Agnico Eagle Mines Limited (AEM)

Why Investors Need to Take Advantage of These 2 Basic Materials Stocks Now

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

One Of The Biggest Investment Opportunities Wall Street Overlooks

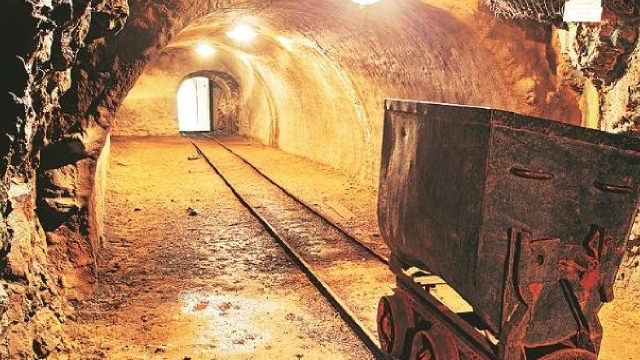

Gold is booming, but the real story isn't macro. It's a supply crisis. Flat output, falling ore grades, and soaring costs are the real game-changers. Despite record margins, miners aren't boosting output. Labor issues, energy costs, and geopolitics are crushing growth, even as prices surge. I'm doubling down on low-cost miners in safe regions and looking beyond mining for high-margin royalty plays. Gold's uptrend may just be starting.

AEM's Key Growth Projects on Track: Will Execution Fuel the Future?

AEM's major gold projects are advancing on schedule, defining a new wave of low-cost, long-life production.

5 Top-Ranked Gold Mining Stocks Amid Strong Central Bank Purchases

FNV, RGLD, KGC, AU, and AEM are surging as strong gold prices and central bank buying fuel bullish mining stock momentum.

Here is What to Know Beyond Why Agnico Eagle Mines Limited (AEM) is a Trending Stock

Agnico (AEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

5 Dividend Growth Stocks for a Safe & Income-Driven Portfolio

AEM, UGI, QFIN, TSM and GPI stand out as top dividend growth picks for building a safer, income-focused portfolio in 2025.

Why Agnico Eagle Mines (AEM) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

AEM Stock Rallies 40% in 6 Months: Should You Buy the Stock Now?

AEM stock surges 40% in six months on gold price gains and strong earnings, with more growth expected driven by key projects.

Gold Stock May Have Antoher Shot at Record Highs

Gold mining stock Agnico Eagle Mines Ltd (NYSE:AEM) is up 1.3% at $117.65 at last glance, brushing off a stronger U.S. dollar as investors favor the greenback amid President Donald Trump's latest tariff threats.

Looking for a Growth Stock? 3 Reasons Why Agnico (AEM) is a Solid Choice

Agnico (AEM) possesses solid growth attributes, which could help it handily outperform the market.

Wall Street Bulls Look Optimistic About Agnico (AEM): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Agnico Eagle: Top Buy And Hold Miner As Gold Rises With Monetary Volatility

Agnico Eagle Mines stands out for its low costs and operational stability, primarily due to its focus on developed countries like Canada and Finland. AEM's profitability is poised to expand significantly as long as gold prices, output, and costs remain stable, with margins that are well above those of its peers. Despite gold's recent surge, I see AEM as attractively valued, trading at a reasonable multiple relative to its robust adjusted income.