Archer Aviation Inc. (ACHR)

Why Archer Aviation Stock Is Soaring—And What Comes Next

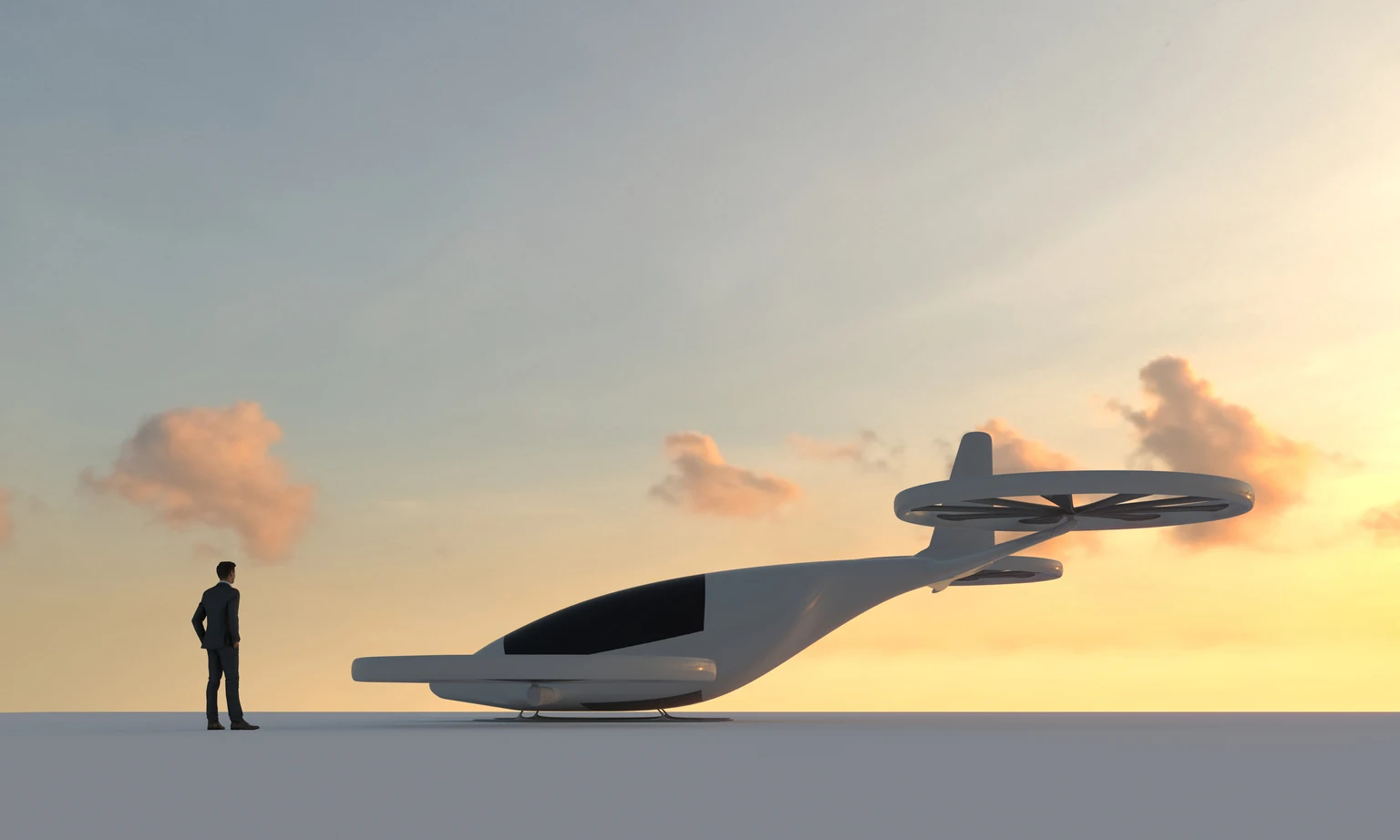

A surge of market excitement has recently propelled Archer Aviation NYSE: ACHR onto multiple retail investor trading watchlists. The electric vertical takeoff and landing (eVTOL) developer's stock price has climbed dramatically, posting a gain of over 51% as of early October 2025.

