center Market Share In Q3

Nvidia (NVDA) surpassed 50% share of the data center equipment market in fiscal 2026 Q3, driven by dominance in rack-scale AI accelerators. NVDA's Data Center revenue grew 66% y/y to over $51 billion, fueled by unmatched scale-up networking and limited effective competition. Competitors like AMD and UA Link consortium lag in delivering high-performance scale-up switches, reinforcing NVDA's leadership and pricing power.

Is Scancell nearing 'significant value crystallisation point'?

There's been an odd reaction to some encouraging news from Scancell Holdings PLC (AIM:SCLP, OTC:SCNLF), with the shares barely flickering this week. The company updated the market with more supportive data from a trial of its drug for people with hard-to-treat melanoma, a common skin cancer.

Reddit Sues Australian Government Over Social-Media Ban for Under-16s

The company said the law infringes on teenagers' freedom of political discourse, adding any reduction in risk of harm would be minimal at best.

Instacart's AI pricing experiment drives up costs for some shoppers, study says

Instacart's AI-pricing experiments can charge customers up to 23% more for identical products, potentially costing families $1,200 extra annually through hidden markups.

Disney will open up its toy chest of 200+ characters for AI creators in a $1 billion deal with OpenAI

Mickey Mouse, welcome to the AI era.

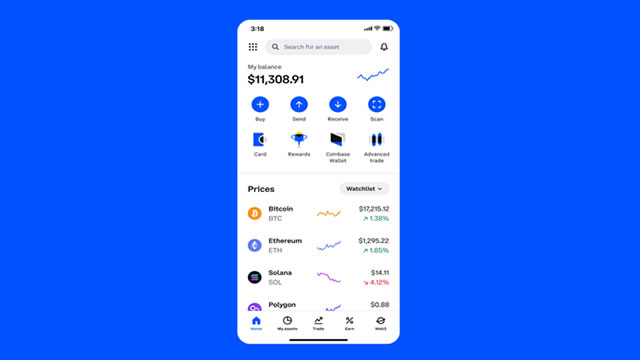

Coinbase Sentiment Hits Rock Bottom as Bitcoin Correlation Crushes Options Traders

Shares of Coinbase (NASDAQ:COIN) closed at $275.09 on December 10 as retail investor sentiment on Reddit remains deeply negative.

EdgeMode Announces Strategic Portfolio Review and Advancement of AI Data Center Development Pipeline in Spain

Company advances a 1.5GW AI-ready data center pipeline in Spain as board-led actions target rescission of a legacy deal, major dilution reduction, and enhanced governance stability Takeaways: FORT LAUDERDALE, Fla., Dec. 12, 2025 – PRISM MediaWire (Press Release Service – Press Release Distribution) – EdgeMode, Inc.

IonQ Vs. Rigetti: The Quantum Pair Trade Hiding In Plain Sight

IonQ and Rigetti present a compelling long/short pair trade due to stark divergences in technology, commercial traction, and capital requirements. IONQ's 99.99% two-qubit fidelity and scalable manufacturing position it far ahead of RGTI, whose roadmap faces significant technical and capex hurdles. IONQ's revenue scale, recurring contracts, and 18% cash-to-market cap ratio contrast sharply with RGTI's grant-driven revenues and only 6.5% cash coverage.

BigBear.ai vs. SoundHound: Which AI Stock Is the Better Buy Now?

The artificial intelligence investment boom has pushed capital far beyond mega-cap leaders into smaller, higher-risk AI specialists with the potential for outsized returns. Among these emerging names, BigBear.ai Holdings BBAI and SoundHound AI SOUN have drawn growing investor attention.

Forget Nvidia: Alphabet Is the New Hot Chip Stock to Own, Apparently

Alphabet (NASDAQ:GOOG) could be among the most-watched mega-cap tech stocks in the market right now.

Fintech Stocks are a Compelling Long-Term Bet for Sustainable Returns

Fintech gains momentum as StoneCo, Block and PayPal reshape payments, lending and banking, drawing investors to fast-growing digital finance platforms.

Mid-Cap ETFs in High Momentum Now: More Rally Ahead?

Mid-cap momentum is building up as investors seek a balance between shaky large caps and volatile small caps. These ETFs -- FNX, MDYV, MDY, IJH & IWR -- are climbing.

Will SoFi Technologies (SOFI) Stock Hit $50 in 2026?

Anthony Noto, the CEO of fintech firm SoFi Technologies (NASDAQ:SOFI), envisions scaling SoFi into a trillion-dollar company.

QYLD: You Can Hold For The Income But It Won't Outperform It's Peers

Global X Covered Call ETF (QYLD) delivers reliable double-digit income but lags peers in total return and capital appreciation. QYLD's strategy of selling covered calls systematically caps upside, making recovery after market downturns difficult and limiting long-term capital growth. Competing ETFs like QQQI and GPIQ now offer higher yields and better appreciation, eroding QYLD's market share and appeal.

