Boston Scientific Corporation (BSX)

Boston Scientific Corporation (BSX) Hits Fresh High: Is There Still Room to Run?

Boston Scientific (BSX) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

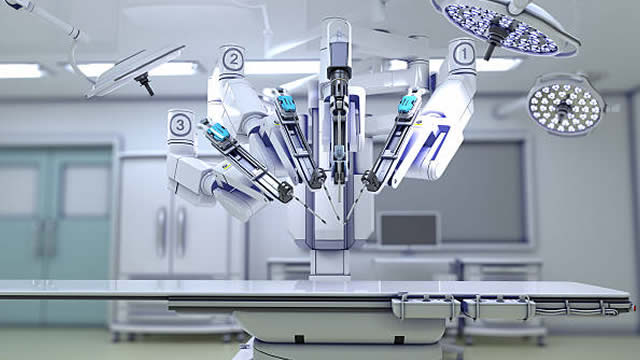

Endoscopy Sales Growth to Support BSX Stock Amid Fierce Competition

Boston Scientific successfully continues its expansion of operations across different geographies outside the United States.

Boston Scientific (BSX) Outperforms Broader Market: What You Need to Know

In the most recent trading session, Boston Scientific (BSX) closed at $91.29, indicating a +0.66% shift from the previous trading day.

Are Medical Stocks Lagging Boston Scientific (BSX) This Year?

Here is how Boston Scientific (BSX) and Aclarion, Inc. (ACON) have performed compared to their sector so far this year.

5 Non-Tech Outperformers of 2024 Set to Fly Higher in the Near Term

Five non-technology high-flyers of 2024 have the potential to fly higher in the short term. These are: CMG, IBKR, KKR, FI, BSX.

Is Boston Scientific Stock a Smart Pick for Your Portfolio Right Now?

Investors continue to be optimistic about BSX, courtesy of its international expansion efforts and WATCHMAN's performance.

Why Boston Scientific (BSX) is Poised to Beat Earnings Estimates Again

Boston Scientific (BSX) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Boston Scientific Corporation: Solid Financials And Upward Continuation

Boston Scientific closes the year at historic highs, with investors refusing to liquidate even at these levels. The smooth upward movement of the stock indicates the quality of its investor base. Strong profit margins and robust growth expectations for the short-term future make me overlook its high valuation.

Boston Scientific (BSX) Falls More Steeply Than Broader Market: What Investors Need to Know

In the closing of the recent trading day, Boston Scientific (BSX) stood at $89.68, denoting a -1.08% change from the preceding trading day.

Why Boston Scientific (BSX) Outpaced the Stock Market Today

In the most recent trading session, Boston Scientific (BSX) closed at $91.07, indicating a +1.35% shift from the previous trading day.

4 Healthcare Stocks Rising More Than 50% in 2024 With Room to Grow

Medical stocks are expected to reap the benefits of affordable health insurance plans, rising surgeries and widespread adoption of telehealth services in the days ahead. However, inflation and supply-chain woes may act as spoilsport.

Boston Scientific (BSX) Rises Higher Than Market: Key Facts

Boston Scientific (BSX) reachead $89.86 at the closing of the latest trading day, reflecting a +1.02% change compared to its last close.