ASML Holding N.V. New York Registry Shares (ASML)

2 No-Brainer Chip Companies to Ride the Artificial Intelligence (AI) Investing Wave

When you hear about artificial intelligence (AI) investing, you may think of the software powered by the technology or the hardware that trains the model. However, investors should also think of the chips that go into these devices to power the AI models.

2 Semiconductor Stocks That Could Help Set You Up for Life

The semiconductor industry was on a roll last year with annual sales exceeding $600 billion for the first time as companies and governments across the globe lined up to purchase chips for building their artificial intelligence (AI) infrastructures, and the good news is that the industry's growth is set to continue in 2025 and beyond.

ASML Holding: Regression Analysis Shows 35% Upside Potential By 2027

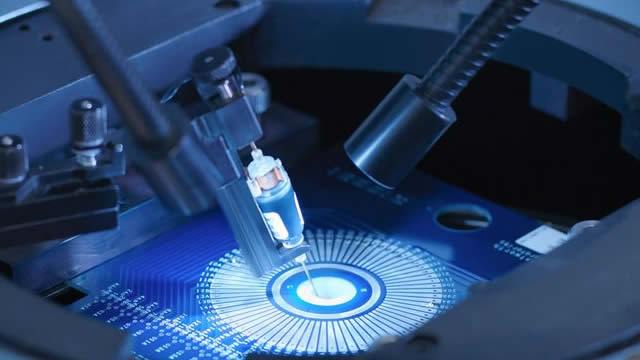

I rate ASML a buy due to its market dominance, unique EUV lithography technology, and strong financial health, predicting double-digit upside potential over three years. ASML's competitive advantage lies in its advanced lithography systems, significant R&D investment, and strategic partnerships with top chipmakers like TSM, Samsung, and Intel. Despite geopolitical risks, ASML's market position and technological barriers ensure its MOAT remains intact, with growth catalysts like AI and western subsidies driving future demand.

Prediction: This Is a Massive Buying Opportunity for ASML Stock

In today's video, I discuss ASML Holdings (ASML 0.08%) and recent updates affecting the semiconductor equipment giant. To learn more, check out the short video, consider subscribing, and click the special offer link below.

ASML Holding Up 8% YTD: Should You Buy, Sell or Hold the Stock?

While ASML's leadership in semiconductor manufacturing equipment is unchallenged, near-term geopolitical risks and premium valuation warrant a cautious approach.

2 'Must-Buy' Growth Stocks In Today's Expensive Market

US stock market valuations are historically high, with the S&P 500 and Nasdaq P/E ratios significantly above historical averages, suggesting cautious asset allocation. Despite high valuations, I see opportunities in Alphabet Inc. (Google) and ASML Holding N.V., both offering strong growth potential and attractive risk/reward profiles. Google's fundamentals are solid, with improving margins and growth in AI-powered cloud services, making it a quality buy at a discount.

Prediction: ASML Will Beat the Market. Here's Why.

It's only February, but it's already been a wild year for semiconductor stocks.

ASML: Why I Am Going All-In Now

ASML Holding is poised for multi-year growth driven by surging demand for lithography systems essential for semiconductor production, making it a core investment. ASML's Q4 profits beat estimates, with €9.3 billion in sales and €4.79 billion in gross profits, reflecting strong demand and operational efficiency. The company anticipates sustained growth in 2025, fueled by hyperscalers and data centers needing microchips for AI workloads, projecting €30-35 billion in total sales.

Better Artificial Intelligence Stock: Nvidia vs. ASML

Artificial intelligence (AI) is rapidly transforming our world, promising to revolutionize everything from human interaction and environmental stewardship to space exploration. This technological revolution, driving us toward what's known as Industry 5.0 (the next phase of industrialization, characterized by human-centric, sustainable, and resilient production through human-machine collaboration), is creating immense opportunities for innovative companies.

ASML Q4: A Golden Quarter And Buying Opportunity

ASML's AI-driven demand, High-NA EUV dominance, and solid execution support a 33% two-year price CAGR, despite near-term China risks, making it a compelling buy even at current levels. Strong Q4 results, stable 2025 guidance, and long-term projections (€44-60B revenue by 2030) reinforce ASML's leadership, with expanding gross margins and robust free cash flow generation. Geopolitical risks persist, but AI tailwinds, TSMC/Samsung demand, and High-NA EUV rollout secure ASML's position as the premier lithography supplier—current valuation remains highly attractive.

Wall Street Analysts Think ASML (ASML) Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

The Big Tech CapEx Boom Is Coming: ASML Is Ready

ASML's long-term growth potential remains solid due to its dominance in the EUV lithography market and increasing AI demand, despite recent EPS estimate downgrades. Big tech companies' significant CapEx plans for AI infrastructure should benefit ASML, enhancing its growth outlook despite DeepSeek concerns. ASML's recent earnings were strong, with Q4 2024 revenue up 24% YoY and full-year 2025 revenue expected to grow by 15%.