Lululemon: No Longer A Value Trap (Rating Upgrade)

I upgrade my rating on lululemon athletica after an improvement in sentiment driven by signs of international growth offsetting U.S. headwinds and the CEO departure. After Q3 2025, the Americas segment is still weak: revenue -2% yoy, US -3%, with traffic pulling back post-Thanksgiving, and any improvement possibly is now delayed to Q1 2026. International revenue was up 33% yoy, driven by China Mainland +46%. FY25 China guidance was upgraded to "at or better than" the high end of the 20%–25% range.

Tilray and Canopy Growth Stocks Surge on Reports Trump to Loosen Marijuana Restrictions

The reclassification of the drug would alleviate tax burdens on cannabis companies.

Costco posts strong Q1 results as digital sales surge

Costco Wholesale Corporation (NASDAQ:COST, XETRA:CTO) reported an 8% rise in first-quarter revenue on Thursday aftermarket, lifted by robust digital engagement and steady traffic, while membership fees climbed and the retailer continued to aggressively expand its warehouse footprint. Revenue for the quarter ended November 24 rose to $67.3 billion, topping analysts' estimates by about $200 million.

Four Corners Takes Over a Jiffy Lube Property, Expands Portfolio

FCPT boosts its portfolio with a $2.7M Jiffy Lube acquisition, adding long-term leased, auto-focused real estate in a strong retail corridor in Colorado.

Air Products And Chemicals: De-Risking Moves Support A Re-Rating

Despite a flat EPS, underlying performance held up, and guidance for 2026 exceeded expectations, helped by cost discipline and a healthier earnings trajectory. Progress with Yara on both Louisiana and NEOM provides clearer offtake visibility, strengthens project economics, and helps address commercial risks that previously weighed on sentiment. With EPS growth poised to accelerate (+7–9% in FY26) and CAPEX trending lower, we remain buyers.

NVDA, INTC and AMD Forecast – Chips Looking for Momentum After Broadcom Concerns

Semiconductor stocks show mixed but constructive action into Friday, with Nvidia consolidating, Intel supported on pullbacks, and AMD stabilizing despite cautious AI guidance. Overall momentum favors buying dips across the group.

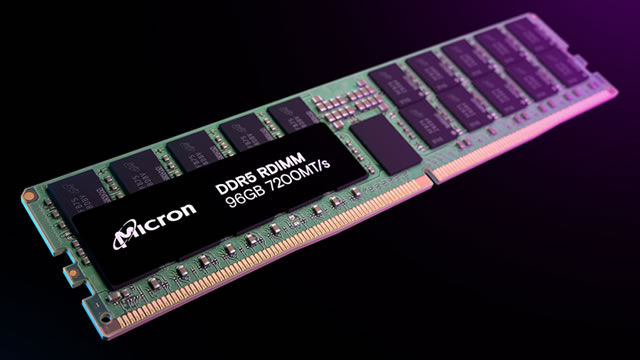

Should You Add Micron Stock to Your Portfolio Ahead of Q1 Earnings?

MU eyes strong Q1 gains as AI-driven memory demand, better pricing and new chip ramps set the stage for a robust earnings update.

Here's Why Investors Should Keep an Eye on KMI, EPD, WMB Stocks

Midstream players like Kinder Morgan, Enterprise Products and Williams offer predictable, fee-based cash flows, even as oil and gas prices fluctuate.

Rivian Post Autonomy & AI Day: Is the Stock Worth Buying Now?

RIVN highlights new autonomy chips, LiDAR plans and an AI assistant as it eyes long-term gains despite cash burn and trimmed guidance.

Fastly: SaaS Play With Breakout Potential In 2026

Fastly, Inc. delivered strong Q3 results, exceeding expectations on revenue, margins, and free cash flow, with a robust (raised) full-year outlook. The Saas firm achieved its third consecutive quarter of free cash flow in Q3'25 and is on track for its first full year of positive FCF. Strong margin momentum and RPO growth continue to support a strong buy rating for Fastly as we are heading into 2026.

The Best Way To Invest In Data Centers: Blue Owl Capital

Data center REITs have problems. Valuations are high, maintenance capex is often understated, and overbuilding and potential obsolescence are significant risks. For these reasons, our Top Pick in this sector is not a traditional landlord, but rather an alternative asset manager enjoying rapid growth.

AbbVie Slipped Below 50-Day SMA Last Week: How to Play the Stock

AbbVie dips below its 50-day SMA, but strong immunology momentum and a resilient long-term trend keep the story compelling.

Grab These 4 Stocks With Solid Net Profit Margin to Enhance Returns

TILE, RSSS, NRIM and DAVE boast strong net margins, rising earnings and bullish analyst ratings that signal upside.

Best Growth Stocks to Buy for December 12th

SANM, GLDD and ALRM made it to the Zacks Rank #1 (Strong Buy) growth stocks list on December 12, 2025.

Will Ford's Leaner EV Approach Give It a Stronger Foothold in Europe?

Ford's tie-up with Renault aims to revive its Europe EV push with affordable models built on Ampere tech and produced in France.

Huge Insider Buying in MGM and Salesforce

As the year begins to wind down, investors are looking to position themselves for 2026.