Applied Materials Inc. (AMAT)

Summary

AMAT Chart

Applied Materials: Upgrading To Buy Amid AI And Semiconductor Tailwinds

Applied Materials faces headwinds from reduced China exposure and cyclical weakness in key segments, tempering recent growth. 2026 is expected to favor AMAT's strengths, with leading-edge foundry/logic, DRAM, and advanced packaging driving anticipated growth. Valuation appears stretched; reverse DCF implies aggressive 23.9% FCF growth needed to justify the current price.

The Chip Equipment Maker That Quietly Turned $1,000 Into $11,280 in a Decade

Applied Materials has been one of the semiconductor industry's quietest success stories.

AMAT Gains From Traction in WFE Products: A Sign of More Upside?

Applied Materials sees rising demand for WFE tied to AI and HPC, with strength in leading-edge nodes and DRAM, though China restrictions remain a headwind.

Applied Materials Inc. (AMAT) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Applied Materials Inc. ever had a stock split?

Applied Materials Inc. Profile

| Semiconductors & Semiconductor Equipment Industry | Information Technology Sector | Gary E. Dickerson CEO | XWBO Exchange | US0382221051 ISIN |

| US Country | 36,000 Employees | 19 Feb 2026 Last Dividend | 17 Apr 2002 Last Split | 5 Oct 1972 IPO Date |

Overview

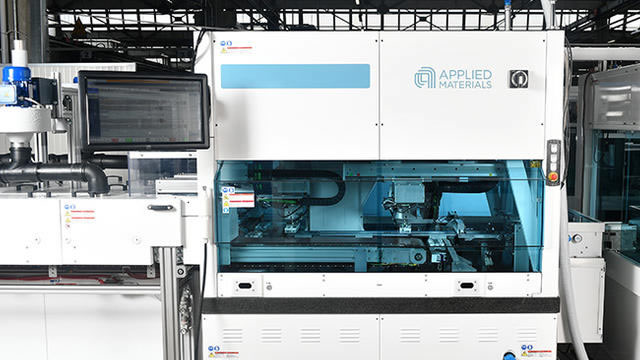

Applied Materials, Inc. is a leading provider in the manufacturing equipment, services, and software sector for the semiconductor, display, and related industries. Founded in 1967 and headquartered in Santa Clara, California, the company has carved a niche for itself by offering a broad range of products and services that cater to the needs of the semiconductor and display manufacturing sectors. Applied Materials operates globally, with significant presences in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe. The company’s operations are segmented into three main divisions: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets, each focusing on specific needs of its diverse client base.

Products and Services

- Semiconductor Systems

This segment is focused on the development, manufacture, and sale of a variety of manufacturing equipment used in the fabrication of semiconductor chips or integrated circuits. Technologies offered include:

- Epitaxy

- Ion Implantation

- Oxidation/Nitridation

- Rapid Thermal Processing

- Physical Vapor Deposition

- Chemical Vapor Deposition

- Chemical Mechanical Planarization

- Electrochemical Deposition

- Atomic Layer Deposition

- Etching

- Selective Deposition and Removal

- Metrology and Inspection Tools

- Applied Global Services

This segment delivers integrated solutions aimed at optimizing equipment and fabrication performance and productivity. Services include:

- Spares and Upgrades

- Service Solutions

- Remanufactured Earlier Generation Equipment

- Factory Automation Software

These services and products are designed for semiconductor, display, and other product manufacturers, emphasizing efficiency and reliability.

- Display and Adjacent Markets

Applied Materials' expertise extends into the display sector, offering products for the manufacture of:

- Liquid Crystal Displays (LCDs)

- Organic Light-Emitting Diodes (OLEDs)

- Other advanced display technologies

These products are vital for TVs, monitors, laptops, personal computers, electronic tablets, smartphones, and other consumer-oriented devices. The segment focuses on providing cutting-edge technologies to keep pace with the evolving demand for better and more efficient display technologies.