American Electric Power Company, Inc. (AEP)

American Electric Power (AEP) Q4 Earnings Match Estimates

American Electric Power (AEP) came out with quarterly earnings of $1.24 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $1.23 per share a year ago.

Sleep Like A King, Earn Like A Pro: 2 Big Dividend Ideas For Income And Wealth

I once thought holding cash for a market crash was smart, but waiting for crashes is a risky game. Inflation devalues cash much faster than investing. Market timing is tough. Predicting corrections consistently is nearly impossible, and staying invested can prevent the damage inflation causes to your purchasing power. Instead of waiting for the "perfect" moment, I focus on consistent investing in resilient infrastructure and public real estate that outperforms the market.

Insights Into AEP (AEP) Q4: Wall Street Projections for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for AEP (AEP), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended December 2024.

American Electric Power to Post Q4 Earnings: What's in Store?

AEP's Q4 results are likely to be hurt by the warmer weather pattern. Yet, higher transmission revenues are likely to have bolstered the overall performance.

American Electric Power (AEP) Reports Next Week: Wall Street Expects Earnings Growth

AEP (AEP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

DeepSeek: Why REITs And Utilities Loved The News

The market reacted strongly to the unveiling of China's AI, DeepSeek, with AI stocks plummeting and REITs and utilities trading up significantly. Investors are shifting towards predictable returns from REITs and regulated utilities, which offer 8%-10% expected returns, amid uncertainties surrounding AI's future profitability. The DeepSeek news has made the steady cashflows of REITs and utilities more attractive as the allure of AI's unbridled growth diminishes.

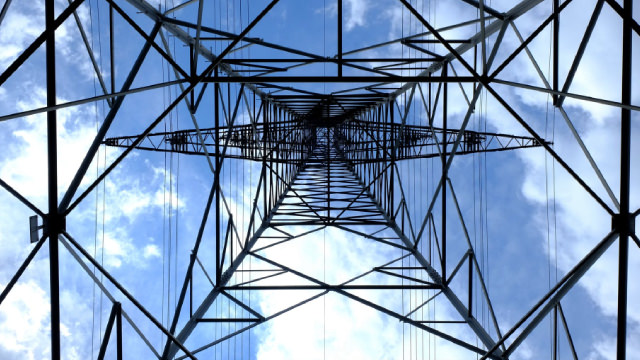

American Electric Power: Charge Up Your Portfolio With Durable Assets

American Electric Power offers a solid investment with a 3.8% dividend yield and a strong track record of shareholder returns and financial management. Management targets 6-8% annual EPS growth starting in 2026, driven by a $54 billion capital investment plan and operational efficiencies. AEP's new CEO is committed to optimizing the company structure, aiming for improved performance and strategic growth in regulated utilities and renewable energy.

Will AEP (AEP) Beat Estimates Again in Its Next Earnings Report?

AEP (AEP) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Why Investors Need to Take Advantage of These 2 Utilities Stocks Now

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

American Electric Power Is Attractive Going Forward, Analyst Double-Upgrades Stock

BofA Securities analyst Ross Fowler upgraded the shares of American Electric Power Company Inc AEP from Underperform to Buy and raised the price target from $98 to $104.

My Top 10 Utilities For 2025

Long-term rates have risen, creating potential buying opportunities for utilities like AEP, AWK, AWR, BKH, ES, EVRG, SJW, WEC, WTRG, and XEL. These utilities have strong fundamentals, attractive valuations, and investment-grade balance sheets, offering potential total returns of 20% to 56% by 2025. Despite rate sensitivity, these utilities are well-positioned for long-term growth with secure dividends and robust balance sheets.

AEP Stock Rides on Investments & Renewable Portfolio Expansion

AEP continues to benefit from its systematic investment plan and renewable portfolio expansion initiatives.