AerCap Holdings N.V. (AER)

Aercap Holdings N.V. (AER) Hit a 52 Week High, Can the Run Continue?

AerCap (AER) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Are Transportation Stocks Lagging Aercap (AER) This Year?

Here is how AerCap (AER) and Seacor Marine (SMHI) have performed compared to their sector so far this year.

AER or WAB: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Transportation - Equipment and Leasing sector might want to consider either AerCap (AER) or Westinghouse Air Brake Technologies (WAB). But which of these two stocks is more attractive to value investors?

Is Aercap (AER) Stock Outpacing Its Transportation Peers This Year?

Here is how AerCap (AER) and A.P. Moller-Maersk (AMKBY) have performed compared to their sector so far this year.

AER vs. WAB: Which Stock Is the Better Value Option?

Investors interested in stocks from the Transportation - Equipment and Leasing sector have probably already heard of AerCap (AER) and Westinghouse Air Brake Technologies (WAB). But which of these two companies is the best option for those looking for undervalued stocks?

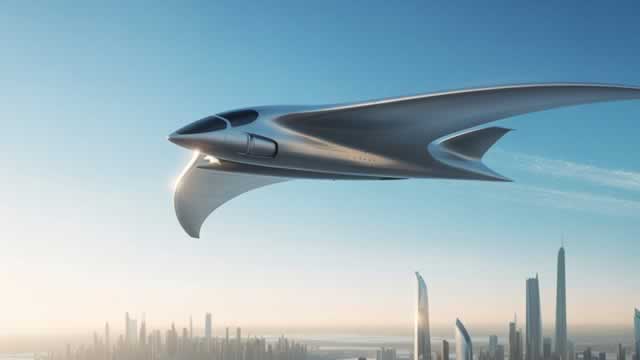

AerCap Stock Still Has Room To Fly Higher

AerCap delivered strong Q3 results, raising full-year guidance on robust lease revenue growth and significant gains on asset sales. AER's liquidity coverage improved, with prudent cash management and lower average debt costs, supporting ongoing capital expenditures and debt maturities. Despite trading above book value, AER's asset base remains undervalued, and share repurchases continue to add value given asset sale premiums.

Aercap Holdings N.V. (AER) Hits Fresh High: Is There Still Room to Run?

AerCap (AER) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

AerCap Holdings N.V. (AER) Q3 2025 Earnings Call Transcript

AerCap Holdings N.V. ( AER ) Q3 2025 Earnings Call October 29, 2025 8:30 AM EDT Company Participants Joseph McGinley - Head of Investor Relations Aengus Kelly - CEO & Executive Director Peter Juhas - Chief Financial Officer Conference Call Participants Moshe Orenbuch - TD Cowen, Research Division Jamie Baker - JPMorgan Chase & Co, Research Division Hillary Cacanando - Deutsche Bank AG, Research Division Catherine O'Brien - Goldman Sachs Group, Inc., Research Division Ronald Epstein - BofA Securities, Research Division Terry Ma - Barclays Bank PLC, Research Division Christopher Stathoulopoulos - Susquehanna Financial Group, LLLP, Research Division Presentation Operator Good day, and welcome to AerCap's Q3 2025 Financial Results.

AerCap (AER) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for AerCap (AER) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

AerCap (AER) Q3 Earnings and Revenues Surpass Estimates

AerCap (AER) came out with quarterly earnings of $4.97 per share, beating the Zacks Consensus Estimate of $3.16 per share. This compares to earnings of $2.41 per share a year ago.

Is Aercap (AER) Outperforming Other Transportation Stocks This Year?

Here is how AerCap (AER) and A.P. Moller-Maersk (AMKBY) have performed compared to their sector so far this year.

Will AerCap (AER) Beat Estimates Again in Its Next Earnings Report?

AerCap (AER) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.