Barrick Mining Corporation (B)

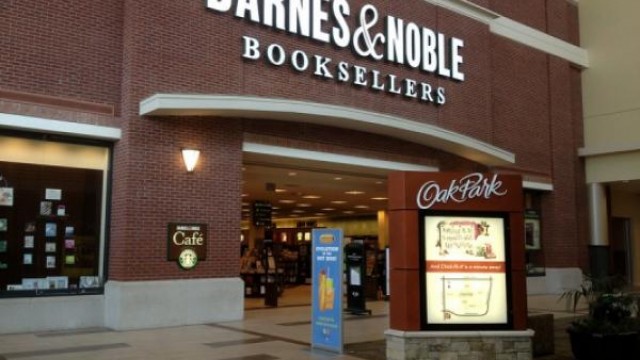

Barnes & Noble Education: Lifting Of The DOE Overhang Is A Significant Positive

BNED has successfully transformed its business with First Day and First Day Complete courseware solutions, leading to significant EBITDA improvement. FDC revenue has rapidly grown, with potential for further growth as the majority of students are not currently enrolled in schools offering FDC. Proposed regulations by the DOE that could have impacted FDC programs were ultimately abandoned, providing a positive outlook for BNED's future growth.

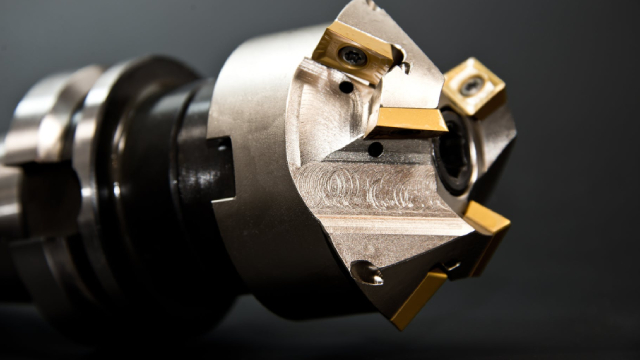

Barnes Group (B) Q2 Earnings Miss Estimates, Sales Rise Y/Y

Barnes Group's (B) Q2 sales increase 13% year over year, driven by the impressive performance of its Aerospace segment.

Barnes Group Roiled By Recent News, But Transformation Rolls On

Barnes Group Inc. missed earnings estimates, leading to a drop in stock price on July 26. Reports suggest Barnes is exploring options, potentially looking for a buyer. Despite short-term setbacks, Barnes continues its transformation process to become more growth and profit-oriented.

Barnes Group (B) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Barnes Group (B) give a sense of how its business performed in the quarter ended June 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Barnes Group (B) Misses Q2 Earnings and Revenue Estimates

Barnes Group (B) came out with quarterly earnings of $0.37 per share, missing the Zacks Consensus Estimate of $0.39 per share. This compares to earnings of $0.58 per share a year ago.

Analysts Estimate Barnes Group (B) to Report a Decline in Earnings: What to Look Out for

Barnes Group (B) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Is Barnes Group (B) Stock Outpacing Its Industrial Products Peers This Year?

Here is how Barnes Group (B) and Kadant (KAI) have performed compared to their sector so far this year.

Barnes & Noble Education Is Growing, But Not Fast Enough

Barnes & Noble Education reported Q4 and full year earnings, showing a per-share loss for both periods. Revenue from BNC First Day increased 37% year over year to $474 million, a significant part of total revenue. The company faces risks such as heavy losses, competition in book-selling, seasonality, and potential dilution of shares.

Strength Seen in Barnes Group (B): Can Its 7.6% Jump Turn into More Strength?

Barnes Group (B) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

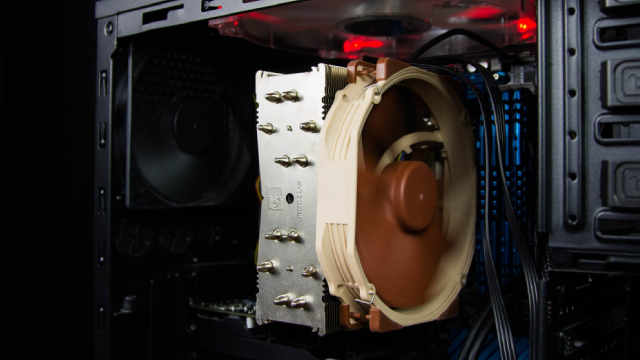

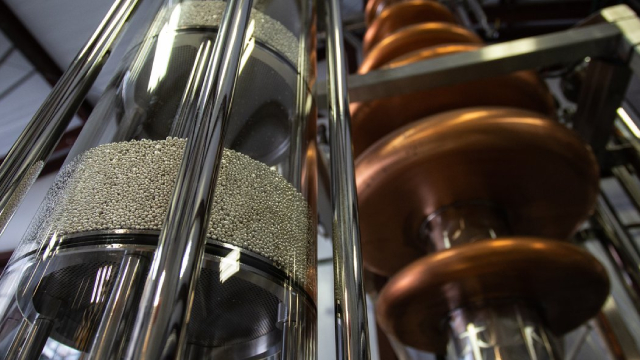

Strength in Aerospace Segment Aids Barnes (B) Amid Cost Woes

Barnes (B) stands to benefit from the solid momentum in the Aerospace segment. However, cost inflation is concerning.

Barnes (B) Teams Up With RTX's P&WC for Engine Component Repair

Barnes (B) extends its repair services contract with P&WC. This involves both companies partnering on the maintenance, repair and overhaul of components for new and existing aerospace engines.

Barnes & Noble Education Stock Sinks After Reverse Split

The company took measures to bolster its financial performance and stock price, including a 1-for-100 reverse stock split completed after Tuesday's close.