Adobe Inc. (ADBE)

Adobe: SaaS Leader At A Great Price

Adobe's strong financials and efficient operations position it for continued growth, despite recent share sell-offs. Fiscal year 2024 Q4 results exceeded expectations, but shares declined due to lowered guidance and concerns about AI investments paying off. Adobe's valuation is attractive, trading below historical averages, and potential returns could be double digits if growth targets are met.

Adobe: Will Text-To-Image Disrupt Adobe's Business Model?

Adobe's FY2024 saw strong financial performance with revenue up 11%, adjusted EBIT up 16%, and adjusted EPS up 25%. Yet, the stock price dropped 27% over the past year. The disruption from AI-driven text-to-image/video tools impacts the lower-end segment of the content creation market, but Adobe's position in the high-end market remains resilient due to customization needs. AI integration in Adobe's core products in Document Cloud, including AI Assistant and Generative Summary, entrenches its dominant market position and competitive advantage.

Adobe: Our Top Idea For 2025 Now Trading At A 30% Discount To SaaS Peers

Adobe, trading at 21.6x forward earnings, trades inline with the S&P 500 despite better growth and a superior business model. Microsoft and Salesforce trade at over 30x forward earnings, despite similar growth expectations for all three names in 2025. Adobe's Q4 results were solid with 11% YoY revenue growth, record Digital Media ARR, and strong EPS growth, despite market concerns. 2025 guidance was slightly below expectations, but Adobe's recurring revenue, pricing power, and AI advancements support continued growth and potential upside.

Adobe Stock Slips 20% in a Week: Should You Brace for a Tough 2025?

ADBE shares are benefiting from strong demand for its creative products and expanding clientele amid increasing competition and stretched valuation.

Down 22%, Here's How Adobe Could Follow in Salesforce's Footsteps to Become a Strong Buy in 2025

With just a few weeks left in the year, the tech sector is shaping up to, once again, beat the S&P 500 (^GSPC -0.39%) largely thanks to gains from Nvidia and Broadcom in the semiconductor industry. The software industry also makes up a large share of the tech sector but has enjoyed mixed results on the year.

3 Growth Stocks Down 21%, 22%, and 28% to Buy in December

This has been a phenomenal year for the broader indexes. But there are still plenty of opportunities for scooping up shares of out-of-favor stocks at compelling valuations.

Adobe Inc. (ADBE) is Attracting Investor Attention: Here is What You Should Know

Adobe (ADBE) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why Is Adobe Stock Down 15%?

Adobe stock has seen a 15% fall in a week after the company reported its Q4 results for fiscal 2024. Although the top and bottom-line figures were ahead of the street estimates, its fiscal 2025 guidance was underwhelming.

Down Over 13% in a Single Day, Is This Megacap Growth Stock Worth Buying in December?

Many tech stocks had epic runs in 2023 and have sustained the momentum this year. But not Adobe (ADBE -0.89%).

Unlocking Adobe (ADBE) International Revenues: Trends, Surprises, and Prospects

Examine the evolution of Adobe's (ADBE) overseas revenue trends and their effects on Wall Street's forecasts and the stock's prospects.

Making the Case For & Against Adobe

Jackson Adar of KeyBanc and Derek Yan of KraneShares break down the pros & cons of Adobe, with investors concerned it's not yet seeing major gains from AI.

Adobe Shares Sink Despite Record Revenue. Should Investors Buy the Stock on the Dip?

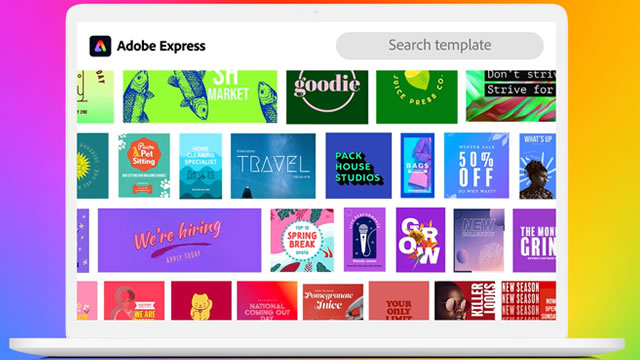

Despite posting record revenue to close out its fiscal year ended Nov. 29, shares of Adobe (ADBE -1.88%) were sinking as investors were disappointed with the company's guidance. Adobe has been at the forefront of generative artificial intelligence (AI) with both its Creative Cloud suite of products that includes Photoshop, and with its Document Cloud business featuring Acrobat.