Badger Meter Inc. (BMI)

Badger Meter (BMI) is an Incredible Growth Stock: 3 Reasons Why

Badger Meter (BMI) could produce exceptional returns because of its solid growth attributes.

Why Badger Meter (BMI) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

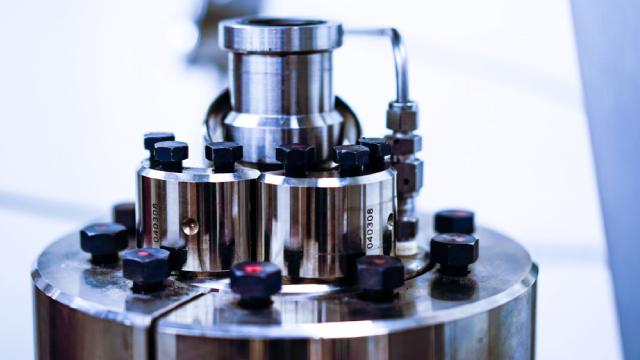

3 Instruments Stocks Likely to Beat Short-Term Industry Hardships

The increasing adoption of industrial automation, focus on higher energy efficiency and optimum resource utilization should drive the Zacks Instruments - Control industry. WTS, BMI and THR are well-positioned to gain from the evolving market dynamics.

Badger Meter (BMI) Rises Yet Lags Behind Market: Some Facts Worth Knowing

In the most recent trading session, Badger Meter (BMI) closed at $219.02, indicating a +0.25% shift from the previous trading day.

Badger Meter (BMI) Increases Yet Falls Behind Market: What Investors Need to Know

Badger Meter (BMI) closed the most recent trading day at $215.17, moving +0.57% from the previous trading session.

Badger Meter (BMI) Beats Stock Market Upswing: What Investors Need to Know

The latest trading day saw Badger Meter (BMI) settling at $209.78, representing a +1.49% change from its previous close.

Badger Meter (BMI) Rises Higher Than Market: Key Facts

Badger Meter (BMI) reachead $214.57 at the closing of the latest trading day, reflecting a +1.27% change compared to its last close.

Badger Meter: Risk/Reward Skew More Balanced, Can't Overlook Embedded Expectations

Badger Meter has rallied significantly, but current high market multiples suggest a balanced risk/reward calculus, with potential consolidation towards $180–200 and upside to the $230s. BMI's industry advantages and exceptional economics, including high ROIC and operating margins, justify a premium valuation, but embedded expectations are exquisitely high. Despite high valuations, the Company remains a high-quality business with strong fundamentals.

Badger Meter (BMI) Rises But Trails Market: What Investors Should Know

In the most recent trading session, Badger Meter (BMI) closed at $213.44, indicating a +0.03% shift from the previous trading day.

3 Reasons Growth Investors Will Love Badger Meter (BMI)

Badger Meter (BMI) possesses solid growth attributes, which could help it handily outperform the market.

Why Badger Meter (BMI) Dipped More Than Broader Market Today

Badger Meter (BMI) closed the most recent trading day at $212.12, moving -0.99% from the previous trading session.

Is Badger Meter (BMI) Outperforming Other Computer and Technology Stocks This Year?

Here is how Badger Meter (BMI) and BWX Technologies (BWXT) have performed compared to their sector so far this year.