Arm Holdings plc American Depositary Receipt (ARM)

3 Reasons Arm Holdings Is a Must-Buy for Long-Term Investors

Arm Holdings (ARM 6.06%) has emerged as a top AI stock following its initial public offering in September 2023. The chip design company, which specializes in power-efficient CPU architecture, seemed to be initially misunderstood by investors, but the stock has since tripled from its IPO price.

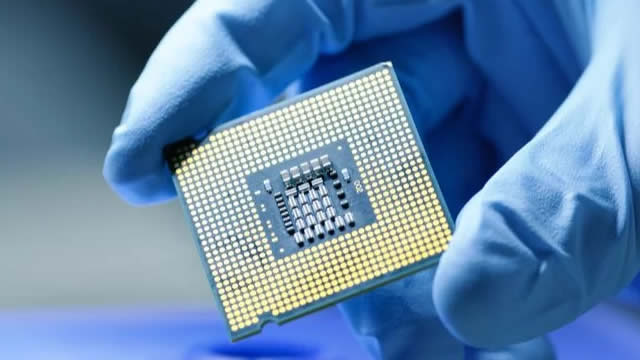

Report: Chip Designer Arm Plans to Become Chip Manufacturer

Chip designer Arm reportedly plans to become a chip manufacturer. Arm, which has traditionally designed chips and licensed those designs to companies like Apple and Nvidia, plans to introduce the first chip it made in-house as soon as this summer, the Financial Times (FT) reported Thursday (Feb. 13).

Exclusive: Arm recruits from customers as it plans to sell its own chips

Arm has begun recruiting from its own customers and competing against them for deals as it pushes toward selling its own chips, according to people familiar with the matter and a document viewed by Reuters.

Why Arm Stock Jumped Today

Arm (ARM 6.06%) stock posted gains in Thursday's trading. The semiconductor company's share price closed out the daily session up 6.1% amid the backdrop of a 1% increase for the S&P 500 (^GSPC 1.04%) and a 1.5% gain for the Nasdaq Composite (^IXIC 1.50%).

Arm is launching its own chip this year with Meta as a customer

Public semiconductor company Arm will start making its own chips this year after landing a high-profile enterprise customer.

Arm shares rise on report that Meta will buy its first chip

Arm shares rose 5% after a Thursday report that it was developing its own chip and that it had secured Meta as one of its first customers. The Financial Times report indicates that Arm is developing a new product that will compete with many of its customers.

Arm secures Meta as first customer for ambitious new chip project, FT reports

Arm Holdings plans to launch its own chip this year after securing Meta Platforms as one of its first customers, in a major shift to its model of licensing its blueprints to other companies, the Financial Times reported on Thursday.

Is Arm Holdings Stock a Buy Now?

Expectations were high for Arm Holdings (ARM -1.48%) going into its fiscal 2025 third-quarter report (for the three months ended Dec. 31, 2024). Shares of the British company shot up remarkably in the past year and are trading at a premium valuation, so it wasn't surprising to see the stock fall when its outlook barely matched Wall Street's expectations.

1 Must-See Quote for AI Stock Investors From Arm Holdings' CEO

The launch of Chinese AI start-up DeepSeek sent shockwaves through the AI sector recently. Stocks like Nvidia plunged double digits on the news as the new competitor threatened to upend the AI ecosystem.

Arm Holdings Q3: Strong Adoption Of Armv9, But The Stock Is Overvalued

Arm Holdings Q3: Strong Adoption Of Armv9, But The Stock Is Overvalued

Arm Holdings: A Central Piece Of The AI Ecosystem

Arm Holdings' entrenched dominance in the mobile market, coupled with several other tailwinds, ensures durable earnings growth for years. Despite a high valuation with a 100 forward non-GAAP PE, ARM's exceptional fundamentals and deep industry partnerships justify a Buy rating. ARM is capitalizing on AI infrastructure build-out and custom silicon development, which has allowed it to break into the data center market.

Arm Holdings' Shares Slip Despite Record Revenue and Strong AI Demand. Is This a Golden Buying Opportunity?

Share prices of Arm Holdings (ARM -2.96%) slipped despite the company posting record fiscal Q3 revenue. However, the stock is still off to a strong start to the year, up nearly 35% year to date as of this writing.