How ACHR Stock Rises 10x To $150?

Archer Aviation (NYSE: ACHR) isn't just another aviation stock—it's positioning itself at the epicenter of what could be the most transformative shift in urban transportation since the automobile. With six Midnight aircraft currently in production and three in final assembly across facilities in California and Georgia, the company is steadily progressing toward commercial launch as investors begin to recognize the magnitude of the opportunity.

What Moved Markets This Week

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

Archer Aviation: Scaling Production Among Notable Steps Towards Commercialization

Archer Aviation remains a compelling buy despite recent volatility, underpinned by strong liquidity, operational milestones, and a $6 billion order book. ACHR's Q2 losses and high R&D expenses reflect aggressive progress toward FAA certification and manufacturing ramp-up, not fundamental weakness. Key catalysts include a $500M Osaka deal, U.S. regulatory tailwinds, and strategic defense acquisitions positioning ACHR for long-term growth.

Archer Aviation: Takeoff Is Imminent (Rating Upgrade)

Archer Aviation Inc. is upgraded to a Buy as commercialization nears, with strong production progress and supportive U.S. policy tailwinds. ACHR's technological milestones, including record-breaking Midnight aircraft flights, reinforce its leadership and readiness for commercial deployment. Despite recent shareholder dilution, ACHR's cash position is robust, and further dilution risk is low as revenue generation approaches.

Archer Aviation: Flying Under The Market's Radar

Archer's $1.7B liquidity provides runway to fund FAA certification, UAE commercialization, and a scale-up toward 50+ annual aircraft by 2026. FAA Type Inspection Authorization and U.S. eIPP trial flights set the stage for commercial service launches beginning in late 2025. Osaka partnership with Soracle, JAL, and Sumitomo integrates Midnight into Japan's urban mobility ecosystem ahead of Expo 2025 and future Asian expansion.

ACHR or EVEX: Which eVTOL Stock Holds More Upside in 2025?

ACHR and EVEX are racing ahead in the eVTOL market, with big partnerships, new milestones, and investor interest fueling 2025 momentum.

Archer Aviation Inc. (ACHR) Declines More Than Market: Some Information for Investors

Archer Aviation Inc. (ACHR) reached $9 at the closing of the latest trading day, reflecting a -1.21% change compared to its last close.

Archer Aviation to Join eVTOL Pilot Program: How to Play the Stock?

ACHR plans to join White House eVTOL pilot program with its Midnight aircraft, but investor caution grows amid stock struggles and lawsuits.

Forget the eVTOL Pilot Program Buzz, Here Is Archer Aviation's Real Flight Path to Massive Gains

Electric vertical takeoff and landing (eVTOL) aircraft pioneer Archer Aviation ( NYSE:ACHR ) popped 4.2% on Monday, closing above $9 per share again.

Is Archer Aviation Stock A Sleeper Hit In The Flying Car Wars?

Archer Aviation offers a differentiated eVTOL strategy with global partnerships, early overseas sales, and a strong defense angle for long-term upside. Despite heavy cash burn and pre-revenue status, Archer's $1.7B liquidity and strategic partnerships provide a sector-leading financial cushion and execution runway. Key milestones include UAE deployments, a record-setting test flight, and official air taxi provider status for the 2028 LA Olympics, driving visibility and credibility.

Archer Aviation Takes Flight (Rating Downgrade)

Archer Aviation has built a strong liquidity runway, raising $1.1 billion and ending Q2 with $1.724 billion in cash. Key milestones include the first piloted Midnight eVTOL flight, strategic defense acquisitions, and progress in international regulatory alliances. I see Archer as fairly valued with a price target of $9.44–$13.26, reflecting both industry multiples and potential upside.