ASML Holding N.V. New York Registry Shares (ASML)

Investors Heavily Search ASML Holding N.V. (ASML): Here is What You Need to Know

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

ASML Holding Stock Down 9% Since Q1 Earnings: Should You Buy the Dip?

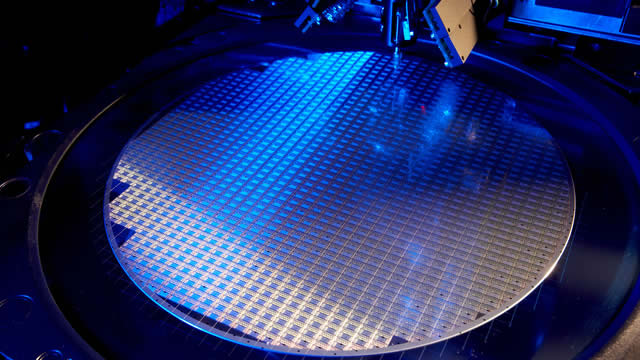

With rising demand for advanced nodes, AI chips and high-bandwidth memory, ASML's lithography tools will remain mission-critical, making the stock worth buying.

Looking for a Growth Stock? 3 Reasons Why ASML (ASML) is a Solid Choice

ASML (ASML) possesses solid growth attributes, which could help it handily outperform the market.

The Surprising Dividend Growth Stock That Just Raised Its Payout Again

The stock market offers investors more than one path to make a profit, but few have proven as successful and enduring as dividend investing.

ASML: I Am Doubling Down, Here's Why

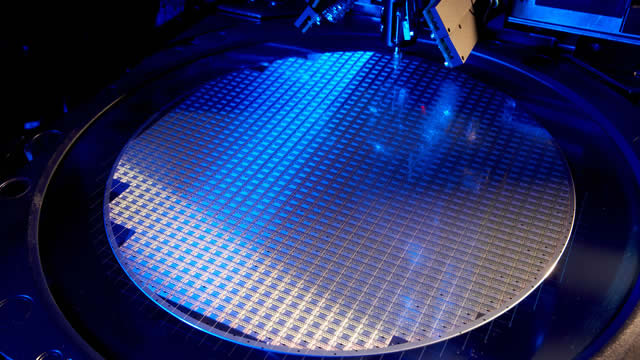

ASML Holding N.V. remains a critical player in semiconductor manufacturing, with robust demand for its lithography systems despite recent stock selloffs and forecast misses. The company's strong financial performance, including a 46% sales jump and improved gross margins, underscores its growth potential amid rising chip and AI spending. Investors may be overly pessimistic; ASML's leading position in the EUV lithography market and anticipated profit growth make it an attractive investment at current valuations.

ASML: Trump Tariff War Boom

ASML Holding N.V.'s recent share price decline presents a compelling entry point due to its technology leadership, strong AI-driven demand, and proactive de-risking from China. Despite lower-than-expected Q1 net bookings, ASML's impressive earnings and revenue growth highlight its resilience and potential for long-term gains. The ongoing U.S.-China trade war is driving global semiconductor supply chain regionalization, benefiting ASML through increased demand for its lithography tools.

New Strong Buy Stocks for April 21st

TKOMY, CELH, BFC, IDCC and ASML have been added to the Zacks Rank #1 (Strong Buy) List on April 21, 2025.

ASML: Shares Could Get Way Cheaper

I believe the post earnings selloff was an overreaction to tariff uncertainty, and I anticipate further volatility with sector specific semiconductor tariffs due next week. That said, I estimate a realistic 10% tariff on US imports will be imposed and fully passed on to customers, limiting ASML's margin hit. I expect High‑NA EUV adoption to lift margins by 2027–28. Mass production of NXE:5200 tools remains several years away.

Applied Materials Vs. ASML: The Ideal Pick During This Cyclical Downturn

This article pits two of the most important semiconductor FAB names against one another to determine which is the better value. Both AMAT and ASML are down -40+% from their all-time highs. Both have outstanding balance sheets, with the entire semi-FAB space as their TAM.

ASML: Time To Buy Is Now, Or Regret Later

ASML's Q1 earnings nearly doubled, with sales of €7.7 billion and gross margins of 54%, beating expectations despite a drop in stock price. The company maintains its 2025 guidance with projected sales of €30-€35 billion and margins of 51%-53%, indicating strong future growth. Risks include trade turmoil and tariffs impacting chip demand, particularly from China, but ASML's market dominance and advanced technology remain strong.

ASML: A Long Term Worry Or Short Term Blip? (Rating Upgrade)

ASML Holding N.V.'s Q1 earnings showed a miss on sales and weak FY2025 guidance, causing a market selloff despite overall positive results. Net bookings were significantly below estimates due to market uncertainties, including trade wars and potential global recession impacts. Despite short-term uncertainties, ASML's long-term outlook remains strong with a 2030 revenue guide of EUR 44B - EUR 60B, suggesting significant upside potential.

ASML Holding: Time To Buy Before The Market Rebounds

The US-China trade tensions and export restrictions are significantly impacting the semiconductor industry. ASML's diversified business model and market dominance position it well to benefit from ongoing AI and semiconductor investments. ASML's long-term growth prospects remain strong, supported by its High-NA systems and pricing power.