Amprius Technologies Inc. (AMPX)

Amprius Technologies (AMPX) Expected to Beat Earnings Estimates: Should You Buy?

Amprius (AMPX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

5 Stocks to Buy in August With Tremendous Upside Potential

The market is shaping up to have a solid August. Tariff risks aside, the underlying economic fundamentals remain healthy, supporting an outlook for earnings growth, and capital returns continue to flow.

My Biggest Bet To Date: The Case For Solid Power Over Amprius And The Rest

A supercycle has emerged in what I call the advanced battery space, constituted by four stocks: QuantumScape, Solid Power, Inc., Amprius Technologies, Inc., and SES AI. A trifecta is in play: speculative disruptors with near term catalysts, a sustained rise in volume, and strong market conditions are driving the rally. I'm leaning on Solid Power and Amprius for exposure to this hype cycle, but I favor Solid Power due to its stronger cash runway and better price action.

3 Hot Tech Stocks Showing Bullish Price Action Right Now

With attention focused on mega caps and AI, it's easy to overlook riskier trades like small and mid-cap technologies. However, bullish activity in the charts of Amprius Technologies NYSE: AMPX, Joby Aviation NYSE: JOBY, and Ambarella NASDAQ: AMBA highlights the potential they offer.

Are Business Services Stocks Lagging Amprius Technologies, Inc. (AMPX) This Year?

Here is how Amprius Technologies (AMPX) and CoreCard Corporation (CCRD) have performed compared to their sector so far this year.

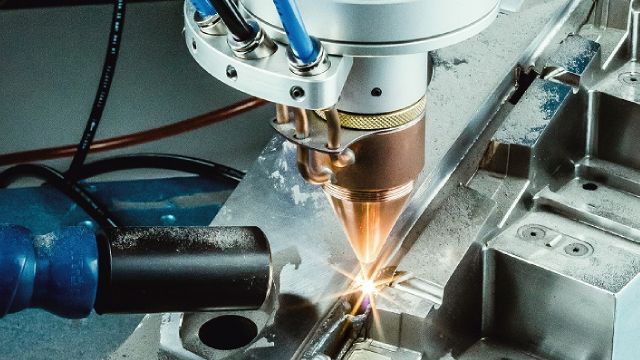

Amprius: Upgrading On Commercial Momentum

I am upgrading AMPX to a buy and forecast a 100% upside for the shares, driven by strong Si-Core sales momentum. AMPX's shift from costly nanowire tech to Si-Core enables drop-in battery replacements with superior energy density, driving commercial traction. Revenue surged 380% YoY in Q1, with major orders, a growing backlog, and new manufacturing contracts supporting near-term profitability.

Amprius: A Triple-Digit Revenue Growth Story

I'm still bullish on Amprius, although I downgraded my strong buy to a buy due to recent price action and the high chance for an equity financing round. I see triple-digit yoy revenue growth in 2025, driven by the remaining part of the $20 million LEV deal and new aerospace orders, including the $15 million UAS contract. I anticipate further contract wins this year in the UAS and light EV markets, with a good chance to break the $4 resistance on new deal announcements.

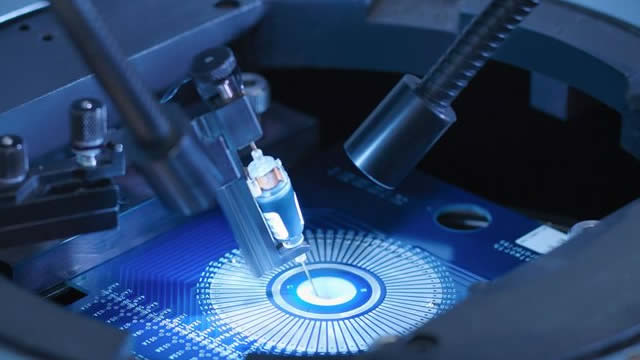

Amprius Technologies: Near-Term Mass Production Matches Up To EVTOL Battery Needs

I reiterate my bullish rating on Amprius, driven by imminent mass production of the SiCoreä 450 Wh/kg battery and strong global manufacturing partnerships. SiCoreä's high energy density and cost advantage position Amprius to capture eVTOL and mission-critical markets, outpacing competitors reliant on lower-density batteries. Amprius's Q1 2025 revenue surged 383% YoY, reflecting robust demand and efficient cost management, despite increased R&D and production scaling.

Amprius Technologies, Inc. (AMPX) Q1 2025 Earnings Call Transcript

Amprius Technologies, Inc. (NYSE:AMPX ) Q1 2025 Results Conference Call May 8, 2025 5:00 PM ET Company Participants Dr. Kang Sun - Chief Executive Officer Sandra Wallach - Chief Financial Officer Conference Call Participants Colin Rusch - Oppenheimer Mark Shooter - William Blair Chip Moore - ROTH MKM Amit Dayal - H.C. Wainwright Derek Soderberg - Cantor Fitzgerald Operator Good afternoon.

Amprius Technologies (AMPX) Reports Q1 Loss, Tops Revenue Estimates

Amprius Technologies (AMPX) came out with a quarterly loss of $0.08 per share versus the Zacks Consensus Estimate of a loss of $0.09. This compares to loss of $0.11 per share a year ago.

How Amprius Technologies (AMPX) Stock Stands Out in a Strong Industry

Amprius Technologies (AMPX) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

Amprius Market Gets Amped Up on Growth Outlook

Amprius Technologies' NYSE: AMPX stock price is not immune to the volatility plaguing the broader market. However, the trend in price action reveals a market that is getting amped up on an increasingly positive news cycle and is ready to shoot higher.