ASML Holding N.V. New York Registry Shares (ASML)

1 Brilliant Artificial Intelligence (AI) Stock Down 30% From Its All-Time High That's a No-Brainer Buy

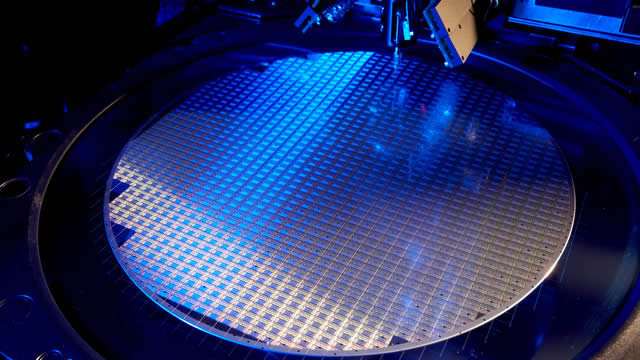

Few companies' products are as critical to the modern world's technological infrastructure as those made by ASML (ASML 3.75%). Without the chipmaking equipment the Netherlands-based manufacturer provides, much of the world's most innovative technology wouldn't be possible.

Analyst Upgrades Chip Supplier After Underperformance

UBS just upgraded Netherlands-based semiconductor equipment stock ASML Holding NV (NASDAQ:ASML) to "buy," with a price-target hike to €750 from €660, citing potential upside after the stock's recent underperformance.

ASML upgraded as UBS eyes return of 'quality compounder'

ASML Holding NV (NASDAQ:ASML, ETR:ASME) has been upgraded to 'buy' by UBS, which sees the semiconductor equipment maker as poised to return to form as a “quality compounder” from 2027 onwards. The bank highlighted that the market has already priced in concerns over weakening lithography intensity and uncertainty in China, with the shares down 30% from all-time highs in the summer of 2024.

ASML (ASML) Sees a More Significant Dip Than Broader Market: Some Facts to Know

In the latest trading session, ASML (ASML) closed at $725.85, marking a -2.26% move from the previous day.

ASML: Negative Sentiment Presents A Long-Term Opportunity

ASML Holding N.V.'s recent share price weakness is a buying opportunity for long-term investors, given its strong fundamentals and leading position in EUV technology. The company posted robust financial results, with 23% revenue growth and improving margins, driven by surging demand for EUV machines in AI and memory applications. Despite management's cautious 2026 outlook due to tariff and geopolitical risks, I believe these concerns are overblown and cyclical volatility is natural.

ASML: Valued Like It's March 2020 Again

Current valuation is highly attractive, with forward P/E ratios at multi-year lows, reminiscent of the COVID-19 crash, despite strong growth prospects. Industry tailwinds from key customers like Intel, TSM, and Nvidia, plus secular demand, reinforce my conviction in ASML's long-term potential. Geopolitical risks and seasonal volatility exist, but as a long-term value investor, I see ASML as a massively undervalued, high-quality opportunity.

ASML Sees 30% EUV Growth in 2025: Is Demand Sustainable Through 2026?

ASML Holding expects EUV sales to surge 30% in 2025 on AI and memory demand, but macro risks cloud the outlook for 2026.

ASML: A Fundamentally Undervalued Monopoly At The Heart Of The AI Revolution

ASML is the indispensable, monopolistic foundation of the global semiconductor industry, yet it trades at a significant and unjustified 'European discount' versus its tech clients. Geopolitical risks and export bans to China are overblown; global chip demand will simply shift to other ASML customers, preserving overall equipment demand. ASML's current dominance in EUV lithography ensures a strong moat and growth for the next 5-10 years, making the recent price decline a buying opportunity.

The Massive $1.7 Trillion U.S.-EU Trade Deal: 2 AI Stocks That Benefit Most

Key Points in This Article: The $1.7 trillion U.S.

ASML Has Entered Buy Territory, But Only For Patient Investors

There are a few players in the technology sector who have a near monopoly in their businesses, and investors can use that to their advantage when planning for the next outsized upside play in their portfolios. Knowing what to look for comes into play for the savvy ones, and those who can connect the dots will likely land on the right side of history in this artificial intelligence gold rush.

Is Trending Stock ASML Holding N.V. (ASML) a Buy Now?

ASML (ASML) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

ASML: The Best Disappointing Chip Stock To Buy

ASML's stock underperformed the S&P 500 due to trade tensions and China-related order cancellations, but its technology leadership remains intact. Despite €1.4 billion in Chinese order cancellations, ASML delivered strong Q2 results with 31% revenue growth and EPS up 47% year-on-year. Guidance reflects uncertainty, especially regarding China, but ASML still expects 15% sales growth and robust margins for the full year.