Advanced Micro Devices, Inc. (0QZD)

Summary

0QZD Chart

Advanced Micro Devices (NASDAQ: AMD) Price Prediction and Forecast 2025-2030 (December 2025)

Shares of Advanced Micro Devices ( NASDAQ:AMD ) lost 12.69% over the past month after slipping 4.27% the month prior.

Which Stock To Rally Next: Micron Or AMD?

Advanced Micro Devices experienced a decline of -5.3% over the previous day. You might feel inclined to acquire more shares, or you may consider reducing your investment.

Loss-making Chinese AI chipmaker founded by ex-AMD employees surges eightfold in debut

At 50 times price to sales, MetaX looks expensive but investor demand focused on China's determination to build national champions in the tech sector

Advanced Micro Devices, Inc. (0QZD) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Advanced Micro Devices, Inc. ever had a stock split?

Advanced Micro Devices, Inc. Profile

| Semiconductors & Semiconductor Equipment Industry | Information Technology Sector | Lisa T. Su CEO | LSE Exchange | US0079031078 ISIN |

| US Country | 28,000 Employees | - Last Dividend | 22 Aug 2000 Last Split | 15 Oct 1979 IPO Date |

Overview

Advanced Micro Devices, Inc. (AMD) stands as a global semiconductor company, distinguishing itself through its operations across several key sectors: Data Center, Client, Gaming, and Embedded. With a comprehensive portfolio that includes x86 microprocessors, graphics processing units (GPUs), system-on-chip (SoC) solutions, and an array of development services and technologies, AMD caters to a diverse clientele. This includes original equipment and design manufacturers, public cloud service providers, and independent distributors. Since its incorporation in 1969, AMD has established its headquarters in Santa Clara, California, reflecting the company’s enduring commitment to innovation and excellence in the semiconductor industry.

Products and Services

AMD’s expansive product line is designed to meet the increasing demands of modern technology applications, ranging from consumer computing to professional data centers. Here is an overview of its key offerings:

- x86 Microprocessors: AMD provides a spectrum of x86 microprocessors under various branding, including the high-performance AMD Ryzen and Ryzen Threadripper series, AMD Athlon for more budget-conscious solutions, and specialized AMD PRO A-Series for professional applications.

- Graphics Processing Units (GPUs): The company manufactures GPUs for consumer gaming, professional workstations, and data centers. These are marketed under the AMD Radeon and Radeon Pro brands, offering exceptional graphics performance and efficiency.

- Accelerated Processing Units (APU): Combining x86 CPU cores with integrated GPUs, APUs deliver efficient performance for sleek consumer electronics and small form factor devices.

- Embedded Processors and Semi-Custom SoC Products: Tailoring solutions for specific customer needs, AMD develops embedded processors and semi-custom SoC products for a wide range of applications, including gaming consoles and industrial systems.

- Data Center GPUs: Under the Radeon Instinct and Radeon PRO V-series, AMD provides GPUs optimized for data center deployments, enhancing computational power in workloads such as machine learning and high-performance computing.

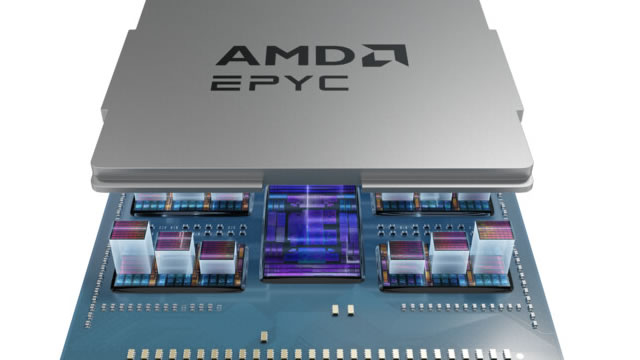

- Server Microprocessors: The AMD EPYC series offers server microprocessors with exceptional scalability, performance, and security features for modern datacenters.

- Field Programmable Gate Arrays (FPGA) and Adaptive SoCs: AMD provides FPGA products under several brandings, such as Virtex, Kintex, and Artix, and adaptive SoCs like Zynq and Versal series, catering to customizable computing needs across industries.

- Compute and Network Acceleration: Products like the Alveo brand of acceleration boards facilitate increased performance in computing and networking functions within data centers and other computing environments.

AMD serves its varied product portfolio to a global clientele through a composite of direct sales forces and sales representatives, highlighting the company's wide-reaching impact on modern computing, gaming, data centers, and embedded technologies.