AMC Entertainment Holdings Inc. (AMC)

AMC Networks: There's Hidden Opportunity With This One

AMC Networks is facing challenges in its core business, leading to declining revenue and profitability. The company's streaming services, including AMC+, show potential for growth and hidden value. Shares of AMC Networks are attractively priced, but long-term issues in the industry may limit upside potential.

Look Out, Bears! Why Short Selling May Soon Disappear.

The environment for short sellers on Wall Street has grown tougher, leading many prominent figures to scale back or exit. Jim Chanos, famous for predicting Enron's collapse, converted his hedge fund into a family office last year.

AMC stock price forecast: buy, sell, or hold?

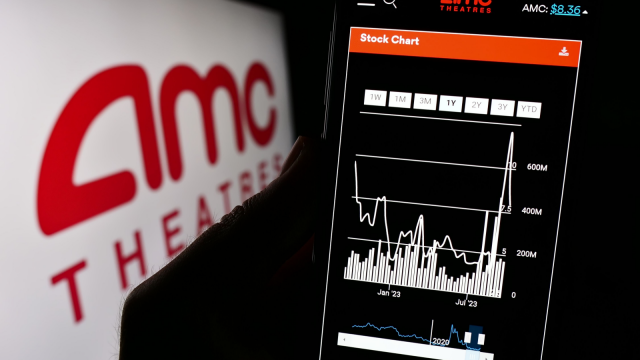

AMC Entertainment (NYSE: AMC) stock price has crawled back in the past few weeks, helped by the meme stock frenzy. It has jumped to $5.80 from the year-to-date low of $2.40.

AMC Stock Alert: Shareholders Reject Plan to Declassify Board

Cineplex operator AMC Entertainment (NYSE: AMC ), which, while broadly embattled, received a lifeline from meme-trading sentiments, saw its shares continue to move higher on Thursday. In the prior session, AMC stock skyrocketed as shareholders pushed back against management's proposal.

Roaring Kitty's Last Meow? AMC Stock's Rally Fizzles as Reality Bites

The seeming inability of retail investors to permanently lift meme stocks bodes badly for AMC Entertainment (NYSE: AMC ) stock. Meanwhile, the company's rather unimpressive first-quarter results, along with its high valuation and huge debt load, also don't look good for its outlook.

3 Sorry Meme Stocks to Sell Now While You Still Can: Summer Edition

Investing in meme stocks is speculative and risky, and with meme stocks tumbling, now is the time to look for meme stocks to sell. With little more than internet discussion board chatter to go on, meme stocks are the stock market's equivalent of the Wild West.

Why Fast-paced Mover AMC Entertainment (AMC) Is a Great Choice for Value Investors

AMC Entertainment (AMC) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen.

The 5 Biggest Buyers of AMC Entertainment (AMC) Stock in Q1

Shares of AMC Entertainment (NYSE: AMC ) are up more than 10% today, although the rise isn't attributed to any company-specific news. Rather, AMC stock is trading higher in sympathy with GameStop (NYSE: GME ).

3 Meme Stocks Due to Run Out of Steam Soon

It's safe to say that you just can't keep meme stocks out of the equation. Especially after the recent meme stock rally, triggered by Keith Gill, aka “Roaring Kitty,” to social media, had the market buzzing again.

3 Leisure & Recreation Services to Gain from Robust Industry Trend

The Leisure & Recreation Services industry benefits from optimizing business processes and robust demand for cruising. RCL, CNK and AMC are well-positioned to capitalize on these.

Why Is AMC Entertainment (AMC) Stock Up 20% Today?

AMC Entertainment (NYSE: AMC ) stock rose 20% over the weekend as “meme stock trading” came back. The action began in GameStop (NYSE: GME ).

Is AMC stock a buy right now?

The meme-stock frenzy appears to reign after Roaring Kitty, a significant figure in previous GameStop (NYSE: GME) stock surges, shared a screenshot on Reddit suggesting a substantial investment in the gaming retailer.