Airbnb, Inc. (ABNB)

3 Quality Stocks to Buy That Fell 5% in a Single Day

Recent volatility in the stock markets has allowed investors to buy discounted quality stocks you couldn't find earlier in 2024. For example, the S&P 500 lost 8.5% from its 52-week high of 5,669.67 in mid-July to its Aug. 5 closing price of 5,186.33.

This Former Top Growth Stock to Buy Is Still Undervalued

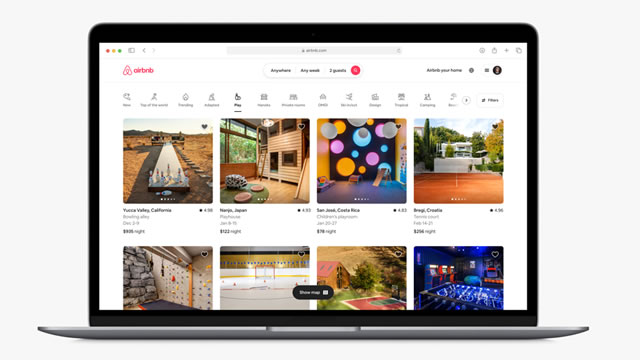

Airbnb is becoming the go-to destination for travelers worldwide.

3 Tech Stocks to Dump After Disappointing Q2 Earnings

The trade in technology stocks is getting more difficult. The mega-cap tech names known collectively as the “Magnificent Seven” lost a combined $1 trillion of value amid the global market rout that occurred on August 5.

3 Stocks to Sell Amid Slowing Consumer Spending

After enduring a long period of high inflation and elevated interest rates, many U.S. consumers are feeling some pain, multiple data points strongly suggest. According to Axios, credit card delinquency rates rose 1.8 percentage points versus this time last year to 7.2%, and 8% of auto loans were delinquent at the end of Q2, representing a year-over-year increase of 0.7 percentage points.

Airbnb: Why It's Still Worth Catching The Falling Knife Now (Upgrade)

Airbnb investors who ignored overvaluation risks were hammered. Airbnb's growth story is showing cracks, but there are no real reasons to sell in a panic. Airbnb's growth inflection could take longer than expected. However, it's also not standing still. I will explain why.

Airbnb's Stock Nears Death Cross: Is The Vacation Over For Investors?

Airbnb Inc ABNB is facing a rough patch as it nears a Death Cross, a bearish technical signal that has traders concerned. Following a disappointing earnings report, Airbnb's stock has been on a downward spiral, raising questions about its immediate future.

Taco Bell and Airbnb Reveal This About Consumer Spending. Watch These Stocks.

Walt Disney and Airbnb reports suggest consumer are pulling back on big-ticket items but there are still companies winning on value.

Airbnb Stock Crashes on Weak Guidance

Is the Airbnb thesis broken or is the market overreacting?

Airbnb long-term catalysts remain strong amid international expansion and monetization efforts: analysts

Analysts at Wedbush continue to see long-term growth potential for Airbnb Inc (NASDAQ:ABNB, ETR:6Z1) amid the emergence of negative travel data points and as the alternative accommodation provider issued a cautious outlook for the third quarter. Shares of Airbnb tumbled almost 15% at $111 on Wednesday as its Q3 revenue guidance missed Street estimates and warned it was seeing some signs of slowing demand in the US.

Airbnb's stock is on pace for its biggest percentage drop ever. Here's how some analysts think the company can rebound.

Airbnb Inc. was among the S&P 500's worst performers on Wednesday and was on track for its biggest percentage drop on record after the vacation-rental platform a day earlier said it saw “some signs of slowing demand from U.S. guests” and “shorter booking lead times.”

Airbnb (ABNB) Q2 Earnings Miss Estimates, Revenues Up Y/Y

Airbnb's (ABNB) second-quarter 2024 results benefit from continuous improvement in Nights and Experiences Booked and growing GBV.

Airbnb Invests 'For Growth While Consumer Slows'; 6 Analysts Cut Forecasts After Q2 Results

Airbnb Inc ABNB shares tanked in early trading on Wednesday, after the company reported downbeat second-quarter earnings.