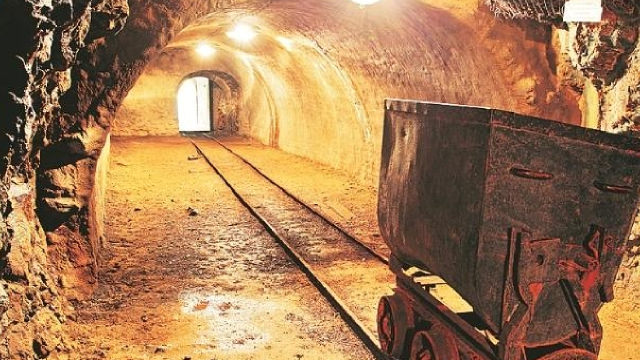

B2Gold Corp (BTG)

B2Gold Achieves First Gold Pour at Goose Mine, Confirms 2025 Outlook

BTG reaches a milestone with first gold pour at the Goose Mine, setting the stage for strong Canadian output and 2025 targets.

B2Gold (BTG) Rises Higher Than Market: Key Facts

B2Gold (BTG) closed the most recent trading day at $3.61, moving +2.27% from the previous trading session.

B2Gold (BTG) Rises Higher Than Market: Key Facts

In the most recent trading session, B2Gold (BTG) closed at $3.65, indicating a +1.67% shift from the previous trading day.

ARMN vs. BTG: Which Gold Mining Stock is the Better Pick Now?

ARMN and BTG ramp up gold production as gold prices hover above $3,300, with both miners advancing key projects.

Why B2Gold (BTG) Dipped More Than Broader Market Today

The latest trading day saw B2Gold (BTG) settling at $3.64, representing a -1.62% change from its previous close.

B2Gold Stock Hits 52-Week High: What's Driving Its Performance?

BTG hits a 52-week high as surging gold prices and strong Q1 results fuel optimism for its 2025 production outlook.

B2Gold (BTG) Up 23.5% Since Last Earnings Report: Can It Continue?

B2Gold (BTG) reported earnings 30 days ago. What's next for the stock?

Is B2Gold Corp (BTG) a Great Value Stock Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

B2Gold: Let The Goose Times Roll

B2Gold remains undervalued despite its recent rally, trading at a steep discount to peers on a P/NAV basis despite an imminent upgrade in its jurisdictional profile. Aside from a jurisdictional upgrade (Canada vs. Africa and the Philippines), Goose is a transformational asset, set to generate over $400 million in annual mine-site free cash flow. Further, recent reserve reductions at Goose may be ugly on the surface but are a temporary setback, and I expect a significantly improved LOMP in the coming years.

B2Gold: Golden Goose About To Hatch

B2Gold is poised for a production boost to ~1.2 million oz with Back River coming online, plus further organic growth projects in the pipeline. Despite recent delays and cost overruns, Back River's imminent completion should resolve investor concerns and unlock significant value. B2Gold trades at a deep discount to peers, with a low 7x forward P/E and strong profitability potential at current gold prices.

Are You Looking for a Top Momentum Pick? Why B2Gold (BTG) is a Great Choice

Does B2Gold (BTG) have what it takes to be a top stock pick for momentum investors? Let's find out.

Are Basic Materials Stocks Lagging B2Gold Corp (BTG) This Year?

Here is how B2Gold (BTG) and Akzo Nobel NV (AKZOY) have performed compared to their sector so far this year.